GBP/USD Forecast: Bullish potential intact, ascending channel breakout awaited

- GBP/USD shot to fresh multi-year tops on Wednesday amid sustained USD selling.

- The upbeat market mood was seen as a key factor weighing on the safe-haven USD.

- The technical set-up favours bullish traders and supports prospects for further gains.

The GBP/USD pair built on the previous day's bullish breakout momentum through the 1.3755-60 congestion zone and refreshed multi-year tops during the Asian session on Wednesday. The British pound continued benefitting from its lead in terms of the coronavirus vaccination drive and diminishing odds for negative BoE interest rates in 2021. The momentum was further supported by the better-than-expected release of UK BRC Like-For-Like Retail Sales, which showed a growth of 7.1% in January as compared to 4.8% previous and 6% expected. This, along with the emergence of heavy selling around the US dollar, pushed the pair further beyond the 1.3800 round-figure mark.

The recent USD recovery started losing momentum following the release of rather unimpressive US jobs report for January, which raised doubts about a relatively faster US economic recovery. Adding to this, the underlying bullish sentiment in the financial markets further undermined the greenback's safe-haven demand. The optimism over the rollout of COIVD-19 vaccines, along with prospects for a massive US fiscal spending plan, has been fueling hopes for a strong global economic recovery. This, in turn, continued boosting investors' confidence and remained supportive of the prevalent upbeat market mood.

Meanwhile, investors remain divided about the impact of the US President Joe Biden's proposed $1.9 trillion stimulus package on the greenback. This was evident from the fact that a modest uptick in the US Treasury bond yields did little to provide any respite to the USD bulls or hinder the pair's ongoing positive move to the highest level since April 2018. Market participants now look forward to the release of the UK NIESR GDP estimate for the three months to January for some impetus. Later during the early North American session, the release of the latest US consumer inflation figures will influence the USD price dynamics and further contribute to produce some meaningful trading opportunities.

Short-term technical outlook

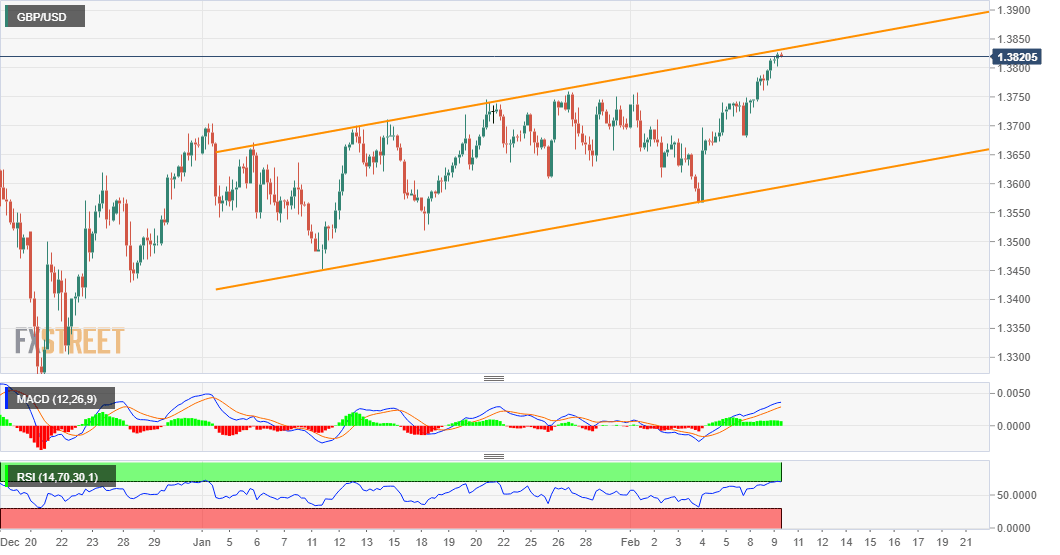

From a technical perspective, bulls took a brief pause near the top boundary of an upward sloping channel, extending from January swing lows. With technical indicators holding in the bullish territory and still far from being in the overbought zone, a convincing breakthrough should pave the way for additional gains. The pair might then accelerate the momentum and aim to reclaim the 1.3900 round-figure mark.

On the flip side, the 1.3755-60 resistance breakpoint seems to protect the immediate downside. Any meaningful fall below the mentioned resistance-turned-support might be seen as a buying opportunity and should remain limited. The 1.3700-1.3680 region now becomes a strong base for the major and act as a key pivotal point for short-term traders.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.