Pound Sterling declines on rising UK fiscal worries, Fed Daly's speech eyed

- The Pound Sterling faces sharp selling pressure amid soaring UK gilt yields.

- UK Retail Sales data for August beats estimates.

- The Fed has signaled two more interest rate cuts this year.

The Pound Sterling (GBP) tumbles against its major peers on Friday as long-dated United Kingdom (UK) gilt yields gain sharply amid soaring public sector borrowings in August. 30-year UK gilt yields jump over 1% to near 5.50%.

The data showed that Public sector net borrowing hit £18 billion, the highest for the month in five years. Economists expected government borrowing to come in significantly lower at £12.8 billion.

Ballooning UK fiscal woes are expected to force the UK government to either cut public spending or raise taxes, or both, in the upcoming Autumn budget.

On the economic data front, the US Retail Sales data for August has come in higher than projected. Month-on-month Retail Sales, a key measure of consumer spending, rose steadily by 0.5%, faster than expectations of 0.4%. Year-on-year, the consumer spending measure grew at a faster pace of 0.7% against estimates of 0.6%. In July, Retail Sales rose by 0.8%, revised lower from 1.1%.

The data has shown that sales by retailers that don’t have stores, such as online sellers and stalls, remained robust. Also, demand at textile clothing and footwear stores remained strong.

Meanwhile, Bank of England (BoE) officials have agreed to slow down the pace of quantitative tightening. In the monetary policy announcement on Thursday, the BoE said that it will unload UK gilts worth 70 billion pounds between October 2025 and September 2026, lower than the 100 billion pounds sold in the past 12 months.

On Thursday, the BoE held interest rates steady at 4% with a 7-2 majority, as expected, and retained its “gradual and careful” monetary easing guidance. The central bank was expected to maintain the status quo as inflation in the UK economy had remained elevated in the past few months. However, the BoE has assured that inflationary pressures will peak around 4% in September.

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the weakest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.25% | 0.41% | -0.03% | 0.13% | 0.15% | 0.23% | 0.46% | |

| EUR | -0.25% | 0.18% | -0.33% | -0.12% | -0.12% | -0.02% | 0.21% | |

| GBP | -0.41% | -0.18% | -0.46% | -0.29% | -0.30% | -0.28% | 0.03% | |

| JPY | 0.03% | 0.33% | 0.46% | 0.13% | 0.31% | 0.33% | 0.34% | |

| CAD | -0.13% | 0.12% | 0.29% | -0.13% | 0.02% | 0.10% | 0.33% | |

| AUD | -0.15% | 0.12% | 0.30% | -0.31% | -0.02% | 0.11% | 0.34% | |

| NZD | -0.23% | 0.02% | 0.28% | -0.33% | -0.10% | -0.11% | 0.23% | |

| CHF | -0.46% | -0.21% | -0.03% | -0.34% | -0.33% | -0.34% | -0.23% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling slides further against US Dollar

- The Pound Sterling slumps to near 1.3490 against the US Dollar after the release of the UK Retail Sales data. The downside move in the GBP/USD pair is also driven by strength in the US Dollar, following the monetary policy announcement by the Federal Reserve (Fed) on Wednesday.

- The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, extends a three-day recovery move, trading firmly around 97.50 at the time of writing.

- On Wednesday, the Fed reduced interest rates by 25 basis points (bps) to the 4.00%-4.25% range and suggested that there would be two more rate cuts in the remainder of the year. This was the first time the Fed made an adjustment in monetary policy this year.

- The Fed’s decision to unwind monetary policy restrictiveness came in the wake of slowing United States (US) labor market conditions. “Balance of risks has shifted, and I can no longer say that the labor market is solid,” Fed Chair Jerome Powell said.

- Meanwhile, US Initial Jobless Claims for the week ending September 13 came in lower than expected. The number of individuals seeking jobless benefits for the first time was at 231K, lower than estimates of 240K and the prior reading of 264K.

- In Friday’s session, investors will focus on the speech from San Francisco Fed President Mary Daly, which is scheduled at 18:30 GMT. Investors would look for cues regarding the pace of the interest rate cuts by the Fed in the monetary policy meeting ahead.

