Pound Sterling Price News and Forecast: GBP trades stable while focus shifts to flash UK/US PMI data

Pound Sterling trades stable while focus shifts to flash UK/US PMI data

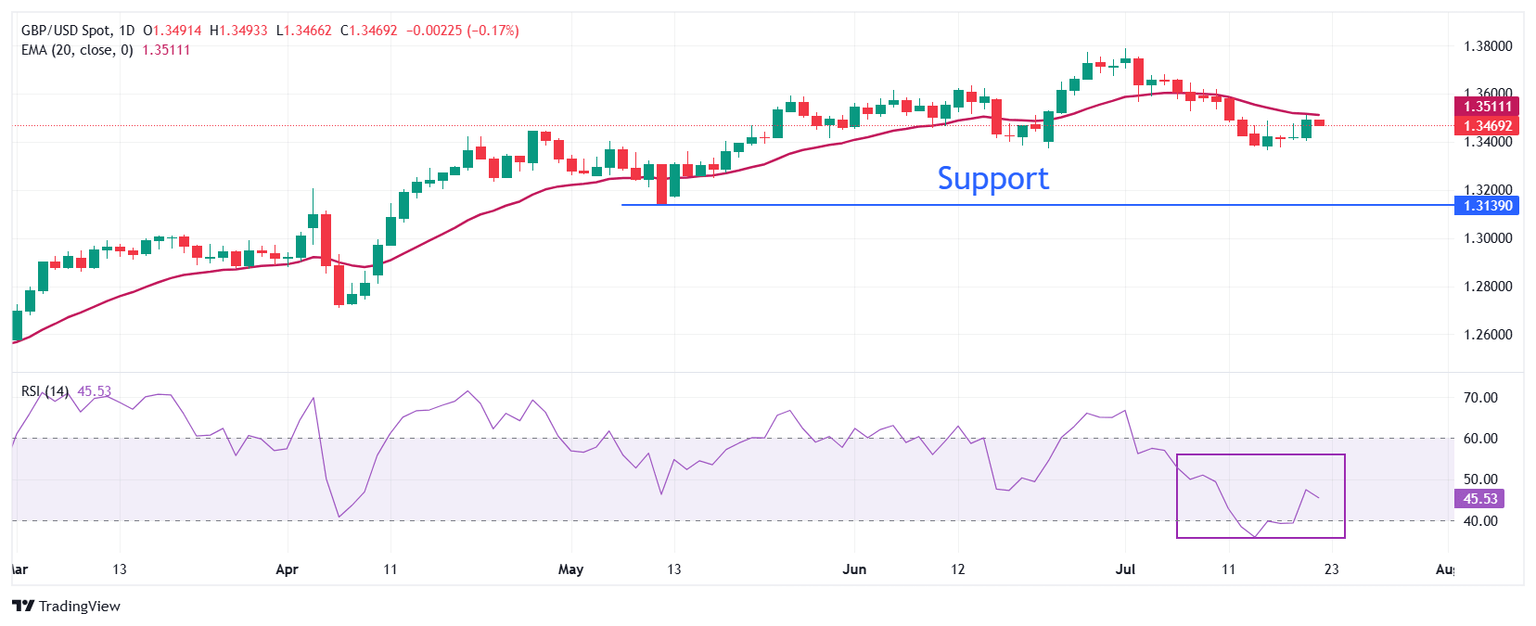

The Pound Sterling (GBP) demonstrates stability against its major peers on Tuesday, with investors awaiting preliminary United Kingdom (UK) S&P Global Purchasing Managers’ Index (PMI) data for July, scheduled for release on Thursday.

Investors will closely monitor the UK PMI data to get cues about whether the impact of a hiring slowdown has started flowing into the economy. The report is expected to show that the overall business activity grew moderately. The Composite PMI is expected to have dropped slightly to 51.9 from 52.0 in June. Read more...

