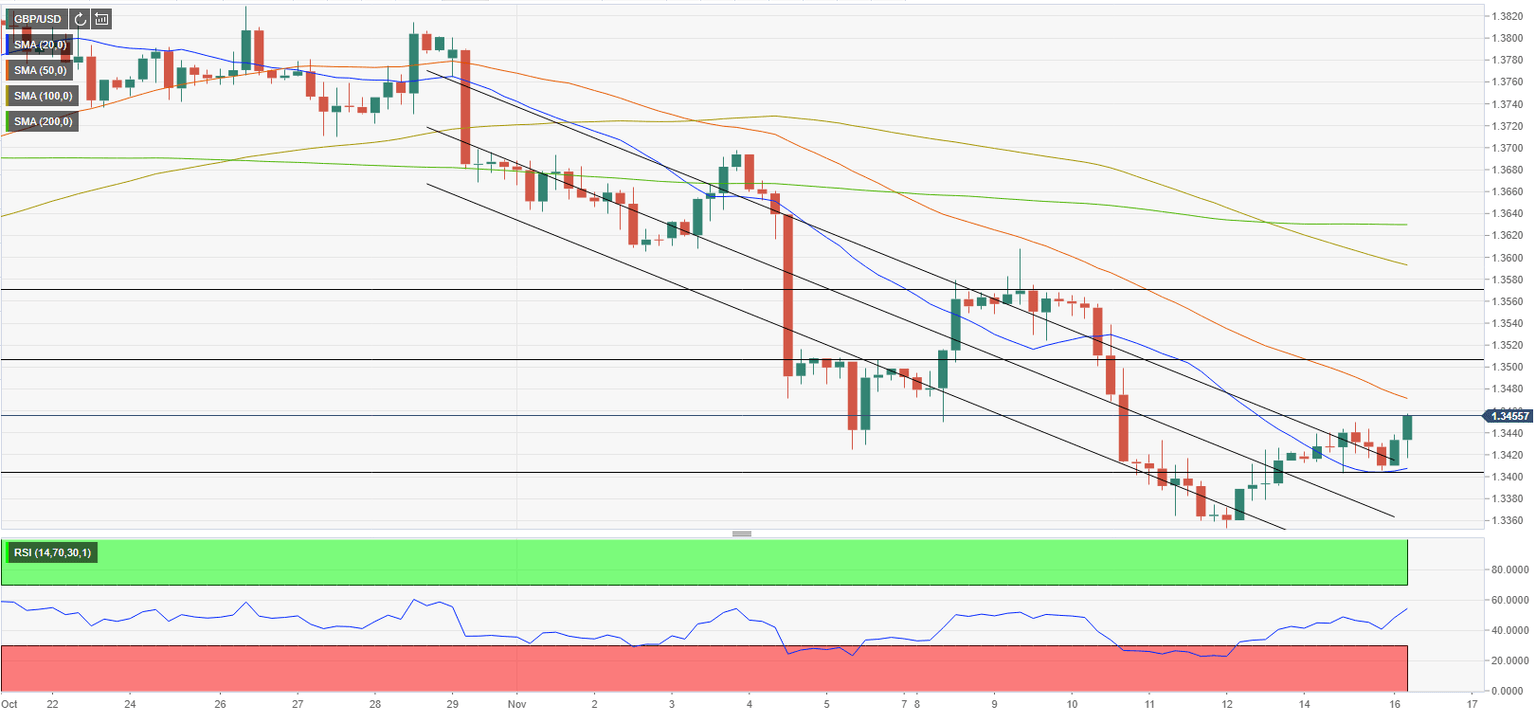

Pound Sterling Price News and Forecast: GBP/USD boosted by strong UK jobs data

GBP/USD boosted by strong UK jobs data, but unable to break above key downtrend for now

Amid a broad pick up in the fortunes of the US dollar following Tuesday’s strong retail sales and industrial production figures, GBP/USD has fallen back from earlier session highs in the 1.3470s and is back to trading in the 1.3430s. At the start of the European trading session, the pair had rallied as much as 0.5%, boosted by a strong labour market report that amny analysts saw as giving the BoE the green light to hike rates in December. While the pair has slipped back from highs, it still holds onto gains of about 0.2% on the session and is, at present, the best-performing currency in the G10. Read more...

