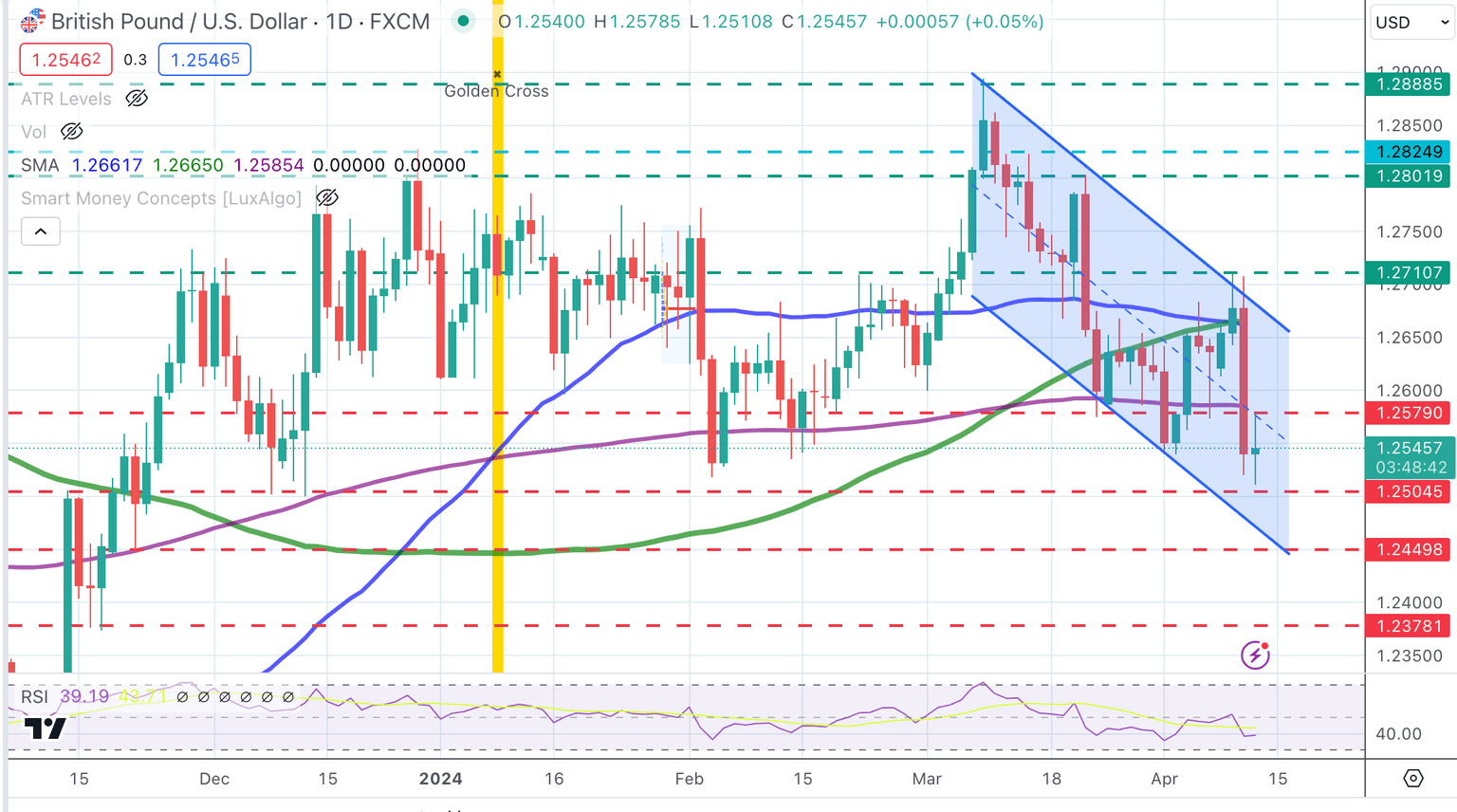

GBP/USD Price Analysis: Pound is under increasing bearish pressure with 1.2500 support in play

The

Sterling keeps trading within a bearish channel from early March lows and seems ready to test an important support area at 1.2500. Wednesday’s long negative candle reflects an impulsive bearish move and gives sellers hope to explore fresh year-to-date lows.

Read More...

Pound Sterling sees more downside as Fed rate cut hopes wane

The Pound Sterling (GBP) remains vulnerable against the US Dollar in Thursday’s early American session after an intense sell-off that dragged the Cable to a two-month low near 1.2520. The near-term appeal of the GBP/USD pair has weakened as the US Dollar strengthens after traders dialled back bets supporting rate cuts by the Fed in the June and July policy meetings.

Read More...

GBP/USD remains under selling pressure below 1.2550, US PPI data looms

The GBP/USD pair remains under selling pressure near 1.2540 after bouncing off the 2024 low of 1.2520. The sell-off in the major pair is driven by the firmer US Dollar (USD) after the upside surprises in US Consumer Price Index (CPI) data in March. Investors await the US March

Producer Price Index (PPI) and weekly Initial Jobless Claims on Thursday ahead of the UK monthly Gross Domestic Product (GDP) numbers later this week.

Read More...