GBP/USD Weekly Outlook: Pound Sterling awaits Fed-BoE policy decisions for fresh impetus

- The Pound Sterling faced rejection again near 1.3450 versus the US Dollar.

- The Fed and BoE policy announcements are set to rock the GBP/USD pair in the week ahead.

- Technically, the pair could see dip-buying as the daily RSI still holds above the midline.

The Pound Sterling (GBP) witnessed a downside correction against the US Dollar (USD) after the GBP/USD pair faced rejection again near the 1.3450 barrier.

Pound Sterling hit three-year highs, then reversed

King Dollar regained its throne, booking the third weekly gain, due to receding tariff war fears and optimism emerging from potential trade deals between the United States (US) and its major Asian trading partners.

US President Donald Trump and some of his colleagues stuck to their rhetoric that trade negotiations continued with China even though Beijing dismissed such talks. Trump said during the week that he has "potential" trade deals with India, South Korea and Japan and that there is a very good chance of reaching an agreement with China.

China eventually confirmed in the latter part of the week, with the Chinese Commerce Ministry stating that “the US has recently sent messages to China through relevant parties, hoping to start talks with China. China is currently evaluating this.”

Optimism on the trade front allayed fears of a likely slowdown in the US economic growth, keeping the USD recovery intact. The first look of the US annualized Gross Domestic Product (GDP) showed on Wednesday that the US economy contracted by 0.3% in the first quarter of 2025 as US firms frontloaded to get ahead of the US levies, resulting in an import surge.

However, Thursday’s ISM Manufacturing PMI eased US growth concerns. The index fell to 48.7 in April from 49.0 in March, against expectations for a bigger fall to 48.

Therefore, the sustained USD demand remained the primary driver behind the GBP/USD pair’s moves as the Pound Sterling finally gave in to the Greenback’s resurgence. The pair hit a fresh three-year high at 1.3445 at the start of the week before setting off a correction to near 1.3250 heading into the release of the US employment report on Friday.

The US Bureau of Labor Statistics (BLS) reported that Nonfarm payrolls (NFP) rose by 177,000 in April, surpassing the market expectation of 130,000. In this period, the Unemployment Rate held steady at 4.2% and annual wage inflation, as measured by the change in the Average Hourly Earnings, remained unchanged at 3.8%. GBP/USD struggled to gain traction after the US labor market data and remained in the lower half of its weekly range heading into the weekend.

Focus on trade headlines and central banks' bonanza

Following a US economic data-dominated week, the upcoming week is relatively light, notwithstanding the Fed and BoE monetary policy decisions.

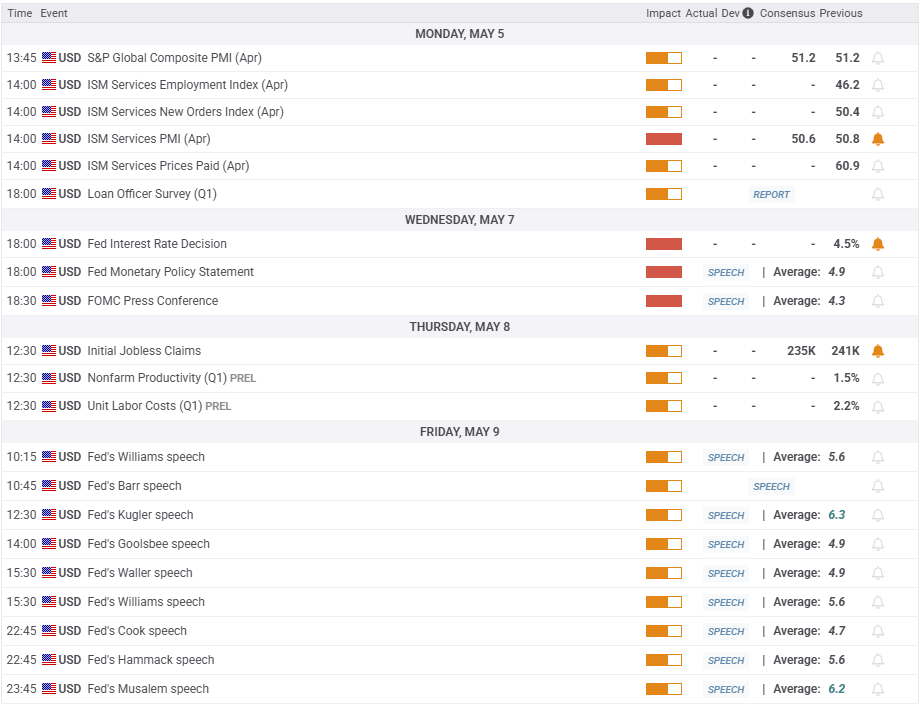

On Monday, the US ISM Services PMI will be of note for the major as the UK markets will remain closed in observance of May Day. Tuesday lacks any top-tier UK or US macro news, so all eyes turn toward Wednesday’s Fed interest rate decision.

The Fed is widely expected to hold rates following the May policy meeting. Still, Chairman Jerome Powell’s words on the potential impact of US tariffs on the economic and inflation outlook will hold the key and impact the USD performance across the board.

