Pound Sterling Price News and Forecast: GBP/USD bullish potential intact

Daily technical and trading outlook – GBP/USD

GBP/USD - 1.3811.. Cable maintained a firm undertone in Australia y'day n easily penetrated Jan's 2-1/2 year 1.3759 top to 1.3789 in Europe on continued usd's weakness. Price later climbed to session highs of 1.3820 in late NY.

On the bigger picture, despite cable's brief break of 2016 post-Brexit low of 1.1491 to a near 35-year trough of 1.1412 in mid-Mar 2020 on safe-haven usd's demand following free fall in global stocks, sterling's rally to as high as 1.2812 (Jun) on broad-based usd's weakness, then to an 8-month peak of 1.3482 in Sep suggests a major bottom is in place. Cable's rally to 1.3686 on the last trading day of 2020 following a last-minute EU-UK trade deal, then gain to a fresh 2-1/2 year peak at 1.3820 Tue suggests price would head twd 1.3895, 'bearrish divergences' on daily indicators may cap price below 1.4000. Read more...

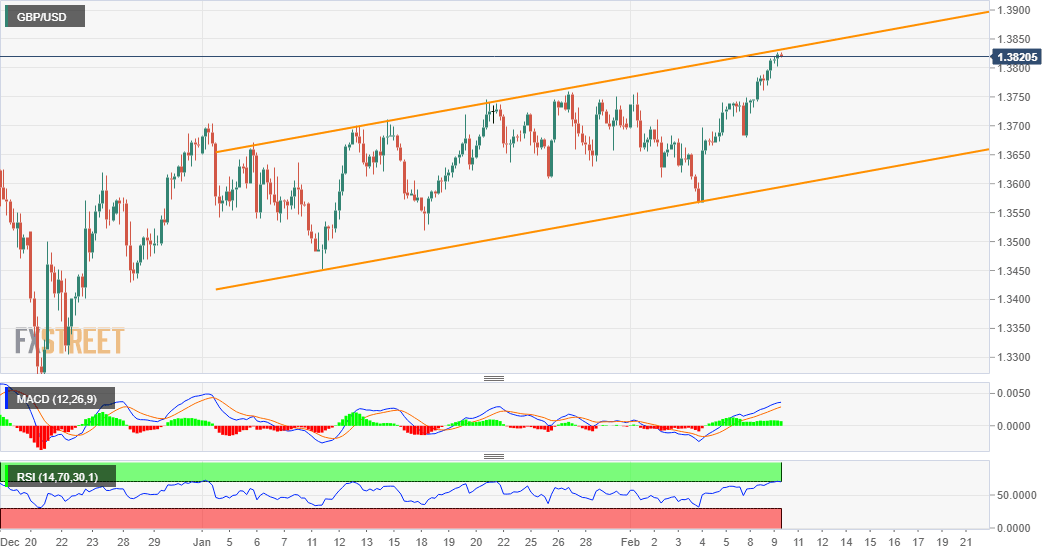

GBP/USD Forecast: Bullish potential intact, ascending channel breakout awaited

The GBP/USD pair built on the previous day's bullish breakout momentum through the 1.3755-60 congestion zone and refreshed multi-year tops during the Asian session on Wednesday. The British pound continued benefitting from its lead in terms of the coronavirus vaccination drive and diminishing odds for negative BoE interest rates in 2021. The momentum was further supported by the better-than-expected release of UK BRC Like-For-Like Retail Sales, which showed a growth of 7.1% in January as compared to 4.8% previous and 6% expected. This, along with the emergence of heavy selling around the US dollar, pushed the pair further beyond the 1.3800 round-figure mark.

The recent USD recovery started losing momentum following the release of rather unimpressive US jobs report for January, which raised doubts about a relatively faster US economic recovery. Adding to this, the underlying bullish sentiment in the financial markets further undermined the greenback's safe-haven demand. Read more...

GBP/USD jumps to the highest level since April 2018, around mid-1.3800s

The GBP/USD pair caught some fresh bids during the early European session and climbed to mid-1.3800, or the highest level since April 2018 in the last hour.

Following a brief consolidation through the first half of the trading action on Wednesday, the pair regained traction and built on the post-BoE solid bounce from mid-1.3400s. It is worth recalling that the UK central bank pushed back expectations for negative interest rates and provided a strong lift to the British pound. Read more...

Author

FXStreet Team

FXStreet

-637485396523605722-637485507939903495.png&w=1536&q=95)