Pound Sterling Price News and Forecast: GBP/USD attracts buyers for the second consecutive day

GBP/USD Price Forecast: Sticks to strong gains near multi-month top, above mid-1.3000s

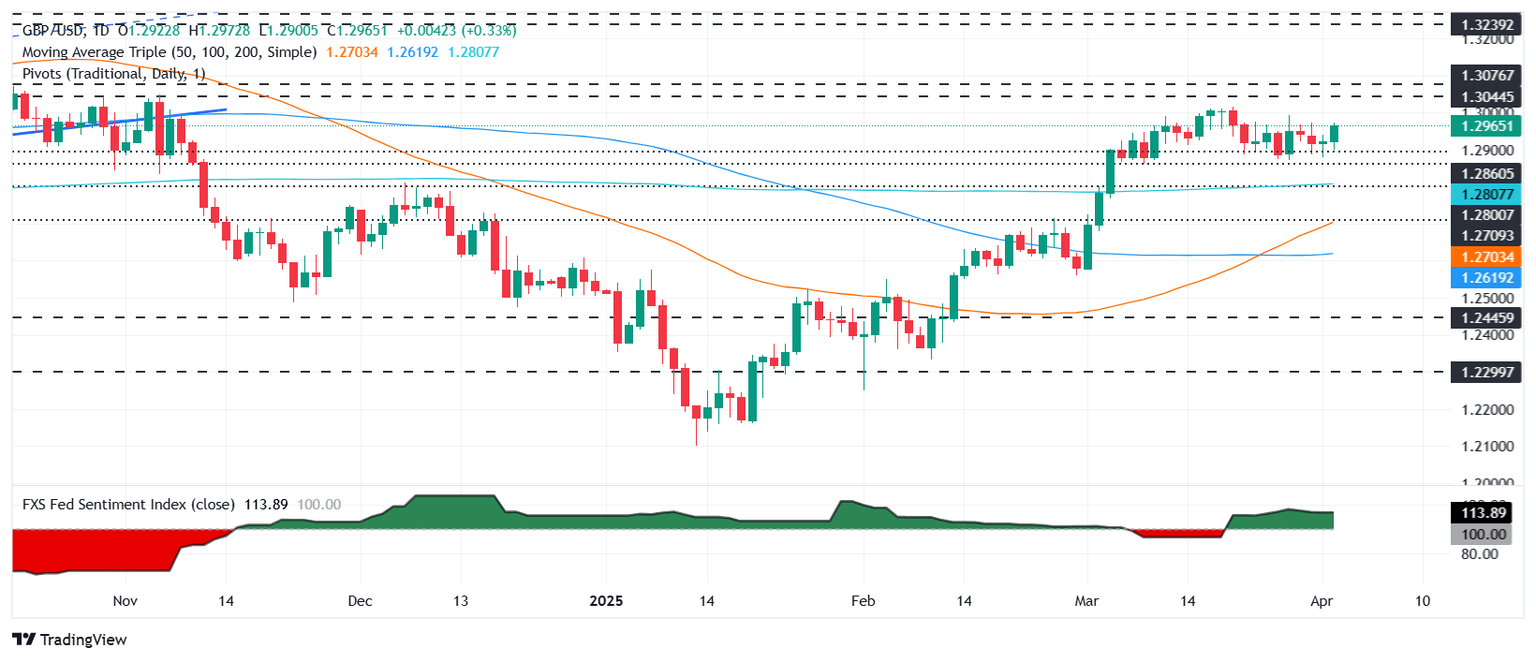

The GBP/USD pair gains strong follow-through positive traction for the second successive day on Thursday and advances to its highest level since October 2024 during the Asian session. Spot prices currently trade just above mid-1.3000s, up 0.40% for the day, and seem poised to climb further amid a bearish US Dollar (USD).

The USD Index (DXY), which tracks the Greenback against a basket of currencies, dives to a fresh year-to-day low in reaction to US President Donald Trump's trade tariffs, which lifts bets that the Federal Reserve (Fed) will resume its rate-cutting cycle soon. This, along with the anti-risk flow, triggers a steep decline in the US Treasury bond yields and further undermines the buck. Read more...

GBP/USD rises to test new highs, absorbs Trump tariffs in stride

GBP/USD stepped into fresh bids at six-month highs on Wednesday after the Trump administration unveiled tariffs that overall came in better than many investors had feared based on President Donald Trump’s cavalcade of tariff threats since taking up residence in the White House 72 days ago. The exact details of the tariff proposals remain complex, but US consumers can expect to pay a flat 10% tariff on all imports into the US, alongside an additional 25% tariff on all automobiles and car parts, and varied “reciprocal” tariffs charged at different levels on a per-country basis. Donald Trump also took the opportunity to remind the world that he still intends to issue even further tariff packages on things like copper, microchips, and other basic imported consumer goods that underpin the entire US economy.

With tariffs set to jack up consumer prices in the coming months, and with a lack of a clear workaround for consumer markets to obtain foreign goods without paying steep import taxes, inflation pressures are likely to rise in the near-term and stay high for much longer than anybody wants. As noted by Federal Reserve (Fed) policymakers, uncertainty around the Trump administration’s trade policies will likely keep interest rates higher for even longer than previously expected. Read more...

GBP/USD climbs past 1.2950 as traders brace for Trump’s tariff announcement

The Pound Sterling (GBP) advances early during the North American session against the US Dollar (USD) as traders await United States (US) President Donald Trump's tariff announcement, which could potentially spur a global economic slowdown. At the time of writing, GBP/USD trades at 1.2950, up 0.22%.

At 20:00 GMT, Donald Trump is expected to announce the imposition of reciprocal tariffs on trading partners in the White House Rose Garden. Although the percentage of duties applied to US trade partners is unknown, The Washington Post mentioned that Trump’s aides were considering a plan of approximately 20% from nearly every country. Read more...

Author

FXStreet Team

FXStreet