Pound Sterling outperforms US Dollar, focus shifts to UK employment, US CPI data

- The Pound Sterling trades firmly against the US Dollar around 1.3450 as traders trim bets supporting BoE’s interest-rate cuts this year.

- Fed Governor Waller could be nominated as Chairman Powell’s successor.

- Investors await UK employment and US CPI data next week.

The Pound Sterling (GBP) clings to three-day gains around 1.3450 against the US Dollar (USD) on Friday. The GBP/USD pair trades firmly as upbeat expectations that the Federal Reserve (Fed) will cut interest rates in the September meeting have kept the US Dollar on the back foot.

According to the CME FedWatch tool, traders have almost fully priced a 25-basis point (bps) interest rate reduction by the Fed in September that would lower borrowing rates to 4.00%-4.25%.

Additionally, the nomination of Council of Economic Advisers Chairman Stephen Miran by US President Donald Trump for the replacement of Fed Governor Adriana Kugler would also increase support for interest rate cuts in the policy meeting next month. Market experts had anticipated that the entry of Trump’s candidate into the rate-setting committee will be favorable for his economic agenda. Trump has criticized the Fed, especially Chairman Jerome Powell, a number of times for supporting a restrictive monetary policy stance.

Meanwhile, a report from Bloomberg points that Fed Governor Christopher Waller could be Jerome Powell’s successor. The report also stated that Waller has met with Trump’s team members, who were impressed with him.

Pound Sterling trades firmly as BoE cuts interest rates with a slim majority

- The Pound Sterling holds onto Thursday’s gains during the European trading session on Friday as traders pare bets supporting interest rate cuts by the Bank of England (BoE) after the monetary policy announcement on Thursday, in which officials decided to cut rates but after a very tight vote.

- The data from money markets shows that traders see a 17 basis points (bps) interest rate reduction in the remainder of the year, suggesting that the BoE will hold interest rates at their current levels until 2026.

- On Thursday, the BoE reduced its key borrowing rates by 25 basis points (bps) to 4%, as expected, but the decision was taken by a very slim majority, something that markets hadn't expected. Out of the nine members of the Monetary Policy Committee (MPC), five supported a rate cut, fewer than the seven anticipated by economists. Moreover, the initial vote split was an unprecedented 4-4-1, with four members favouring a hold and one opting for a 50 basis point cut. A second vote was needed to reach the final 5-4 majority to cut rates by 25 basis points, something never seen before.

- In the statement following the decision, the BoE maintained the wording of a “gradual and careful” approach to further easing of monetary policy.

- BoE Governor Andrew Bailey stated that the central bank is committed to bringing inflation sustainably to the 2% target. Bailey warned that rising food and energy prices are de-anchoring consumer inflation expectations, the labor market is softening and the growth outlook is subdued. The BoE raised one-year forward Consumer Price Index (CPI) projections to 2.7% from the 2.4% previously expected.

- Friday's economic calendar is empty, except for Bank of England Chief Economist Huw Pill's commentary in the National MPC Agency briefing at around 11:15 GMT. His words could be worth noting, considering the different perspectives on rates within the BoE as Pill voted to keep rates unchanged.

- Looking at next week, investors shift their focus to the United Kingdom (UK) labor market data for the three-months ending June, which is scheduled to be released on Tuesday.

- In the US, investors will closely monitor the US Consumer Price Index (CPI) data for July, which is scheduled to be released on Tuesday. Investors will pay close attention to the inflation data to confirm whether the impact of tariffs has started feeding into prices. June’s CPI report showed an increase in the price of goods that are largely imported into the economy.

- US headline inflation is expected to rise to 2.8% on year from June’s 2.7%. In the same period, the core CPI – which excludes volatile food and energy prices – is estimated to have risen by 3%, faster than the prior release of 2.9%.

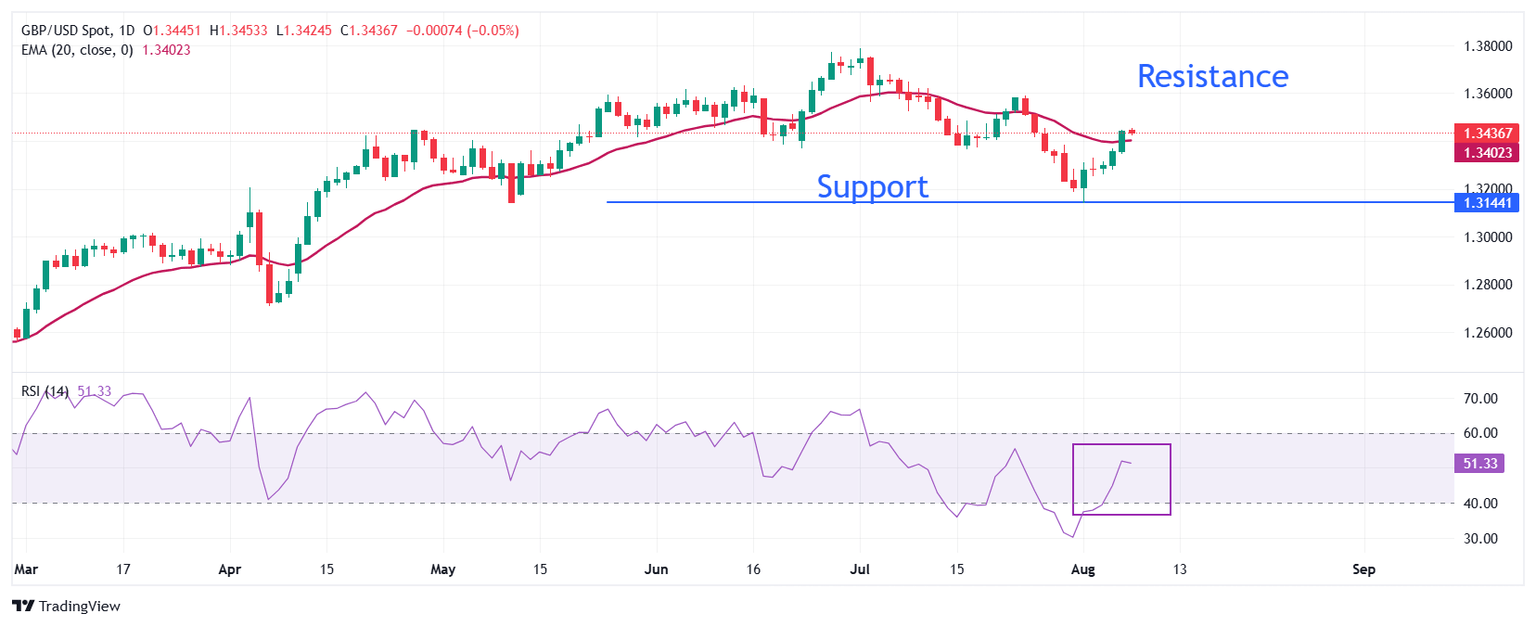

Technical Analysis: Pound Sterling returns above 20-day EMA

The Pound Sterling clings to gains around 1.3450 against the US Dollar during European trading hours on Friday. The near-term trend of the pair has turned bullish as it has climbed back above the 20-day Exponential Moving Average (EMA), which trades around 1.3402.

The 14-day Relative Strength Index (RSI) bounces back above 50.00 after oscillating inside the 20.00-40.00 range in the past few trading sessions, suggesting an attempt for bullish reversal.

Looking down, the August 1 low of 1.3140 will act as a key support zone. On the upside, the July 23 high near 1.3585 will act as a key barrier.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.