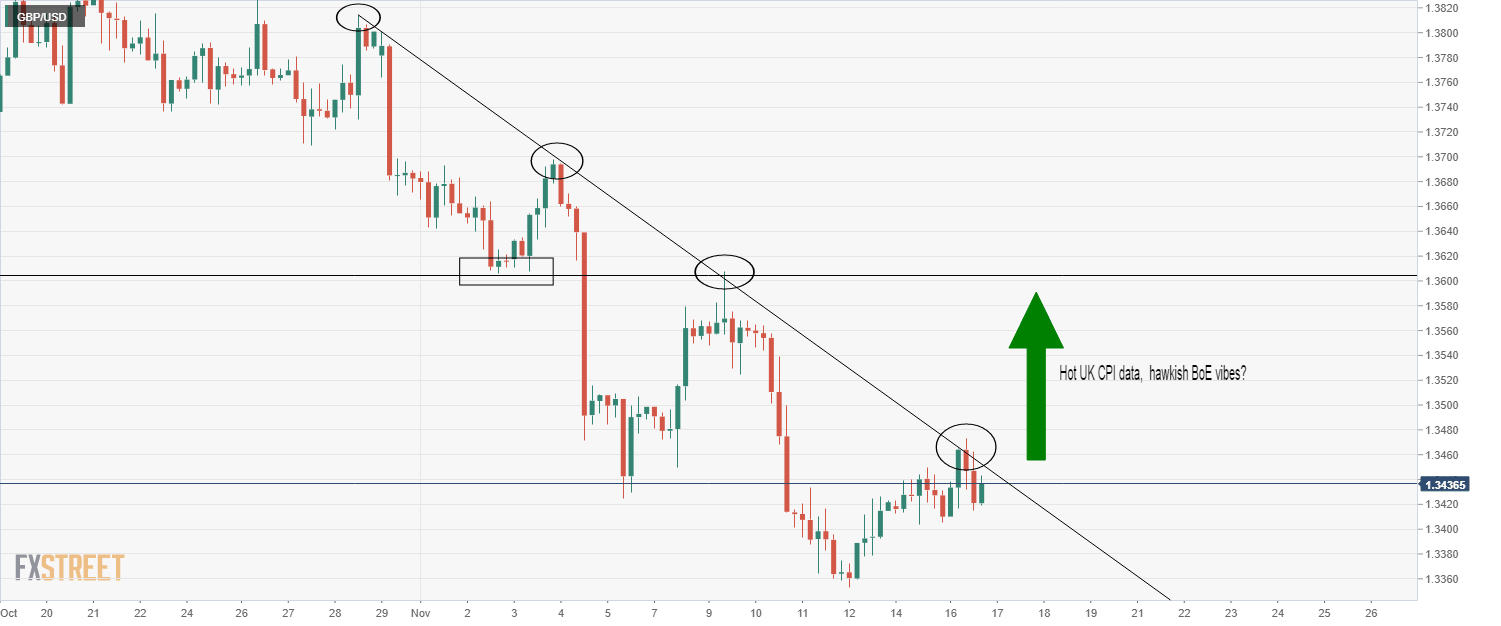

GBP/USD boosted by strong UK jobs data, but unable to break above key downtrend for now

- GBP/USD has fallen back from earlier highs after running into resistance in the form of a key downtrend.

- Wednesday’s UK CPI report, if much hotter than expected, could provide GBP/USD with the tailwinds it needs to break higher.

Amid a broad pick up in the fortunes of the US dollar following Tuesday’s strong retail sales and industrial production figures, GBP/USD has fallen back from earlier session highs in the 1.3470s and is back to trading in the 1.3430s. At the start of the European trading session, the pair had rallied as much as 0.5%, boosted by a strong labour market report that amny analysts saw as giving the BoE the green light to hike rates in December. While the pair has slipped back from highs, it still holds onto gains of about 0.2% on the session and is, at present, the best-performing currency in the G10.

While broad USD strength is likely the main reason why GBP/USD pulled back from earlier highs, technical selling likely also played a role. GBP/USD appeared to test and reject a descending trendline that has been capping the price action since the end of October. Whether or not the pair is able to break above this trend line and recover some lost ground may depend on how Wednesday’s October Consumer Price Inflation (CPI) report goes.

The latest jobs report showed employer payrolls growing by 160K in October, thus easing concerns about the post-end of furlough health of the UK labour market that prevented the BoE from hiking rates in November. Wednesday’s CPI report, if it comes in much hotter than expected as was the case in the US last week, could exacerbate inflation concerns at the bank, thus boosting market expectations for a more aggressive policy response.

GBP Short-Term Interest Rate (STIR) future market pricing has been gradually becoming more hawkish in recent days. In the aftermath of the BoE’s dovish November surprise, December 2022 sterling LIBOR futures rallied from under 98.70 to above 98.90. In other words, markets suddenly went from expecting more than 120bps of tightening by the end of 2022 to under 100bps. But the December 2022 sterling LIBOR futures has quietly fallen back to pre-BoE meeting levels in recent days, with Tuesday’s jobs report sending it under 98.70.

A hotter than expected UK inflation reading tomorrow could send it back to year-to-date lows at just above 98.50. This would be bullish for GBP/USD, and could be the catalyst it needs to break above its recent downtrend. If that were to be the case, bullish technicians may target the 9 November high at 1.3600 as the next key area of resistance. Conversely, should the data disappoint, thus taking hawkish pressure off of the BoE and should the euro continue its dovish ECB/Covid-19 infection surge-related decline, GBP/USD is likely to turn lower. Technical selling may then push it down to annual lows at 1.3350.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset