Pound Sterling Price News and Forecast: GBP/USD attracts some buyers to near 1.3290 on Monday

GBP/USD Price Forecast: The bullish tone remains in play near 1.3300

The GBP/USD pair gains traction to around 1.3290 during the early European session on Monday. The US Dollar (USD) softens against the Pound Sterling (GBP) amid heightened economic uncertainty in the wake of US President Donald Trump's erratic trade policies.

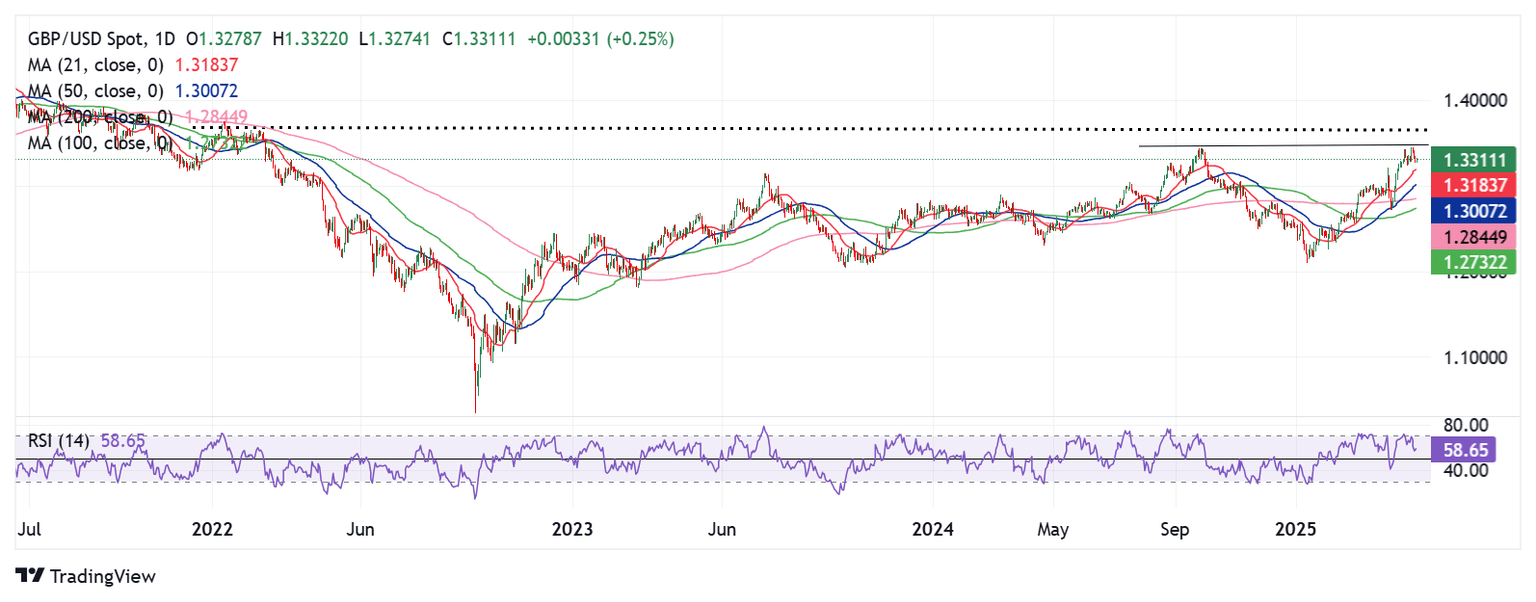

According to the daily chart, the bullish outlook of GBP/USD remains intact, characterized by the price holding above the key 100-day Exponential Moving Average (EMA). The upward momentum is supported by the 14-day Relative Strength Index (RSI), which stands above the midline near 55.60, suggesting the path of least resistance is to the upside. Read more...

GBP/USD Weekly Outlook: Pound Sterling awaits Fed-BoE policy decisions for fresh impetus

The Pound Sterling (GBP) witnessed a downside correction against the US Dollar (USD) after the GBP/USD pair faced rejection again near the 1.3450 barrier. King Dollar regained its throne, booking the third weekly gain, due to receding tariff war fears and optimism emerging from potential trade deals between the United States (US) and its major Asian trading partners.

US President Donald Trump and some of his colleagues stuck to their rhetoric that trade negotiations continued with China even though Beijing dismissed such talks. Trump said during the week that he has "potential" trade deals with India, South Korea and Japan and that there is a very good chance of reaching an agreement with China. Read more...

GBP/USD consolidates above mid-1.3200s as traders move to the sidelines ahead of BoE this week

The GBP/USD pair kicks off the new week on a subdued note and oscillates in a narrow trading band around the 1.3260-1.3265 area, near a one-week low touched during the Asian session.

The US Dollar (USD) remains on the defensive below a multi-week top amid heightened economic uncertainty on the back of US President Donald Trump's tariff plans and turns out to be a key factor acting as a tailwind for the GBP/USD pair. Adding to this, the prospect of more aggressive policy easing by the Federal Reserve (Fed) further seems to undermine the Greenback. Read more...

Author

FXStreet Team

FXStreet