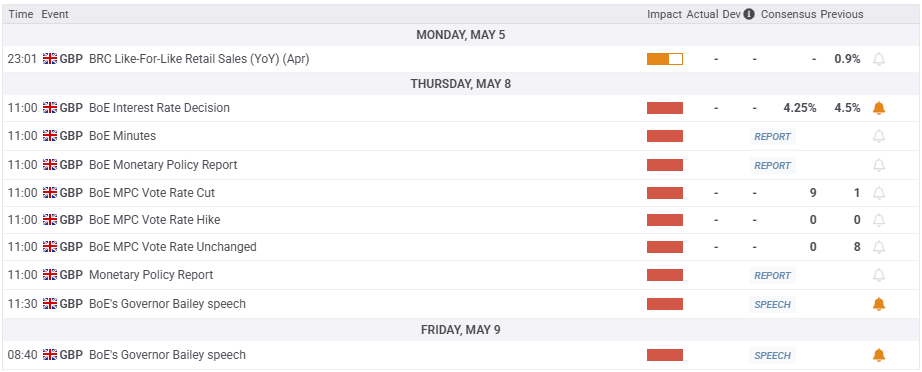

The BoE will steal the spotlight on ‘Super Thursday’as the Bank’s Monetary Policy Report (MPR) and Governor Andrew Bailey’s press conference will throw fresh hints on the timing of the next interest rate cut.

Later that day, the US will publish its weekly Jobless Claims data.

BoE Governor Bailey will make his second public appearance of the week on Friday, speaking at the Reykjavík Economic Conference in Iceland. Fed policymakers will also return to the rostrum after the ‘blackout period’.

That said, potential trade deals between the US and its major trading partners and developments on the tariff front will continue playing a pivotal role in the week ahead.

GBP/USD: Technical Outlook

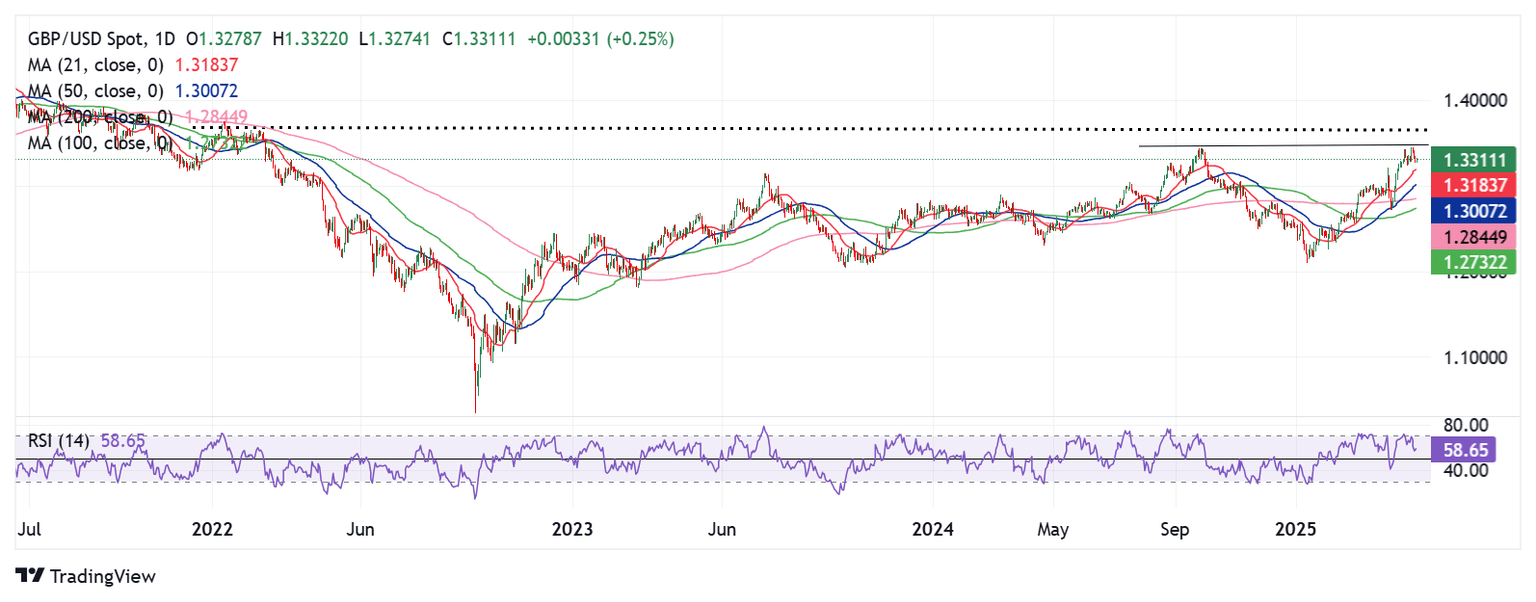

Amid a Golden Cross and a bullish 14-day Relative Strength Index (RSI) on the daily chart, risks remain skewed to the upside for the GBP/USD pair in the short term.

The 50-day Simple Moving Average (SMA) crossed above the 200-day SMA on a daily closing basis on April 17, providing conviction to the bullish streak.

Meanwhile, the 14-day Relative Strength Index (RSI) has turned north while above the midline, currently near 59.

The pair must close the week above the critical 1.3350 psychological barrier to negate the corrective bias. The next powerful resistance aligns at the three-year high of 1.3445.

Acceptance above that level will likely kick off a fresh uptrend toward the February 2022 high of 1.3644.

Alternatively, if the correction gathers steam, the 1.3200 round level will be tested initially, below which the immediate support of the 21-day SMA at 1.3184 will be tested.

A sustained break below the 21-day SMA will target the 50-day SMA at 1.3007, followed by the 200-day SMA at 1.2845.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.