Pound Sterling Price News and Forecast: GBP/USD attracts sellers for the third straight day

GBP/USD Price Forecast: Slides below mid-1.3400s, over one-week low ahead of UK CPI

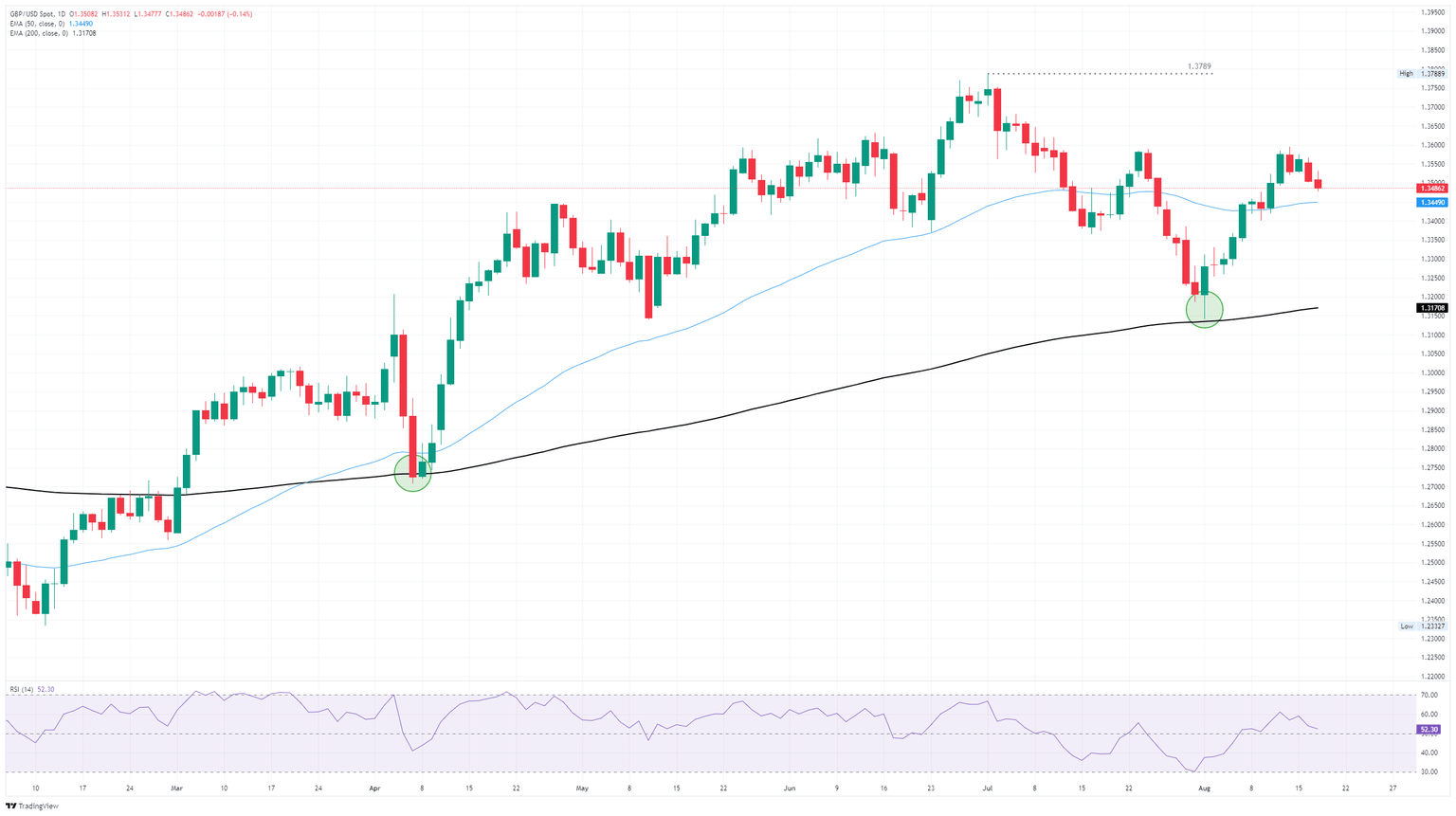

The GBP/USD pair drifts lower for the third consecutive day on Wednesday – also marking the fourth day of a negative move in the previous five – and drops to an over one-week low during the Asian session. Spot prices currently trade around the 1.3475 region, down 0.10% for the day amid some follow-through US Dollar (USD) buying and ahead of the UK consumer inflation figures.