Technical Analysis: Pound Sterling skids below 20-day EMA

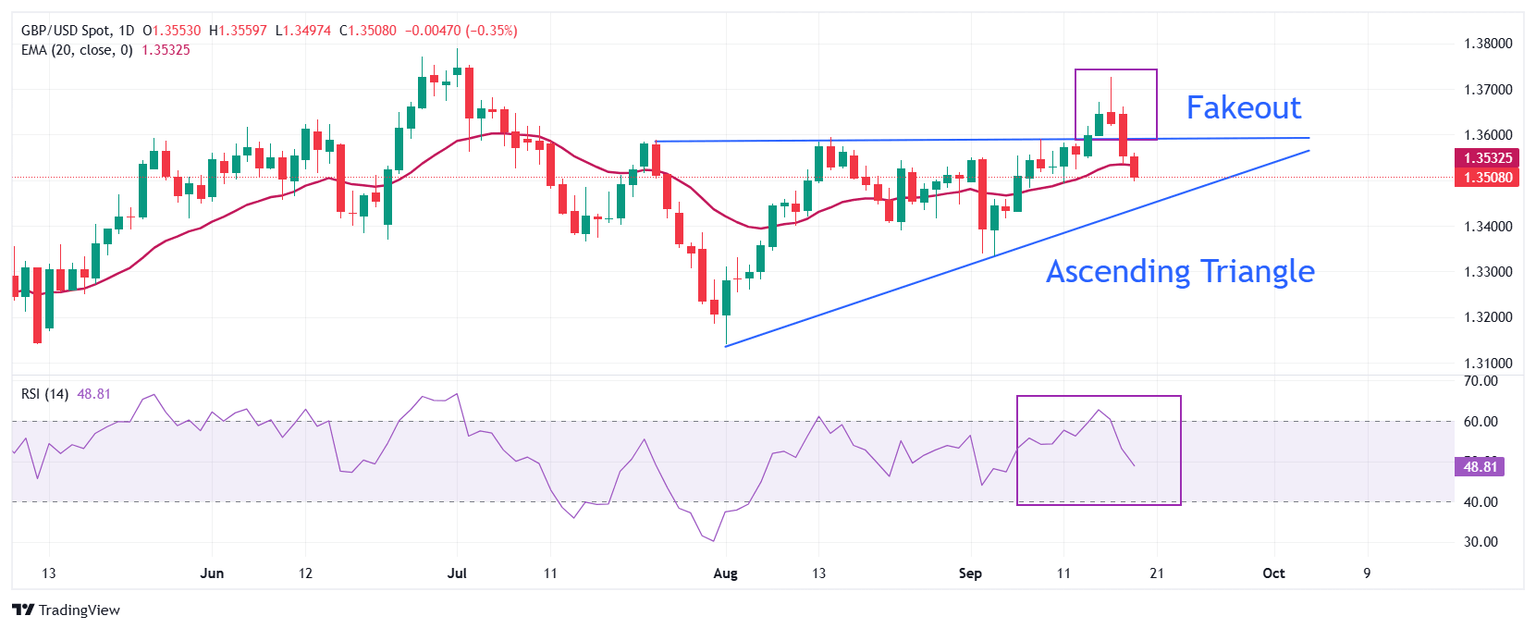

The Pound Sterling declines to near 1.3500 against the US Dollar on Friday. The GBP/USD faces intense selling pressure after a fake breakout of an ascending triangle chart pattern.

The Cable has declined below the 20-day Exponential Moving Average (EMA), which trades around 1.3530, suggesting that the near-term trend has turned bearish.

The 14-day Relative Strength Index (RSI) has fallen sharply below 50.00. A fresh bearish momentum would emerge if the RSI breaks below 40.00.

Looking down, the August 1 low of 1.3140 will act as a key support zone. On the upside, the July 1 high near 1.3800 will act as a key barrier.

UK gilt yields FAQs

UK Gilt Yields measure the annual return an investor can expect from holding UK government bonds, or Gilts. Like other bonds, Gilts pay interest to holders at regular intervals, the ‘coupon’, followed by the full value of the bond at maturity. The coupon is fixed but the Yield varies as it takes into account changes in the bond's price. For example, a Gilt worth 100 Pounds Sterling might have a coupon of 5.0%. If the Gilt's price were to fall to 98 Pounds, the coupon would still be 5.0%, but the Gilt Yield would rise to 5.102% to reflect the decline in price.

Many factors influence Gilt yields, but the main ones are interest rates, the strength of the British economy, the liquidity of the bond market and the value of the Pound Sterling. Rising inflation will generally weaken Gilt prices and lead to higher Gilt yields because Gilts are long-term investments susceptible to inflation, which erodes their value. Higher interest rates impact existing Gilt yields because newly-issued Gilts will carry a higher, more attractive coupon. Liquidity can be a risk when there is a lack of buyers or sellers due to panic or preference for riskier assets.

Probably the most important factor influencing the level of Gilt yields is interest rates. These are set by the Bank of England (BoE) to ensure price stability. Higher interest rates will raise yields and lower the price of Gilts because new Gilts issued will bear a higher, more attractive coupon, reducing demand for older Gilts, which will see a corresponding decline in price.

Inflation is a key factor affecting Gilt yields as it impacts the value of the principal received by the holder at the end of the term, as well as the relative value of the repayments. Higher inflation deteriorates the value of Gilts over time, reflected in a higher yield (lower price). The opposite is true of lower inflation. In rare cases of deflation, a Gilt may rise in price – represented by a negative yield.

Foreign holders of Gilts are exposed to exchange-rate risk since Gilts are denominated in Pound Sterling. If the currency strengthens investors will realize a higher return and vice versa if it weakens. In addition, Gilt yields are highly correlated to the Pound Sterling. This is because yields are a reflection of interest rates and interest rate expectations, a key driver of Pound Sterling. Higher interest rates, raise the coupon on newly-issued Gilts, attracting more global investors. Since they are priced in Pounds, this increases demand for Pound Sterling.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.