Pound Sterling Price News and Forecast: GBP/USD at the mercy of US inflation and Omicron

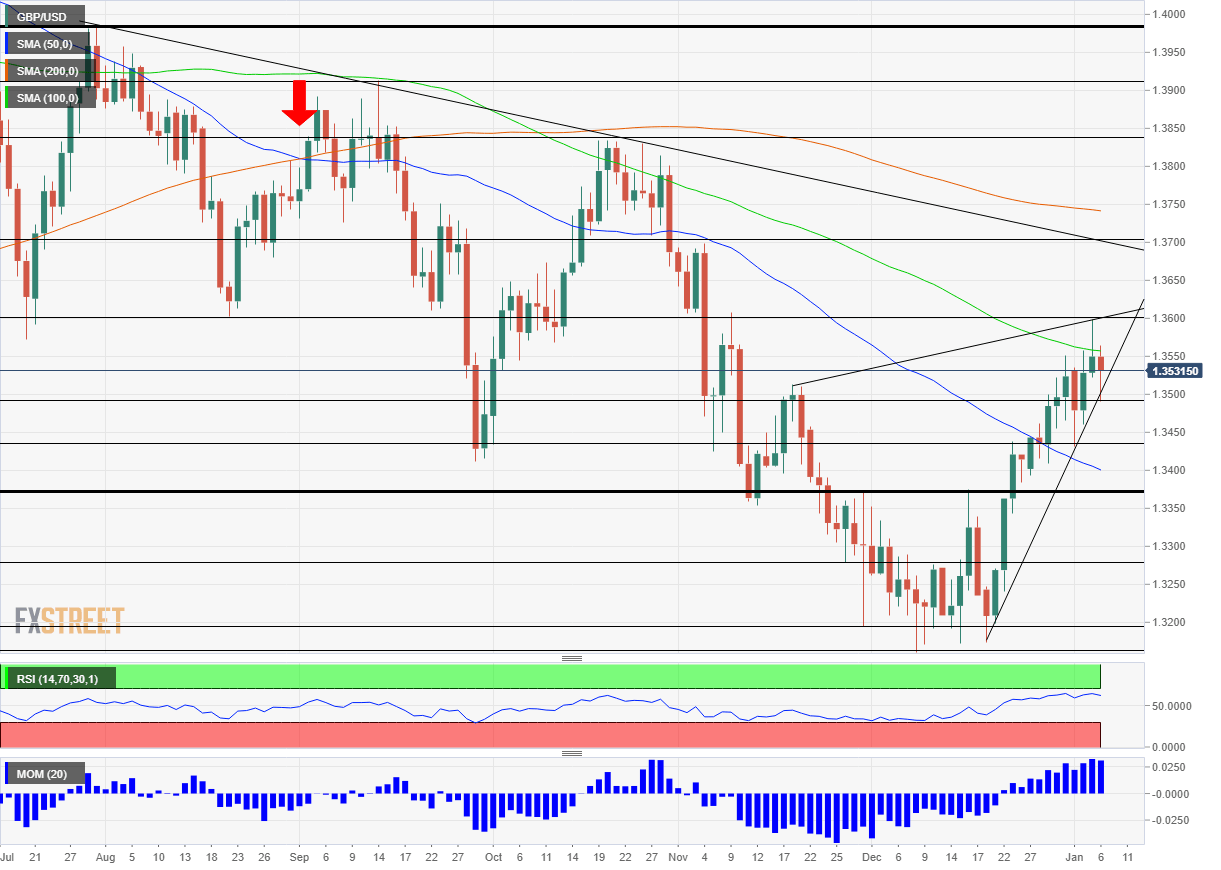

GBP/USD Weekly Forecast: Cable at the mercy of US inflation and Omicron, correction seems imminent

Omicron may be peaking in London – but the Federal Reserve's urge to tighten is still rising. These two forces will likely remain in play in the upcoming week, featuring all-important US inflation and retail sales data, GDP from the UK and a covid-watch. Read more...

