Pound Sterling Price News and Forecast: GBP declines on rising UK fiscal worries

Pound Sterling declines on rising UK fiscal worries, Fed Daly's speech eyed

The Pound Sterling (GBP) tumbles against its major peers on Friday as long-dated United Kingdom (UK) gilt yields gain sharply amid soaring public sector borrowings in August. 30-year UK gilt yields jump over 1% to near 5.50%.

The data showed that Public sector net borrowing hit £18 billion, the highest for the month in five years. Economists expected government borrowing to come in significantly lower at £12.8 billion. Read more...

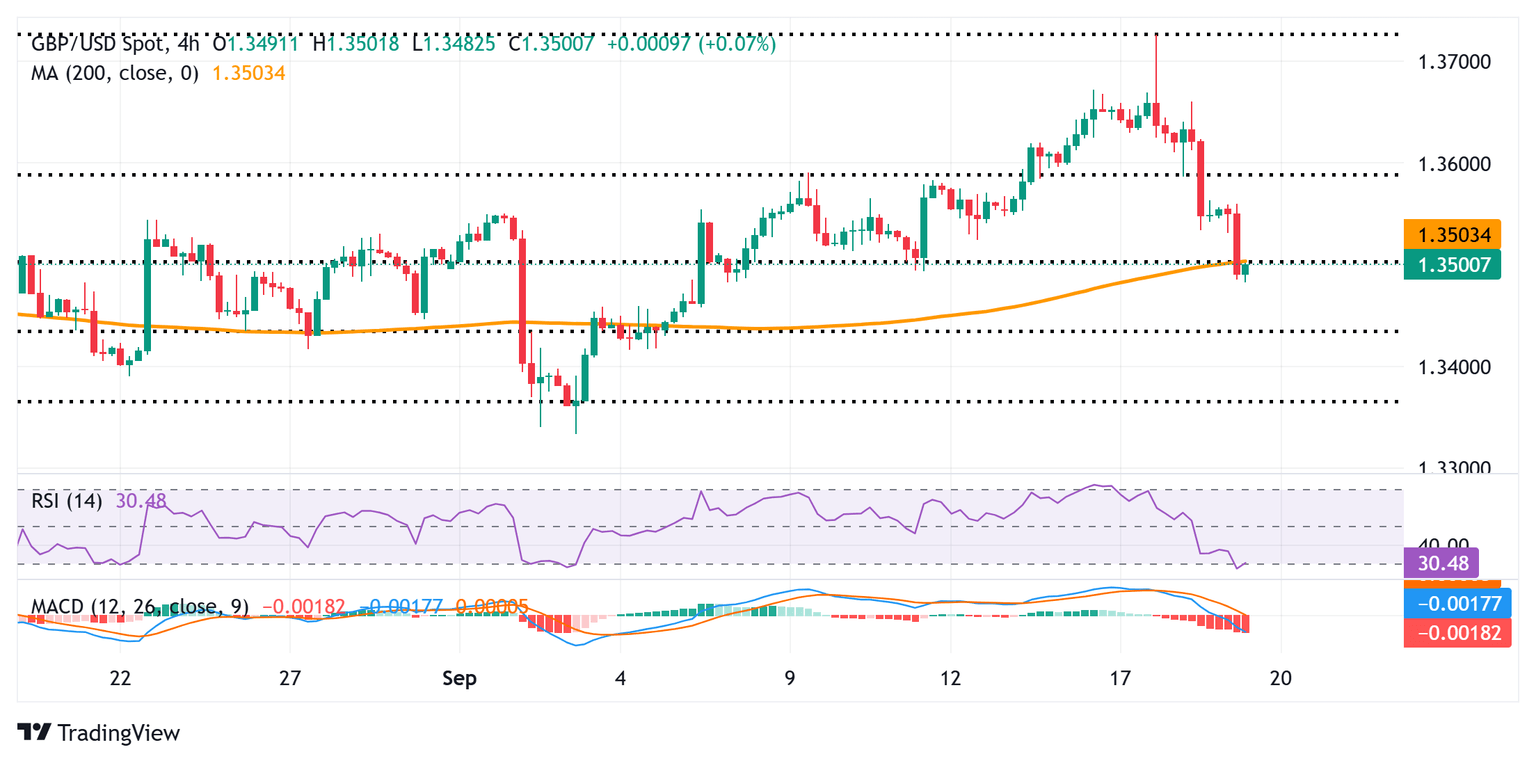

GBP/USD Price Forecast: Seems vulnerable amid BoE’s dovish pause, firmer USD

The GBP/USD pair prolongs this week's retracement slide from its highest since early July for the third straight day and slides below the 1.3500 psychological mark, or a two-week trough during the early European session on Friday. The US Dollar (USD) sticks to its post-FOMC strong recovery gains from a three-and-a-half-year low. Furthermore, the Bank of England's (BoE) dovish outlook contributes to the British Pound's (GBP) underperformance and exerts additional pressure on the currency pair.

A hawkish assessment of Federal Reserve (Fed) Chair Jerome Powell's remarks on Wednesday remains supportive of the USD move up for the third straight day. The US central bank, as was anticipated, lowered borrowing costs by 25 basis points (bps) for the first time since December 2024 and indicated that more interest rate cuts would follow by the year-end amid the softening labor market. Read more...

Author

FXStreet Team

FXStreet