GBP/USD Forecast: Pound Sterling turns bullish as Trump-Powell drama weighs on USD

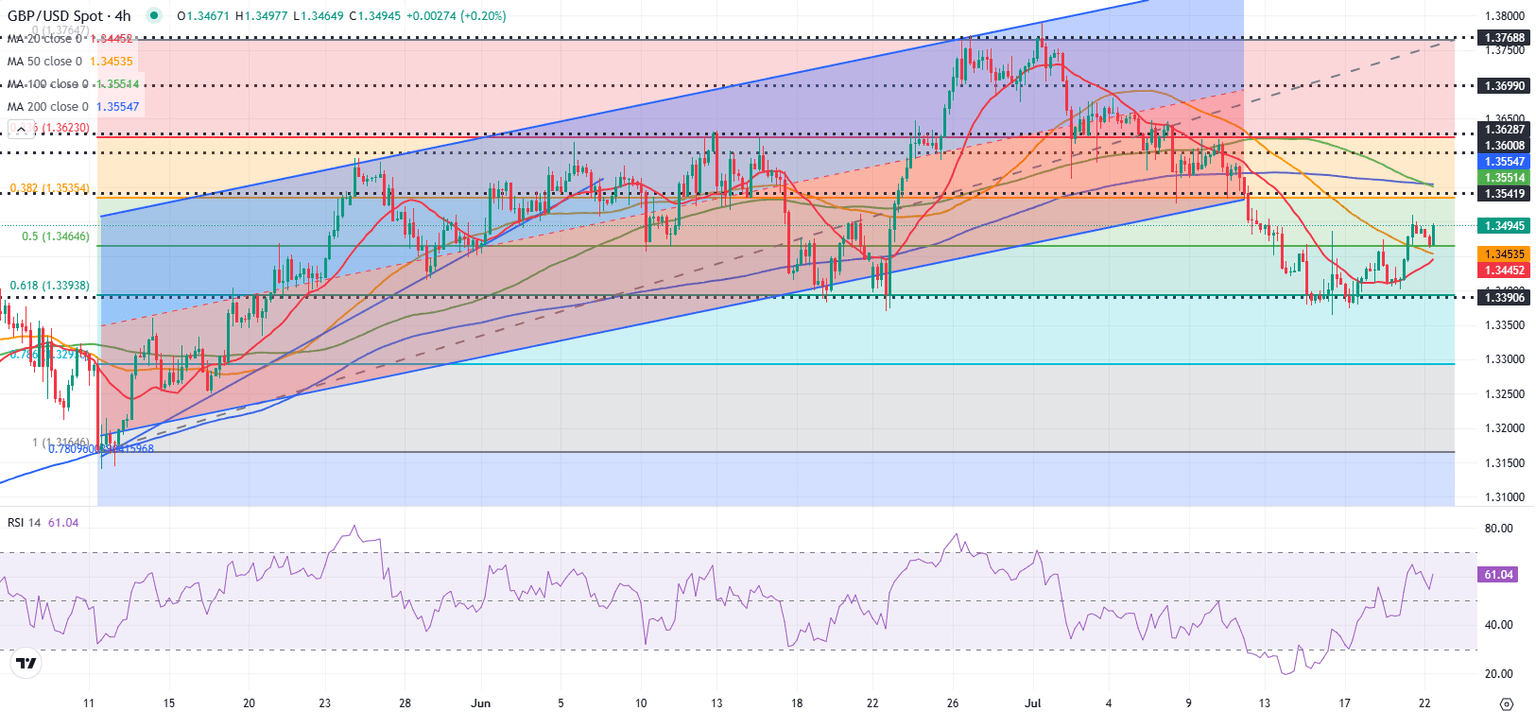

GBP/USD gained about 0.6% on Monday and erased a large portion of the previous week's losses. The pair stays in a consolidation phase slightly below 1.3500, while the technical outlook hints at a bullish shift in the near term.

The broad-based selling pressure surrounding the US Dollar (USD) fuelled GBP/USD's rebound on Monday. In the absence of high-tier data releases, growing fears over the Federal Reserve (Fed) losing its independence and Chairman Jerome Powell losing his position weighed on the currency. Read more...

Author

FXStreet Team

FXStreet