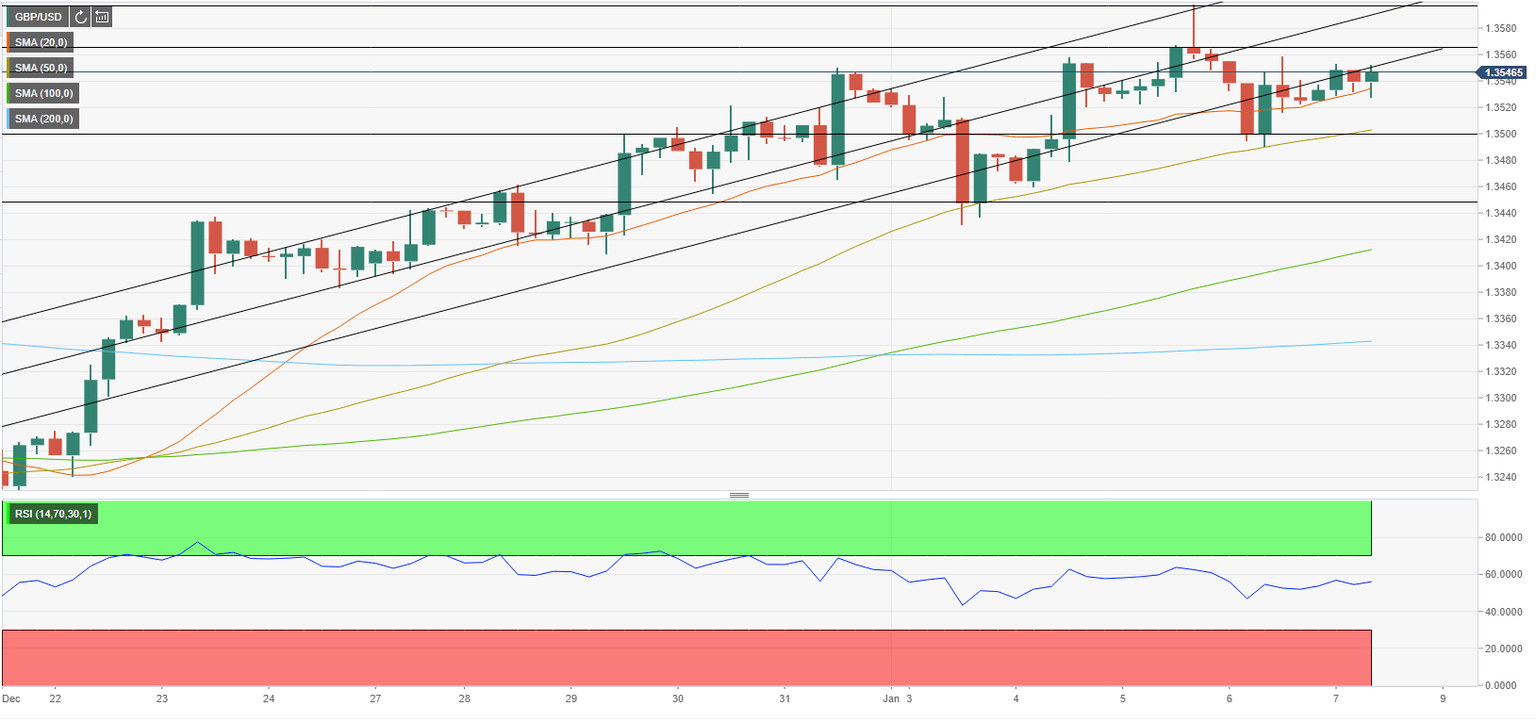

GBP/USD Forecast: Can buyers defend 1.3500 on a strong NFP print?

GBP/USD has been moving sideways around 1.3550 so far on Friday after closing in the negative territory on Thursday. Investors await the US Bureau of Labor Statistics to release the December jobs report, which could have a significant impact on how markets price the Federal Reserve's policy outlook. The FOMC's December policy meeting minutes showed on Wednesday that participants saw it appropriate to start the balance sheet normalization process after the first hike. The publication further revealed that current economic conditions, namely the inflation outlook and the state of the labour market, were seen as factors that would allow a faster balance sheet runoff than the previous financial crisis. Read more...

GBP/USD subdued just under 1.3550 with FX markets primed for US jobs report

GBP/USD is unsurprisingly trading in subdued fashion as FX market participants await the release of the latest official US labour market report at 1330GMT. So far on Friday, the pair has been unable to poke above the 1.3550s and has mostly been going sideways in the 1.3530-50 area. In the broader technical context, GBP/USD’s has been moving higher within the confines of a bullish trendline since just after Christmas and this trend currently remains intact. But traders may be leery about chasing the pair any higher if the upcoming US labour market report comes in as good as expected, thus boosting the prospect of a March Fed rate hike. Read more...

Author

FXStreet Team

FXStreet