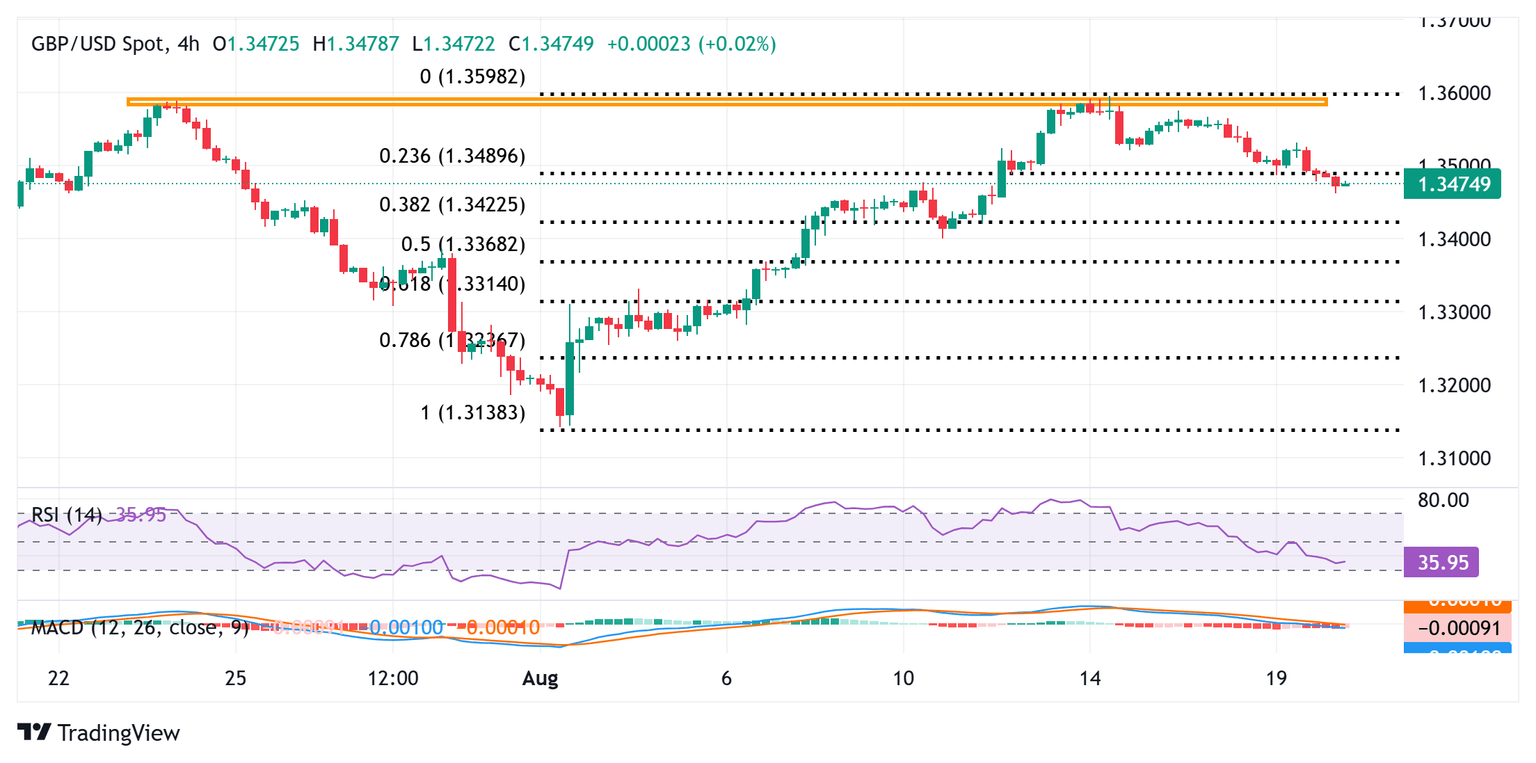

From a technical perspective, last week's failure ahead of the 1.3600 mark constituted the formation of a bearish double-top chart pattern. A subsequent fall below the 23.6% Fibonacci retracement level of the recent rally from the 1.3140 area, or the lowest level since mid-April, touched earlier this month, backs the case for further losses. However, positive oscillators on the daily chart warrant some caution. Read more...

GBP/USD eases ahead of bloated data docket

GBP/USD eased lower on Tuesday, edging back below 1.3500 as Cable traders await a reason to make a move. The trading week opened up with little of note on the economic data docket, leaving markets to react to headline flows that remained constrained.

All of that changes beginning on Wednesday. The United Kingdom’s (UK) latest Consumer Price Index (CPI) inflation figures will be released during the upcoming London market session, followed by the latest interest rate decision meeting minutes from the Federal Reserve (Fed) during the New York market hours. Read more...

GBP/USD holds near 1.3500 as ceasefire hopes offset Fed, UK CPI risks

GBP/USD holds firm at around 1.3500 on Tuesday amid reports of a possible end to the war between Ukraine and Russia. At the same time, traders await inflation data in the United Kingdom (UK), the minutes of the Federal Reserve’s (Fed) July meeting and the Fed Chair Jerome Powell's speech at Jackson Hole.

Geopolitical developments are being cheered by investors, with the Pound erasing some of its earlier losses. Last Friday’s Trump-Putin meeting laid the groundwork for Monday’s summit between Washington and European leaders, including Ukraine’s President Volodymyr Zelenskiy. Recently, Sky News Arabia reported that Putin suggested a possible meeting with Zelenskiy in Moscow. Read more...

Author

FXStreet Team

FXStreet