Pound Sterling Price News and Forecast: GBP/USD buyers hesitate as key resistance holds

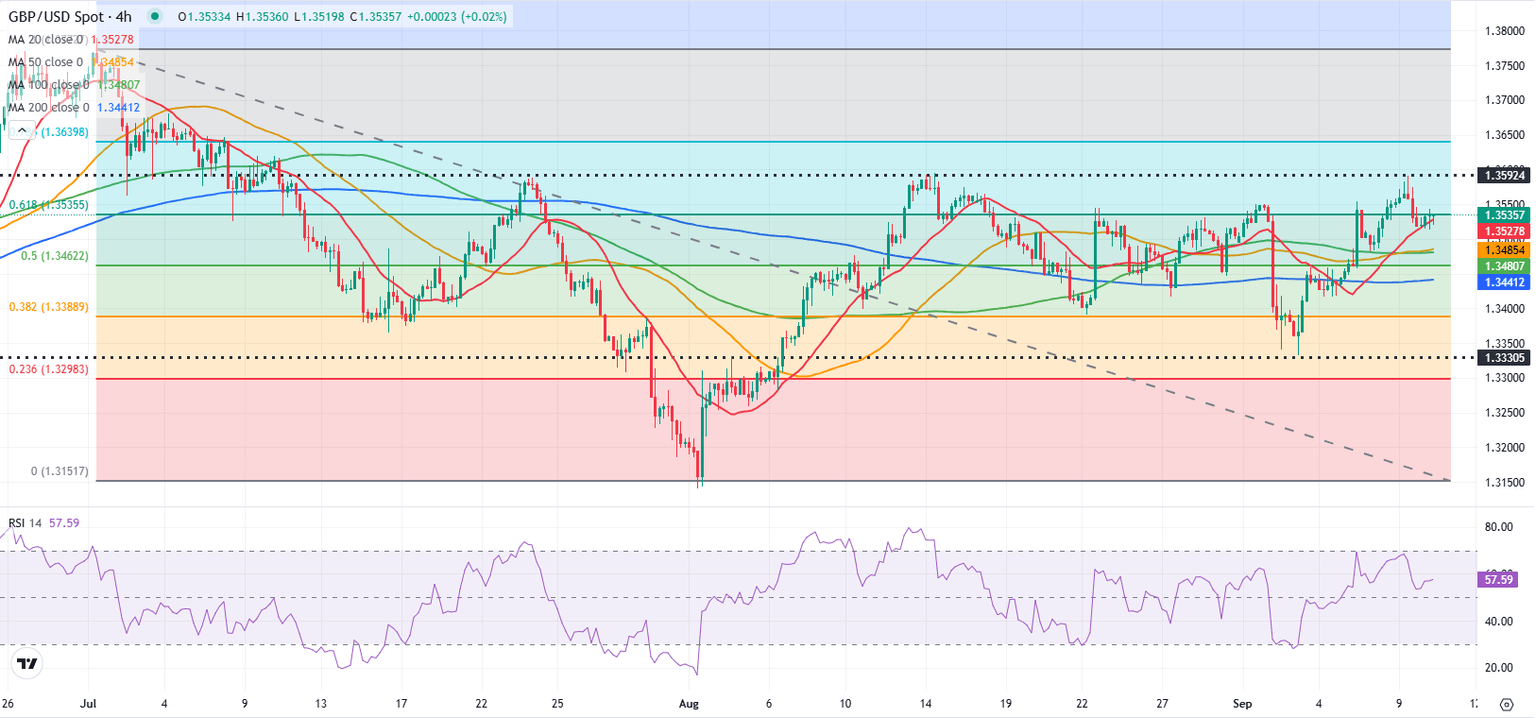

GBP/USD Forecast: Pound Sterling buyers hesitate as key resistance holds

GBP/USD fluctuates above 1.3500 in the European session on Wednesday after posting small losses on Tuesday. The pair could attract technical buyers if it manages to clear the 1.3590-1.3600 resistance area.

The US Dollar (USD) staged a rebound in the second half of the day and caused GBP/USD to turn south, as markets turned risk-averse on escalating geopolitical tensions in the Middle East. Read more...

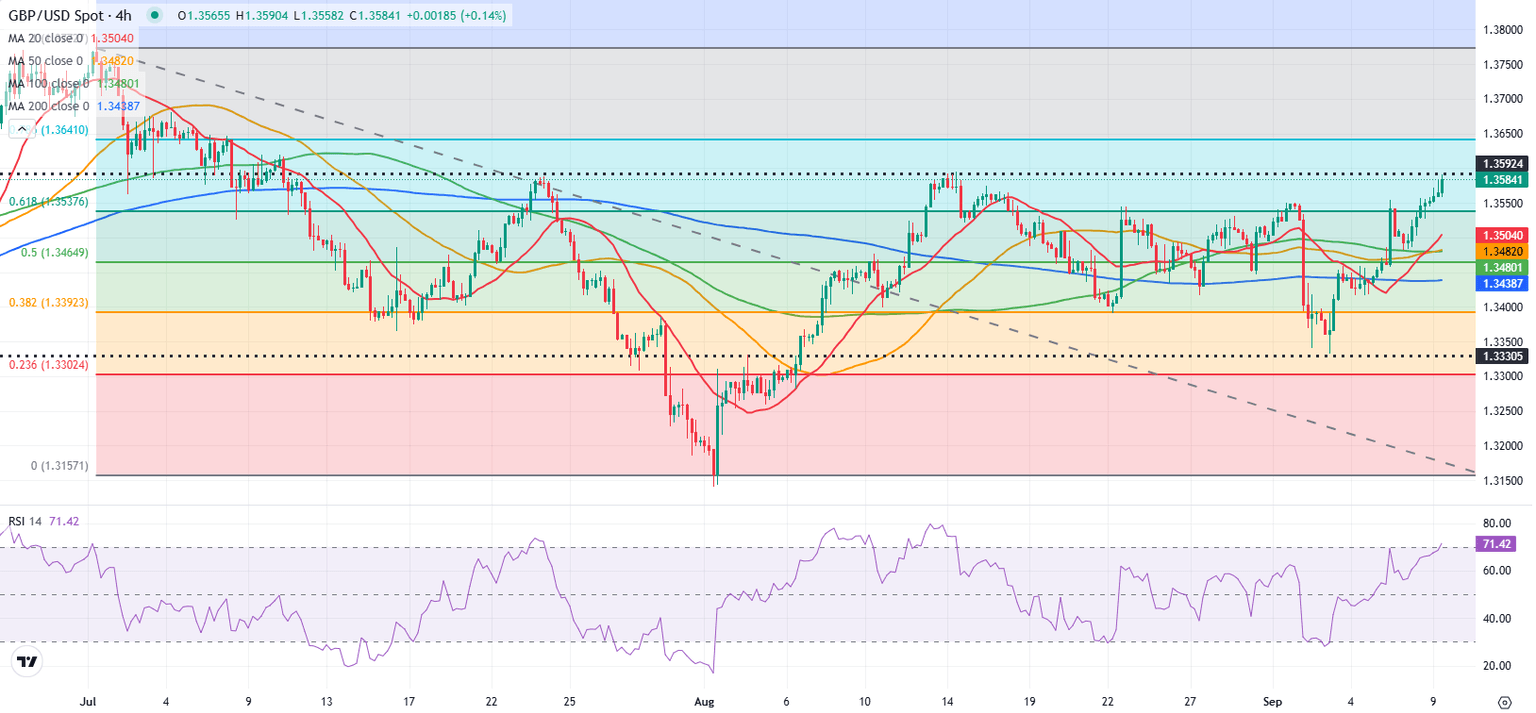

GBP/USD Forecast: Bulls could ignore overbought conditions

GBP/USD gains traction in the European session on Tuesday and advances toward 1.3600 after posting modest gains on Monday. Although the technical picture starts showing overbought conditions for the pair, investors could refrain from positioning themselves for a correction unless there is a convincing recovery in the US Dollar (USD).

Last Friday's disappointing labor market data from the US, which showed an increase of only 22,000 in Nonfarm Payrolls (NFP) in August, caused the US Dollar to start the week under bearish pressure and allowed GBP/USD to push higher. Read more...

Author

FXStreet Team

FXStreet