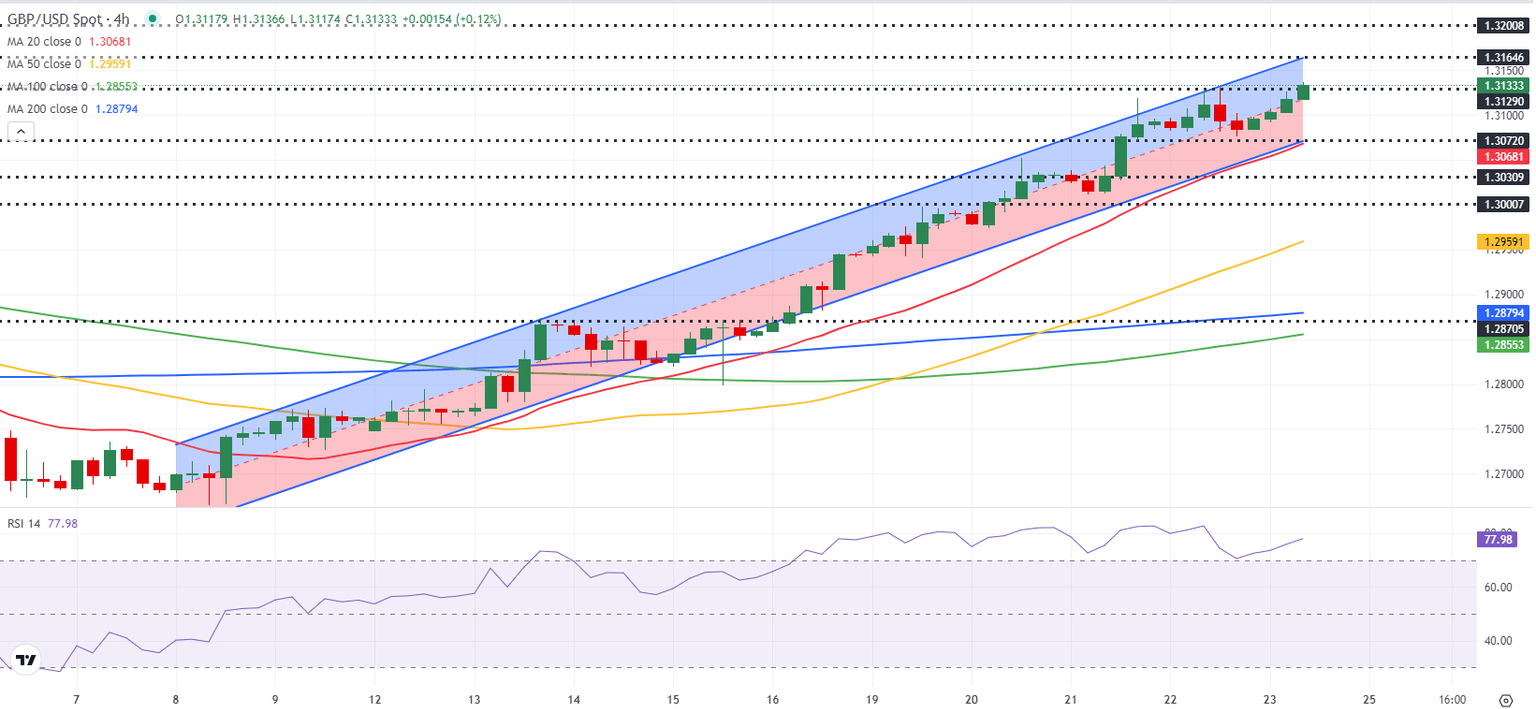

Pound Sterling Price News and Forecast: GBP/USD bulls push towards the 1.3144 resistance

GBP/USD: Bulls push towards the 1.3144 resistance – UOB Group

Price action suggests there is scope for Pound Sterling (GBP) to rise to, and potentially break above the 2023 peak of 1.3144, UOB Group FX strategists Quek Ser Leang and Peter Chia note.

24-HOUR VIEW: “GBP surged two days ago. Yesterday, we indicated that ‘while GBP could continue to rise, it might not be able to break clearly above last year’s high of 1.3144.’ GBP subsequently rose to 1.3130, pulling back to close largely unchanged at 1.3093 (+0.02%). The pullback in overbought conditions indicates that GBP is likely to trade in a range today, probably between 1.3065 and 1.3125.” Read more...

GBP/USD Forecast: No signs of a slowdown in Pound Sterling's uptrend

GBP/USD closed the day flat despite the renewed US Dollar (USD) strength on Thursday and continued to stretch higher early Friday. As investors gear up for Federal Reserve's Chairman Jerome Powell's keynote speech at the Jackson Hole Symposium, the pair trades at its highest level in over a year above 1.3130.

The US Dollar (USD) benefited from the negative shift seen in risk mood on Thursday and the USD Index snapped a four-day losing streak. Pound Sterling, however, held its ground, supported by the upbeat UK PMI data, which showed that the business activity in the private sector continued to expand at a strong pace in August. Read more...

Author

FXStreet Team

FXStreet