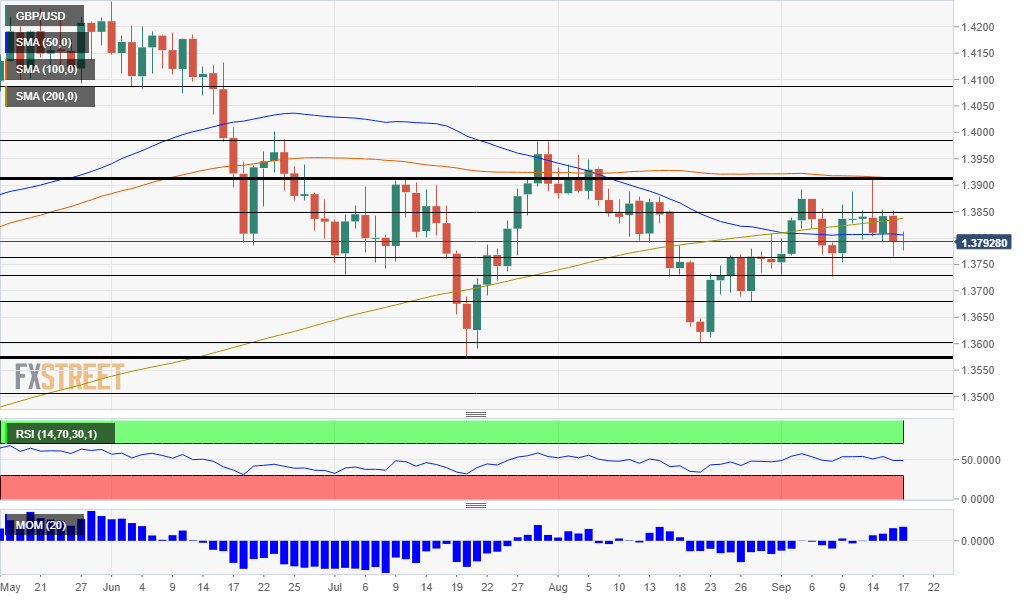

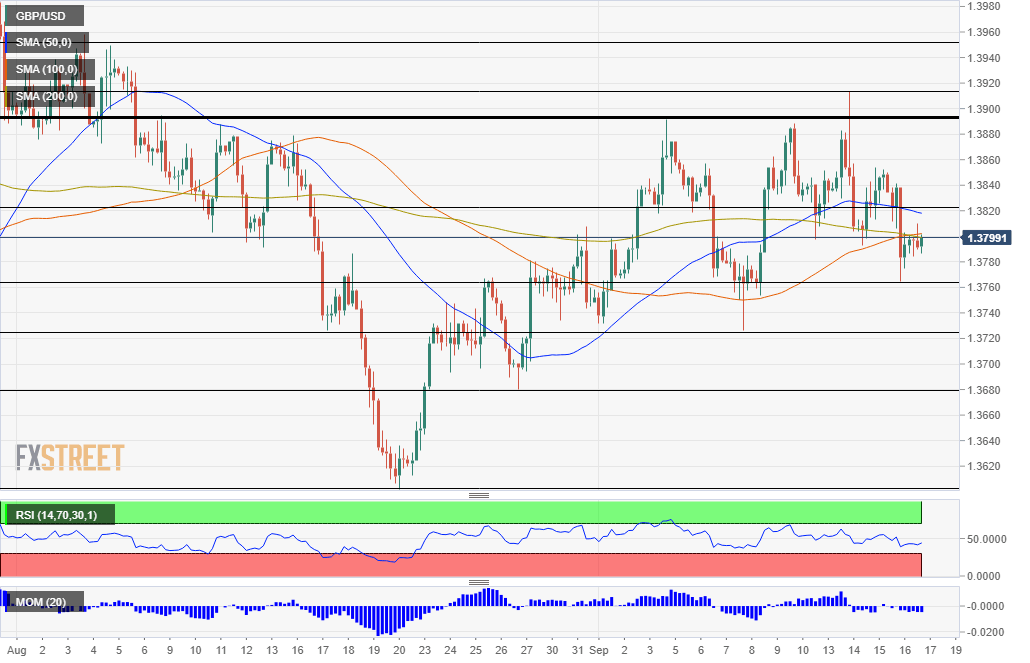

Pound Sterling Price News and Forecast: GBP/USD: Breaking out of range? Duo of central bank decisions to trigger action

GBP/USD Weekly Forecast: Breaking out of range? Duo of central bank decisions to trigger action

Do current inflation trends warrant tightening policy anytime soon? The past week's latest figures have caused jitters, leaving investors confused. Central banks take the stage in the upcoming week, with the Fed's taper timing and the BOE's rate hike prospects critical for GBP/USD. Read more...

GBP/USD reaches a weekly low beneath 1.3750 on disappointing UK Retail Sales

GBP/USD is sliding in the American session to new weekly lows, trading at 1.3754, down 0.26% at the time of writing. As we approach the London Fix and head into the weekend, we could expect some downward pressure on the back of the dampened market sentiment. Read more...

GBP/USD Forecast: More sterling gains? Three higher lows and improving market mood point up

On Thursday, the dollar attracted safe-haven flows that came as US stocks suffered another down day – for no fundamental reason. US Retail Sales figures showed an increase of 0.8% in August, far better than a drop that was expected. On the other hand, inflation is off the highs, as shown by Consumer Price Index figures and by more recent surveys. Read more...

Author

FXStreet Team

FXStreet