Pound Sterling Price News and Forecast: GBP/USD Bulls struggle to take control despite broad USD weakness

GBP/USD Forecast: Bulls struggle to take control despite broad USD weakness

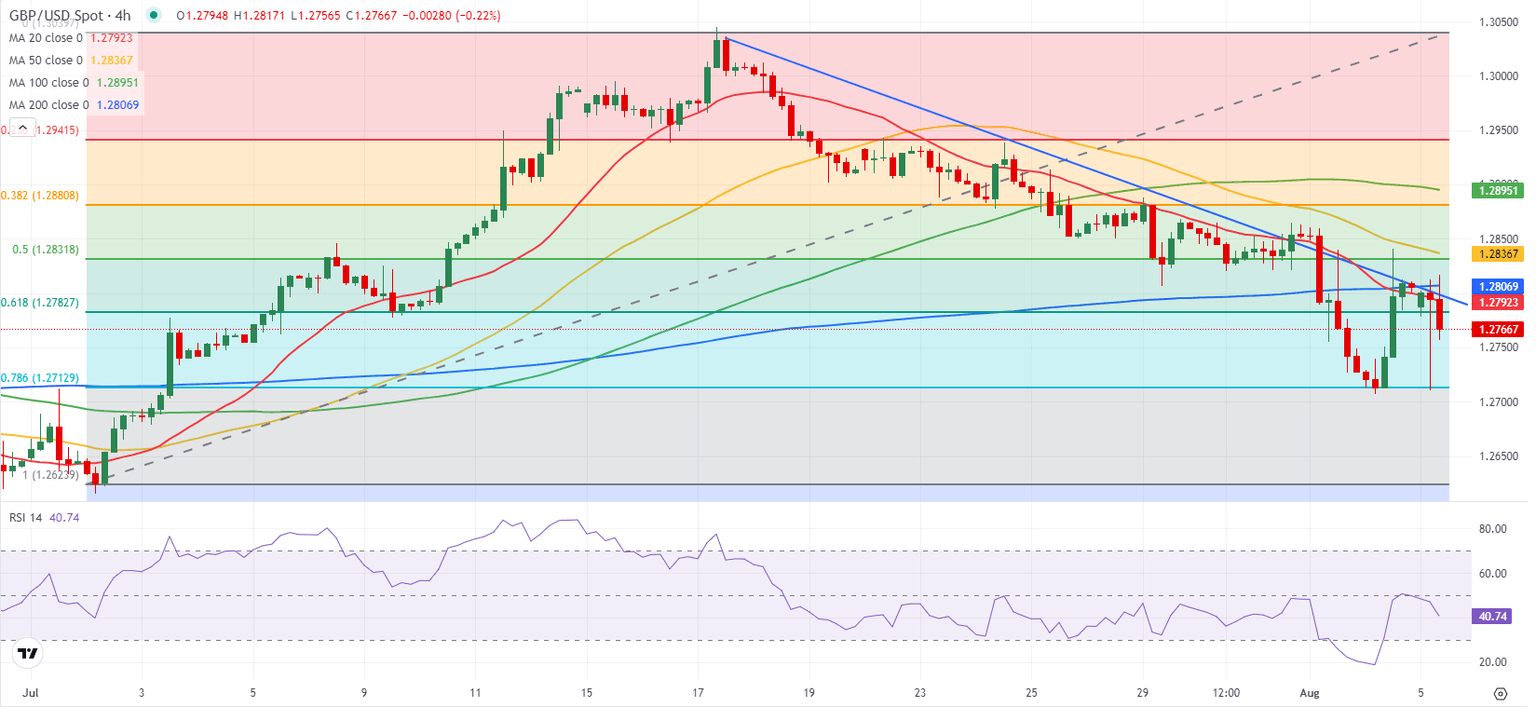

GBP/USD closed in positive territory on Friday but failed to build preserve its recovery momentum at the beginning of the week. At the time of press, the pair was trading in the red slightly above 1.2750.

The selling pressure surrounding the US Dollar (USD) helped GBP/USD erase a portion of its weekly losses in the American session on Friday. The US Bureau of Labor Statistics (BLS) reported that Nonfarm Payrolls rose 114,000 in July. This reading missed the market expectation for an increase of 175,000 by a wide margin. Read more...

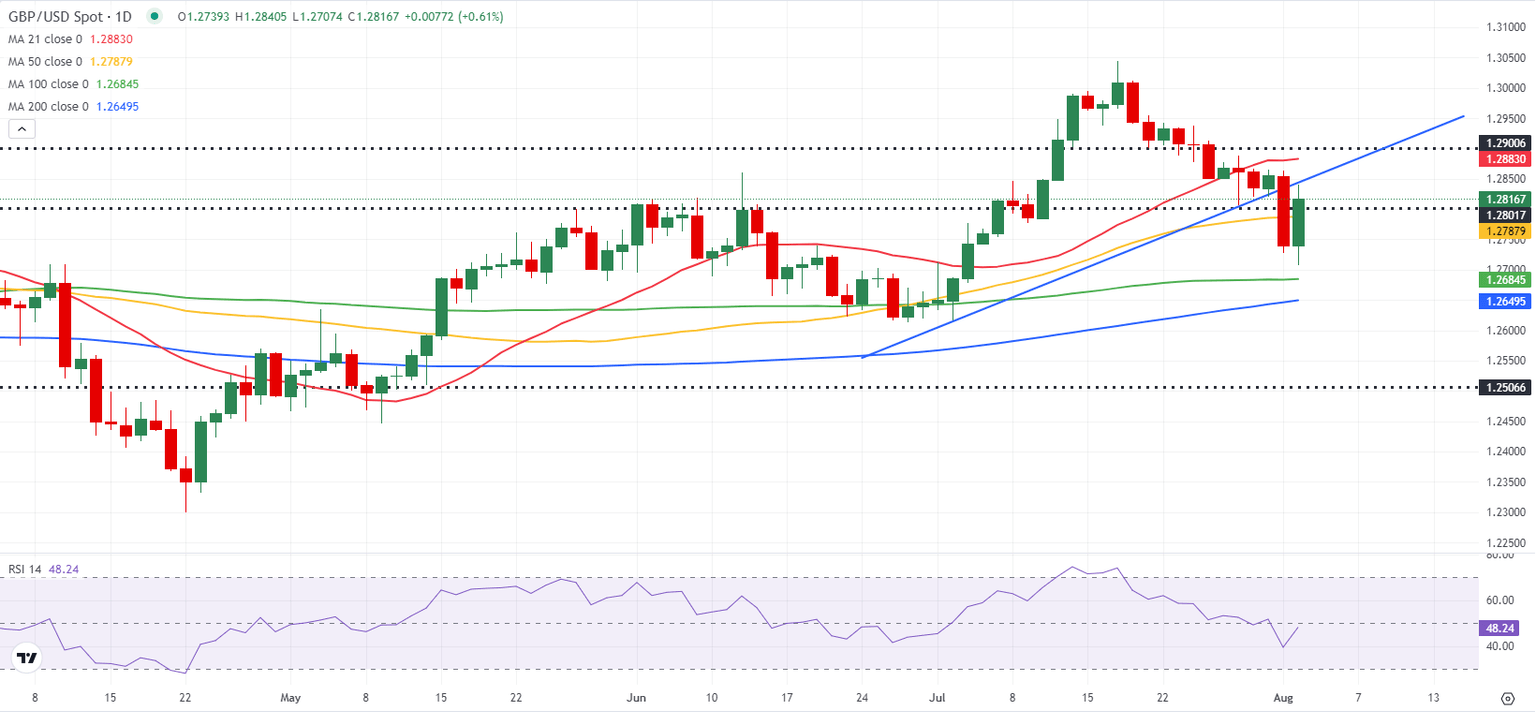

GBP/USD Weekly Forecast: Pound Sterling sellers look to retain control

Recording a third consecutive weekly decline, the Pound Sterling (GBP) reached its lowest level in a month against the US Dollar (USD), leaving GBP/USD to battle the 1.2700 threshold.

GBP/USD remained at the losing end, despite the persistent divergent monetary policy outlooks between the US Federal Reserve (Fed) and the Bank of England (BoE), as the pair witnessed more of a risk trade rather than a rate trade. Read more...

Author

FXStreet Team

FXStreet