Pound Sterling Price News and Forecast GBP/USD: BOE’s Saunders hints on tapering

GBP/USD struggles to hold up against dollar strength amid Powell's testimony, mixed US data

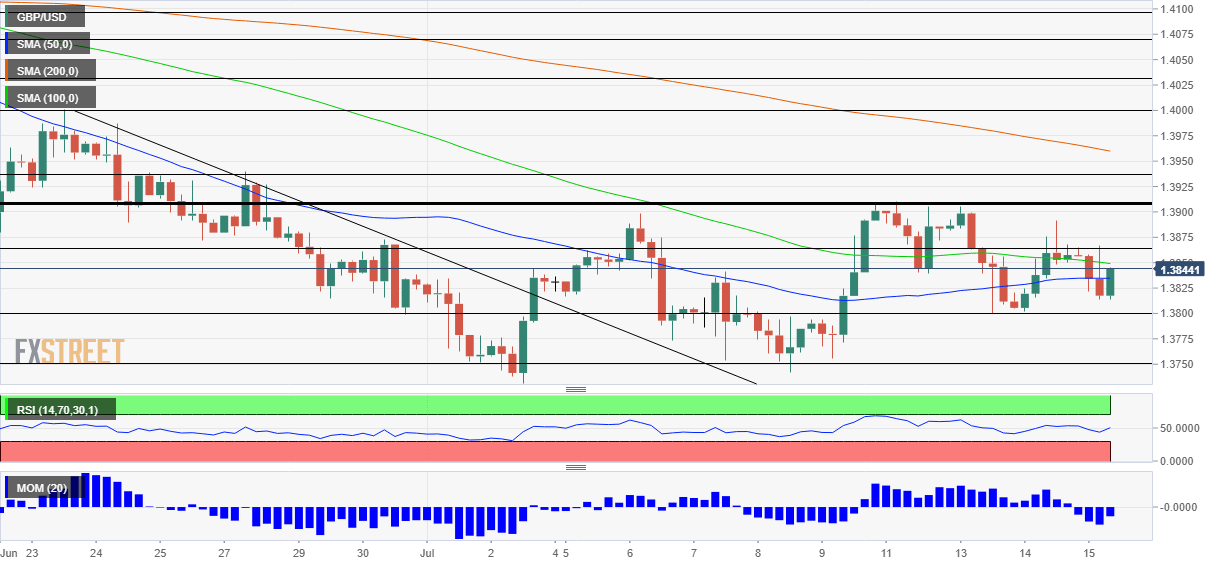

GBP/USD has been falling some 40 pips from the highs as the dollar gains ground. Mostly worse-than-expected US data and uncertainty stemming from Powell weigh on sentiment. UK covid figures are eagerly awaited after Wednesday's leap. Back to the drawing board – GBP/USD has dropped to around 1.3850, nearly unchanged on the day. The safe-haven US dollar has been gaining ground as part of a broader risk-off mood stemming from several factors. Read more...

GBP/USD Forecast: BOE’s Saunders hints on tapering

The GBP/USD pair peaked at 1.3898 during London trading hours, as the pound got a boost from comments from Michael Saunders, policymaker from the Bank of England. He said that during the upcoming months, they would discuss whether to curtail the current assets purchase program and/or take further policy action next year. He clarified that if the “bank rate does rise in the next year or so, it is likely that any rise would be relatively limited.” The pair changed course afterwards as the dollar gathered strength on the back of a souring market’s mood. Stocks edged lower in Europe, accelerating their slumps ahead of London’s close. Wall Street also suffered but ended the day mixed. Read more...

GBP/USD Forecast: Inflation boost? Not so fast, sterling may suffer while BOE looks the other way

GBP/USD has been torn between higher inflation and central bank dismissal – on both sides of the pond. The UK's surge in covid cases could weigh on the pound. Thursday's four-hour chart is painting a mixed picture. No rush – that has been the message from central banks on both sides of the Atlantic, which has been providing negative for cable. Four days before "Freedom Day," sterling has another reason to struggle as covid cases surge. Read more...

Author

FXStreet Team

FXStreet