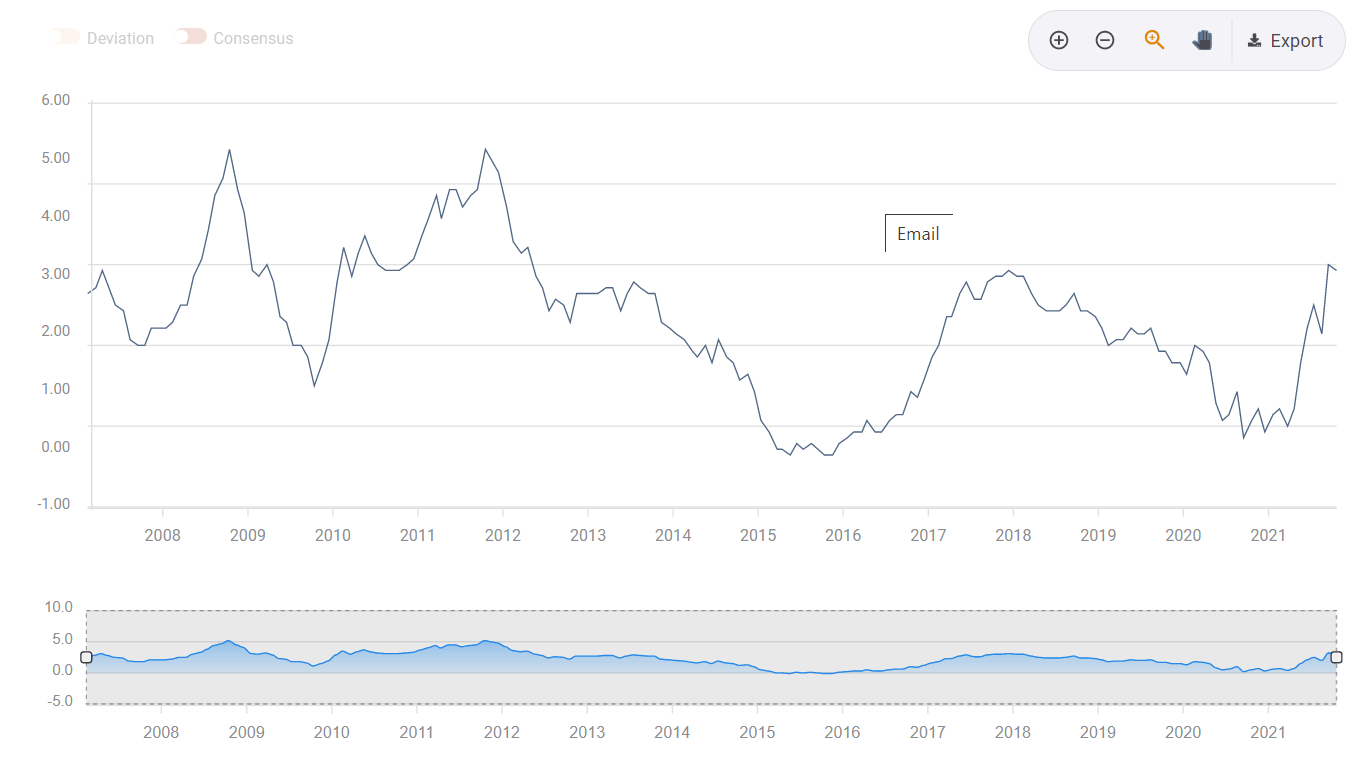

UK CPI Preview: Buy the rumor, sell the fact? Three scenarios for GBP/USD

"I'm very uneasy about the inflation situation" – these words by Bank of England Governor Andrew Bailey have been reverberating through investors' minds ahead of the inflation release for October. They have also been setting a high bar to surpass – and that bar is already high at 3.9% YoY. It is essential to examine another remark Bailey made to MPs on Monday. The governor said that the labor market is tight, and less than 24 hours later, markets learned that Britain's unemployment rate dropped to 4.3% in September, better than expected. Jobless claims also surprised, falling in October – despite the expiry of the furlough scheme. Read more...

GBP/USD Forecast: Technicals point to additional recovery gains

GBP/USD has regained its traction early Tuesday and the technical developments suggest that the pair could extend its recovery unless fundamental drivers hurt the British pound. Although GBP/USD closed virtually unchanged on Monday, the fact that the pair's losses were limited in the face of broad-based USD strength highlighted the pound's resilience at the start of the week. Read more...

Author

FXStreet Team

FXStreet