Pound Sterling Price News and Forecast: GBP/USD bounces off daily low

GBP/USD Forecast: Pound recovery unlikely in current risk-averse environment

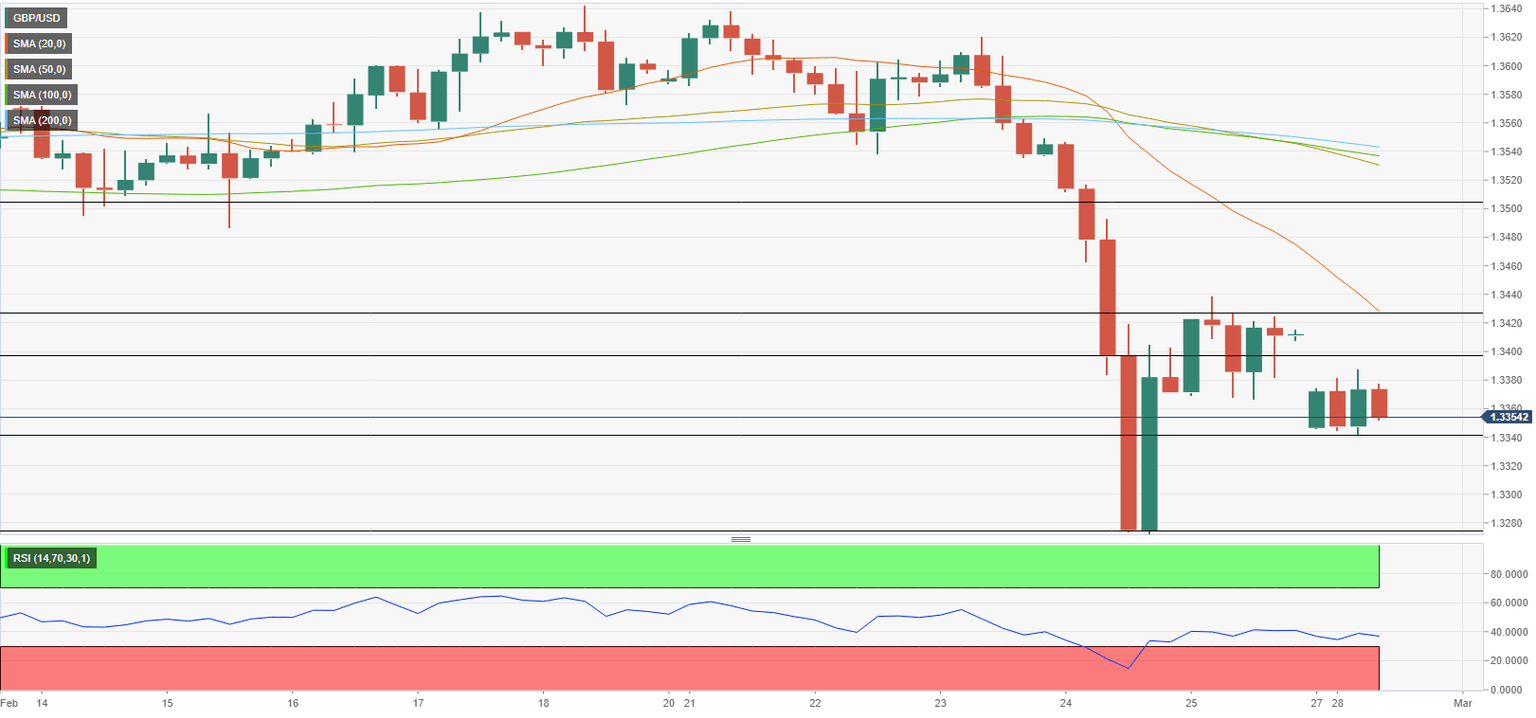

GBP/USD has started the new week on the back foot pressured by another bout of flight to safety amid escalating geopolitical tensions. The pair is likely to face additional bearish pressure in case sellers drag it below 1.3340.

Over the weekend, the UK, alongside the EU and the US, decided to exclude some Russian financial institutions from the SWIFT system. Additionally, the UK announced early Monday that it will prohibit any UK natural or legal persons from undertaking financial transactions involving the Central Bank of Russia. On Sunday, Russian President Vladimir Putin put deterrent forces, including nuclear arms, at the highest threat level. Read more...

GBP/USD bounces off daily low, keeps the red below 1.3400 mark amid Ukraine crisis

The GBP/USD pair recovered a major part of its intraday losses and was last seen trading near the 1.3375 region during the early European session, down around 0.20% for the day.

The pair opened with a bearish gap on the first day of a new week amid a broad-based US dollar strength, bolstered by the weekend developments surrounding the Ukraine crisis. Western nations imposed new sanctions on Russia for its invasion of Ukraine, including blocking some banks from the SWIFT international payments system. Read more...

GBP/USD: Near-term support seems to have formed at 1.3340

GBP/USD has turned south following Friday's modest rebound. The pair is likely to face additional bearish pressure in case sellers drag it below 1.3340, FXStreet’s Eren Sengezer reports.

“As things currently stand, a diplomatic solution to the Russia-Ukraine war seems unlikely, suggesting that the dollar is likely to continue to be preferred over the British pound, at least in the near term.” Read more...

Author

FXStreet Team

FXStreet