Pound Sterling trades with caution ahead of UK inflation

- The Pound Sterling drops slightly to near 1.3200 against the US Dollar after better-than-expected US Retail Sales data.

- Investors expect the BoE to leave interest rates unchanged at 5% on Thursday.

- The UK core CPI is estimated to have accelerated to 3.5% in August.

The Pound Sterling (GBP) faces selling pressure against its major peers on Tuesday. The British currency drops as investors turn cautious ahead of the United Kingdom (UK) Consumer Price Index (CPI) data for August, which will be published on Wednesday. The inflation data will significantly influence market speculation for the Bank of England (BoE) interest rate path for the last quarter of the year as it is expected to leave interest rates unchanged on Thursday.

The UK CPI report is expected to show that the annual core inflation – which excludes volatile components such as food, energy, alcohol, and tobacco – grew at a faster pace of 3.5% from 3.3% in July, with headline inflation steady at 2.2%.

Any signs showing that UK inflation remains persistent would result in the BoE emphasizing the need to keep interest rates unchanged at their current levels in November’s policy meeting. On the contrary, soft inflation figures would allow the BoE to deliver dovish guidance. Currently, financial market participants expect that the BoE will cut interest rates one more time, either in November or in December.

In the UK CPI report, investors will keenly focus on the Service inflation data, which is closely tracked by BoE officials. In July, annual service inflation decelerated sharply to 5.2%, the lowest figure in more than two years.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.07% | 0.18% | 0.85% | 0.02% | -0.19% | 0.14% | 0.22% | |

| EUR | -0.07% | 0.11% | 0.73% | -0.09% | -0.27% | 0.06% | 0.15% | |

| GBP | -0.18% | -0.11% | 0.64% | -0.16% | -0.37% | -0.04% | 0.02% | |

| JPY | -0.85% | -0.73% | -0.64% | -0.81% | -1.00% | -0.67% | -0.61% | |

| CAD | -0.02% | 0.09% | 0.16% | 0.81% | -0.20% | 0.11% | 0.19% | |

| AUD | 0.19% | 0.27% | 0.37% | 1.00% | 0.20% | 0.32% | 0.38% | |

| NZD | -0.14% | -0.06% | 0.04% | 0.67% | -0.11% | -0.32% | 0.06% | |

| CHF | -0.22% | -0.15% | -0.02% | 0.61% | -0.19% | -0.38% | -0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling surrenders its intraday gains against US Dollar

- The Pound Sterling edges lower to near 1.3200 against the US Dollar (USD) in Tuesday’s North American session. The GBP/USD pair surrenders its intraday gains due to a mild recovery in the US Dollar after the release of the monthly United States Retail Sales data for August. The Census Bureau reported that Retail Sales, a key measure for consumer spending, barely grew in August, while it was expected to decline by 0.2%. In July, the consumer spending measure rose by 1.1%, upwardly revised from 1%.

- The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, rebounds mildly to near 100.80 after hovering close to a year-to-date (YTD) low of 100.50. Going forward, investors will focus on the Federal Reserve’s (Fed) monetary policy decision on Wednesday.

- The Fed is widely expected to cut interest rates for the first time in more than four years. The Fed has maintained a restrictive monetary policy stance due to a fierce battle against stubborn inflation, which was prompted by pandemic-led stimulus.

- Market expectations for the Fed to begin reducing interest rates by a wide margin have risen overnight after dovish comments from Jon Faust, a former senior adviser to Fed Chairman Jerome Powell, in comments to the Wall Street Journal (WSJ). Faust said that his preference “would be slightly toward starting with 50 (basis-points interest-rate cut)” as he thinks that several policymakers would forecast a 100-bps interest rate cut by the year-end. “If that is the case, leading off with a 25-basis-point cut risks raising awkward questions over why officials expect to deliver a larger rate cut later this year but didn’t lead with it”, he said.

- According to the CME FedWatch tool, the probability of the Fed reducing interest rates by 50 bps to 4.75%-5.00% in September has increased sharply to 69% from 34% a week ago.

