Pound Sterling Price News and Forecast GBP/USD: Choppy trading conditions leave the pair without a bias

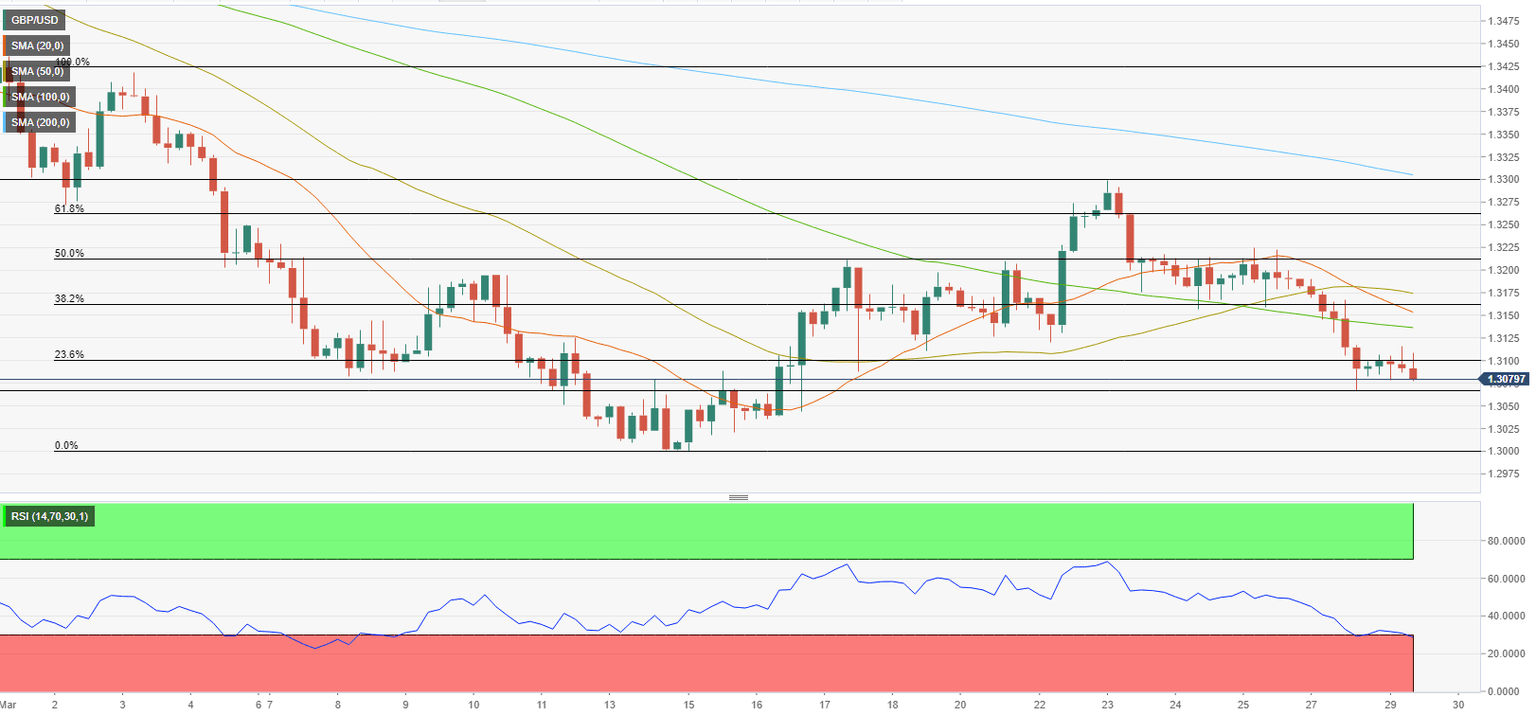

GBP/USD Price Analysis: Choppy trading conditions leave the pair without a bias

GBP/USD in a chop as the bulls and bears battle it out within familiar ranges. Bulls need to get above 1.3110 for the near term. GBP/USD is stuck in ranges across the time frames without a clear bias one way or the other. The following illustrates this across the weekly, daily and hourly time frame. Read more...

