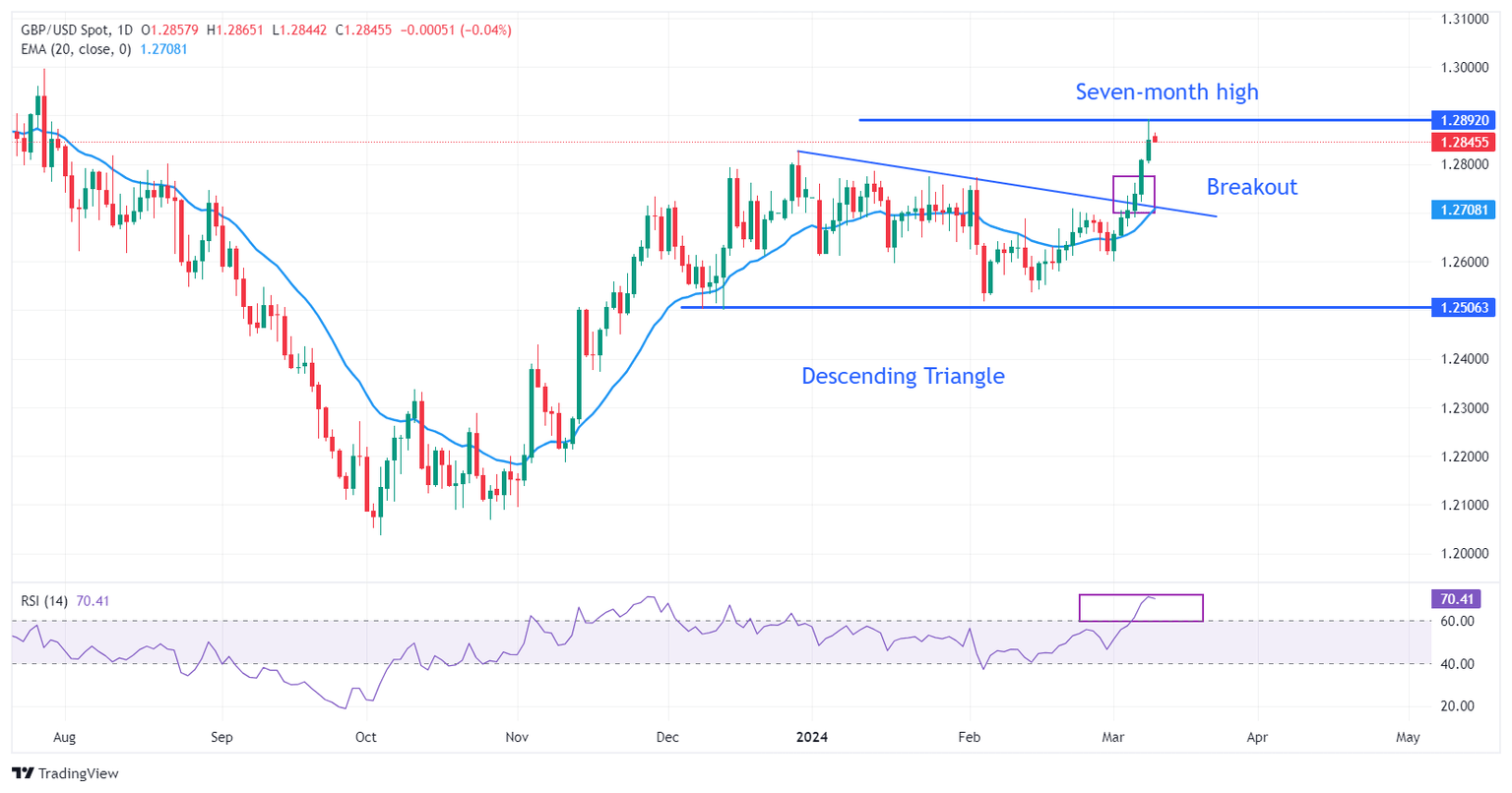

GBP/USD backslides on Monday, finds near-term floor at 1.2800

GBP/USD pared away some gains on Monday, falling from 1.2860 back into the 1.2800 price handle as markets trim rate cut expectations from the Bank of England (BoE). According to the Union Bank of Switzerland (UBS), the BoE is expected to deliver a first rate trim in August versus the previously-expected May.

Read More...

Pound Sterling falls amid uncertainty ahead of data-packed week

The Pound Sterling (GBP) faces selling pressure in Monday’s late European session amid uncertainty ahead of a data-packed week. The GBP/USD pair drops ahead of the United Kingdom Employment and monthly

Gross Domestic Product (GDP), which will be published on Tuesday and Wednesday, respectively.

Read More...

GBP/USD remains steady near the 1.2850, awaits UK employment data

GBP/USD hovers around 1.2850 during the Asian session on Monday, maintaining a positive sentiment to potentially extend its winning streak that commenced on March 1. However, the

US Dollar (USD) has received upward strength and recovered from intraday losses on Friday following the release of upbeat US Nonfarm Payrolls data.

Read More...