Pound Sterling Price News and Forecast: GBP outperforms risky peers at the start of the week

Pound Sterling outperforms risky peers at the start of the week

The Pound Sterling (GBP) outperforms its risky currency peers, but faces selling pressure against safe-haven at the start of the week. The British currency gains on expectations that the Bank of England (BoE) will follow a gradual monetary easing cycle in 2026. The BoE stated in its last policy meeting of 2025 that the monetary policy will remain on a “gradual downward path” after reducing interest rates by 25 basis points (bps) to 3.75% with a 5-4 majority in December.

Market experts believe that the BoE favored a moderate easing campaign as the United Kingdom (UK) inflation is well above the 2% target despite cooling down in the last two months. The UK headline Consumer Price Index (CPI) inflation came down to 3.2% in November from the peak of 3.8% seen in September. Read more...

GBP/USD: Likely to trade between 1.3430 and 1.3490 – UOB Group

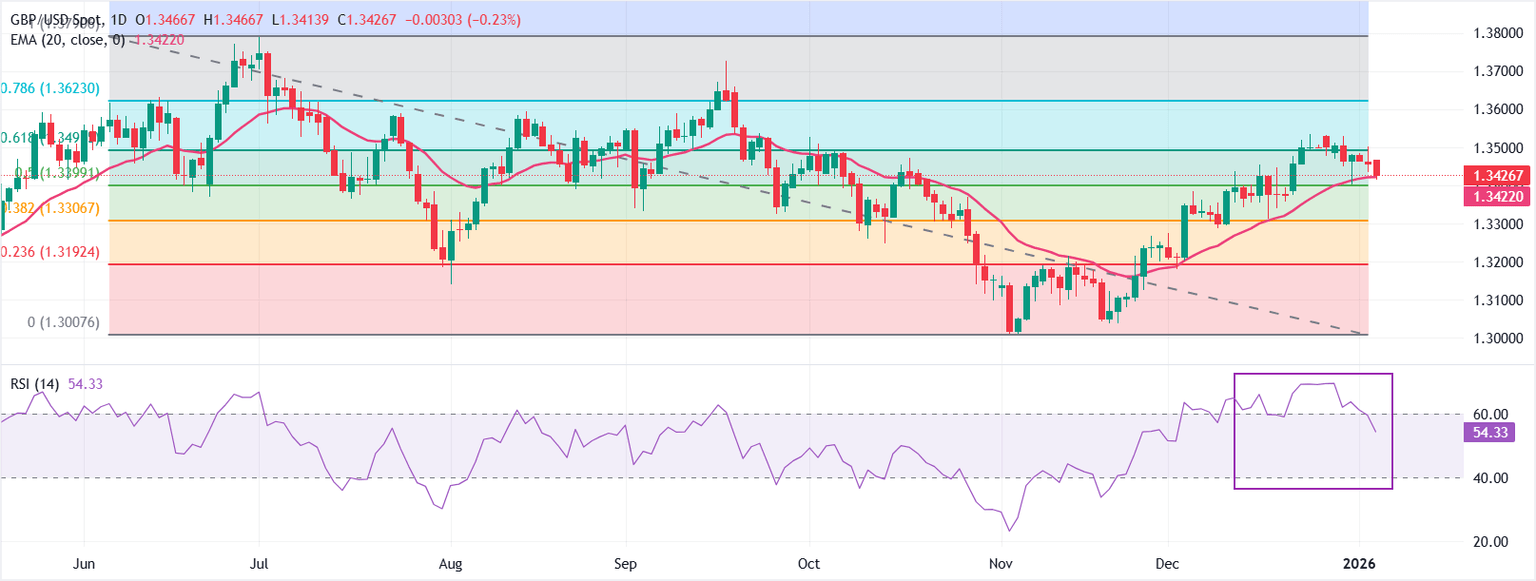

GBP is likely to trade sideways between 1.3430 and 1.3490. In the longer run, momentum indicators are mostly flat; GBP is likely to trade in a range between 1.3400 and 1.3535, UOB Group's FX analysts Quek Ser Leang and Peter Chia note.

24-HOUR VIEW: "GBP swung between 1.3435 and 1.3502 last Friday, closing modestly lower at 1.3462, down by 0.10%. There has been no clear shift in directional momentum. Read more...

Author

FXStreet Team

FXStreet