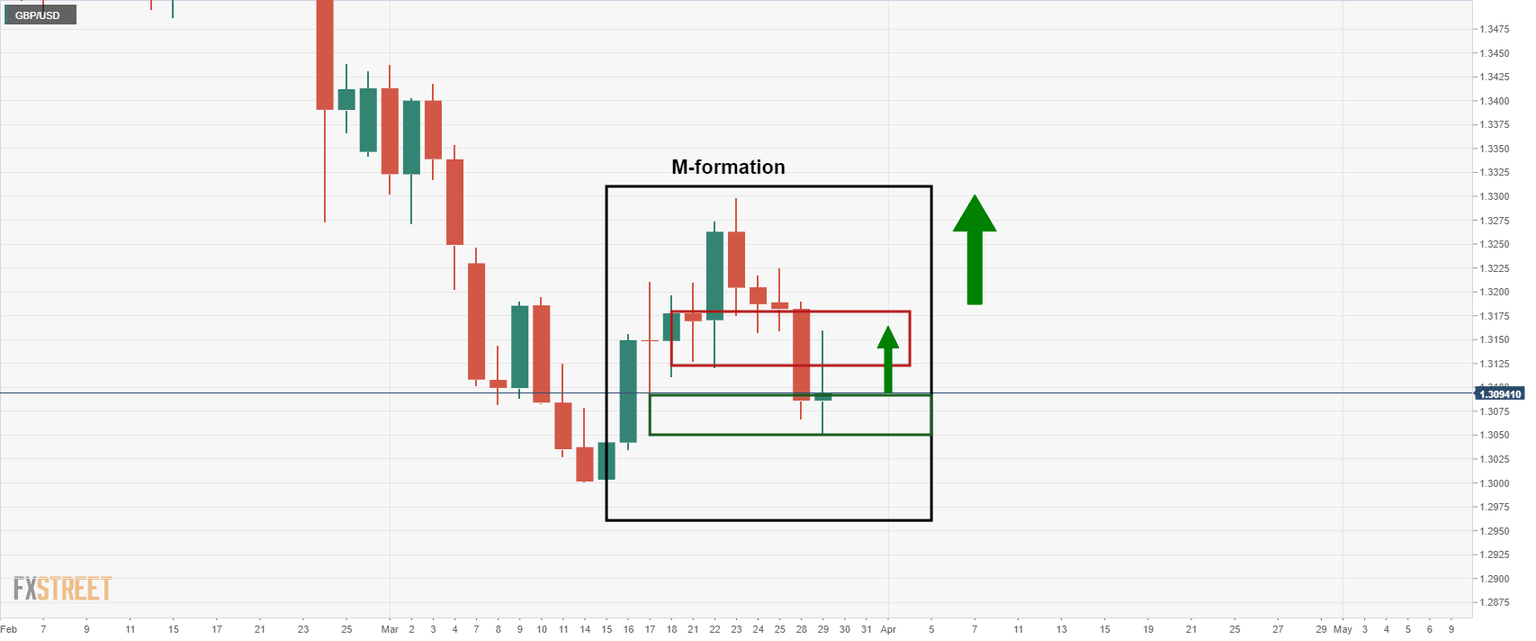

GBP/USD Forecast: Bears could wait for a correction to 1.3140

GBP/USD has gone into a consolidation phase near 1.3100 early Tuesday after having suffered heavy losses at the beginning of the week. The near-term outlook suggests that the pair could extend its recovery but sellers are likely to retain control unless 1.3140 resistance fails. While speaking at a virtual event on Monday, Bank of England (BOE) Governor Andrew Bailey noted that they have to be very cautious on the forward guidance language due to heightened uncertainty surrounding the economic outlook. When asked directly whether or not there will be another rate hike in May, "the situation is very volatile," Bailey responded. Read more...

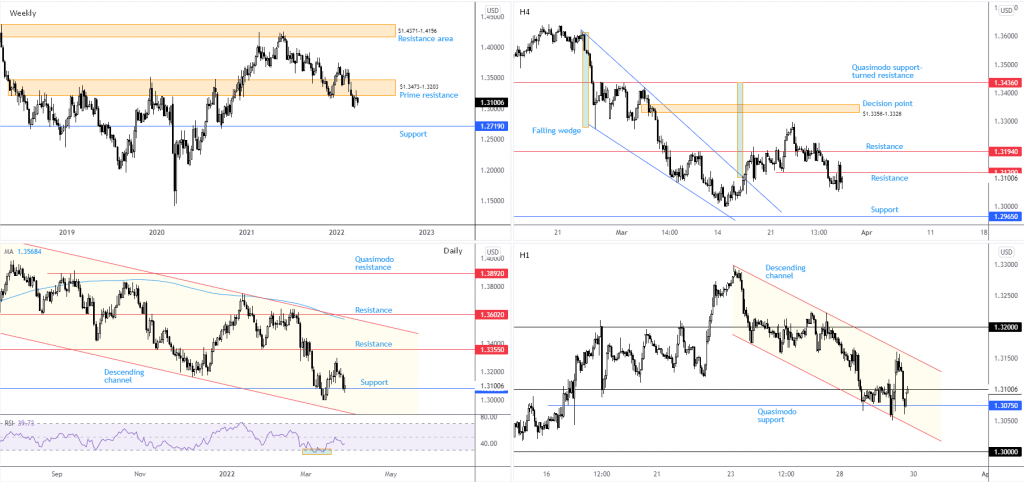

GBP/USD flirting with the possibility of approaching $1.30

From a technical perspective, this week’s downside picture should not surprise. Here’s where we left our week-ahead technical briefing on the weekly timeframe: Not only is the trend to likely weigh on upside efforts, prime resistance is a focal point on the weekly timeframe at $1.3473-1.3203 with the chart demonstrating scope to drop as far south as weekly support from $1.2719. Trend direction has been southbound since late 2007 tops at $2.1161. As a result, the 25 percent move from pandemic lows in March 2020 to February 2021 might be viewed as a pullback within the larger downtrend. This, of course, places a question mark on the 8.5 percent ‘correction’ from February 2021 to March 2022, suggesting the possibility of continuation selling. Read more...

Author

FXStreet Team

FXStreet