Pound Sterling Price News and Forecast GBP/USD: Britain's Big Bang gamble, Fed decision critical for next moves

GBP/USD pares intraday losses, down little around mid-1.3700s

GBP/USD attracted some dip-buying on Friday amid a subdued USD price action. The risk-on impulse in the markets acted as a headwind for the safe-haven USD. Rallying US bond yields underpinned the USD and capped the upside for the pair. The GBP/USD pair remained on the defensive through the early North American session, albeit has managed to rebound around 30 pips from daily lows and was last seen trading around mid-1.3700s. Read more...

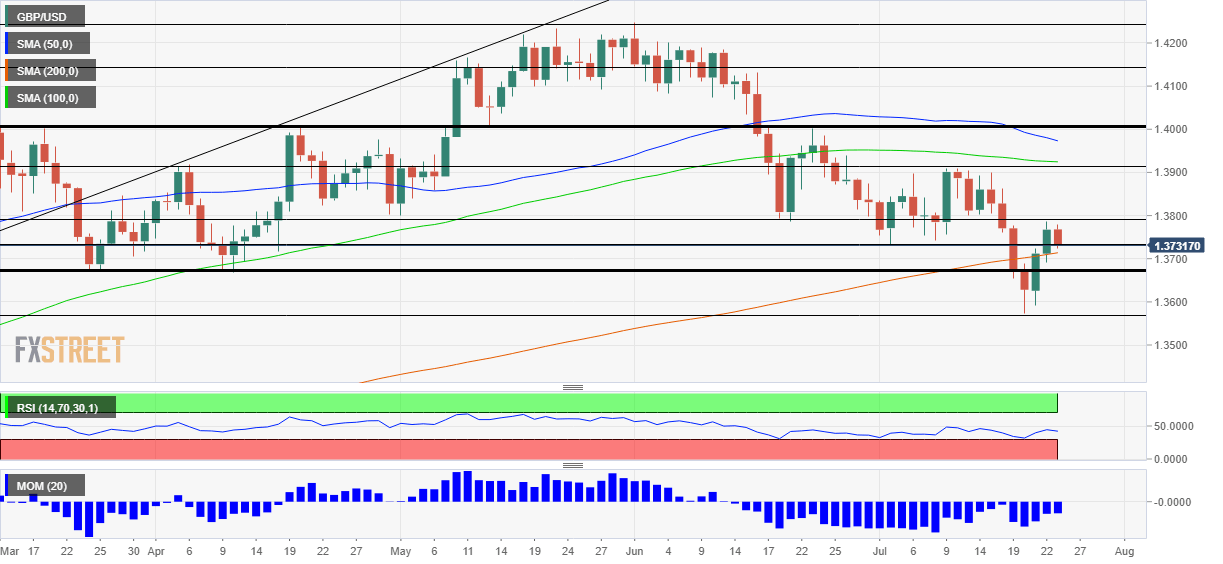

GBP/USD Weekly Forecast: Britain's Big Bang gamble, Fed decision critical for next moves

GBP/USD has tumbled to five-month lows as covid fears grip markets. The Fed decision, Brexit news and covid developments are set to rock cable. Late July's daily chart is showing bears gaining ground. The FX Poll is pointing to an upward move in the medium and long terms. The "Big Bang" has turned into a fall to five-month lows for GBP/USD as covid cases in Britain and around the world trigger fear. Sterling traders eye Brexit news more keenly, and broader markets are closely watching the Fed's decision in the last week of July. Read more...

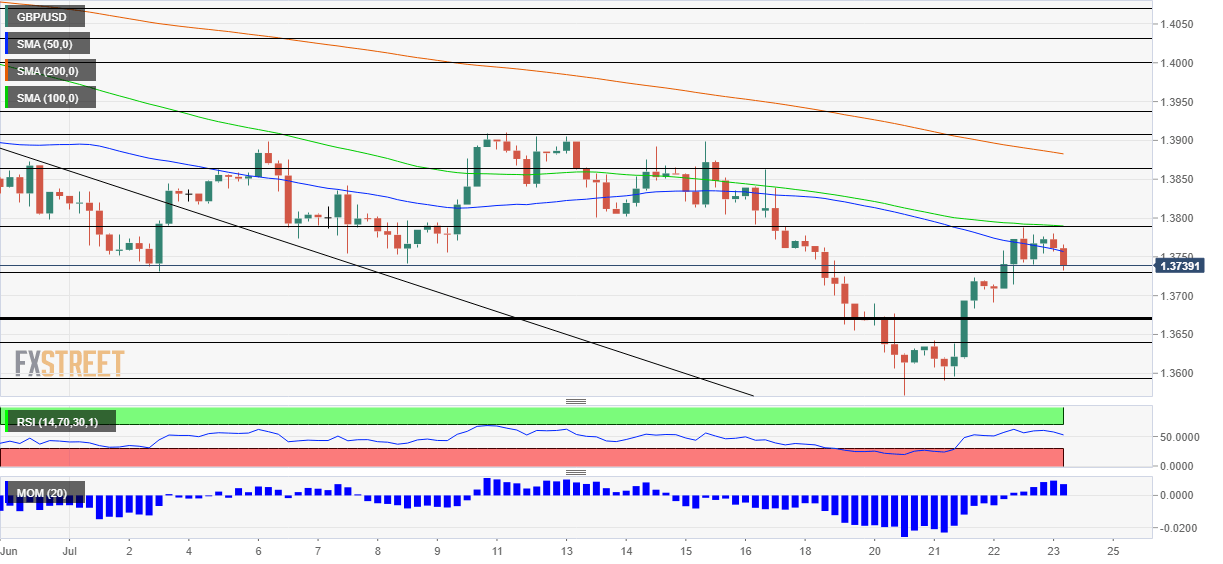

GBP/USD Forecast: Cable torn between British optimism and safe-haven dollar demand, levels to watch

GBP/USD has been retreating from the highs as the dollar has regained some ground. Sterling may receive support from falling covid cases and steps to ease the pingdemic. The safe-haven dollar has room to rise if data disappoints and virus worries increase. Friday's four-hour chart is painting a mixed picture. Exactly two years have passed since Boris Johnson won the Conservative Party leadership contest and took office as Prime Minister – and nobody back then would have thought that "pingdemic" would be the most used words now. Addressing this burning issue is supporting the pound. Read more...

Author

FXStreet Team

FXStreet