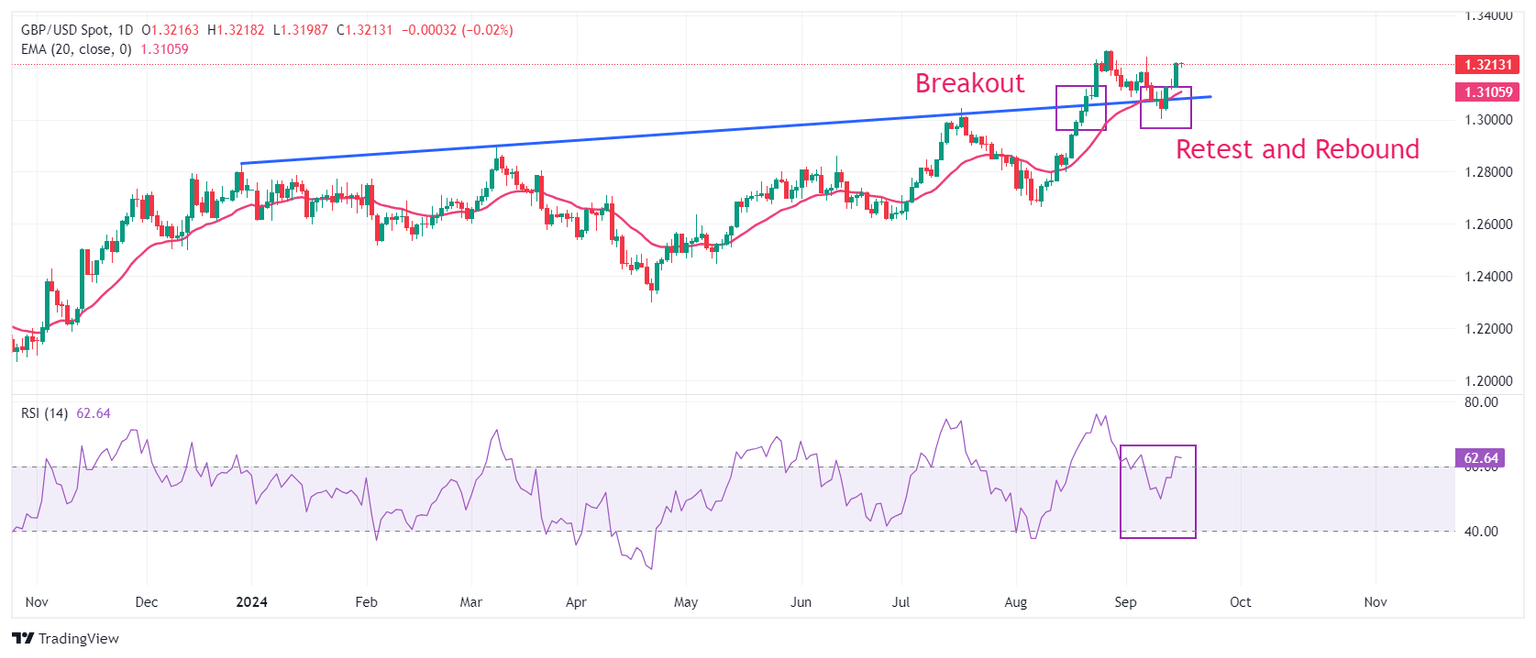

Technical Analysis: Pound Sterling seeks to stabilize above 1.3200

The Pound Sterling holds gains near 1.3200 against the US Dollar in European trading hours. The near-term outlook of the GBP/USD pair remains firm as it holds above the 20-day Exponential Moving Average (EMA) near 1.3100. Earlier, the Cable strengthened after recovering from a corrective move to near the trendline plotted from the December 28, 2023, high of 1.2828, from where it delivered a sharp increase after a breakout on August 21.

The 14-day Relative Strength Index (RSI) stands above 60.00. A fresh round of bullish momentum could occur if the oscillator sustains around this level.

Looking up, the Cable will face resistance near the August 27 high of 1.3266 and the psychological level of 1.3500. On the downside, the psychological level of 1.3000 emerges as crucial support.

Economic Indicator

Core Consumer Price Index (YoY)

The United Kingdom (UK) Core Consumer Price Index (CPI), released by the Office for National Statistics on a monthly basis, is a measure of consumer price inflation – the rate at which the prices of goods and services bought by households rise or fall – produced to international standards. The YoY reading compares prices in the reference month to a year earlier. Core CPI excludes the volatile components of food, energy, alcohol and tobacco. The Core CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as bullish for the Pound Sterling (GBP), while a low reading is seen as bearish.

Read more.Next release: Wed Sep 18, 2024 06:00

Frequency: Monthly

Consensus: 3.5%

Previous: 3.3%

Source: Office for National Statistics

The Bank of England is tasked with keeping inflation, as measured by the headline Consumer Price Index (CPI) at around 2%, giving the monthly release its importance. An increase in inflation implies a quicker and sooner increase of interest rates or the reduction of bond-buying by the BOE, which means squeezing the supply of pounds. Conversely, a drop in the pace of price rises indicates looser monetary policy. A higher-than-expected result tends to be GBP bullish.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.