Pound Sterling trades lower as UK interest rates path remains downwards

- The Pound Sterling demonstrates strength near 1.3500 against the US Dollar on the emergence of Fed’s larger-than-usual interest rate cut bets.

- US NFP data for August showed cracks in the job market.

- Investors await BoE Breeden’s speech on Tuesday.

The Pound Sterling (GBP) underperforms its peers, except the US Dollar, at the start of the week. The British currency weakens as Bank of England (BoE) Governor Andrew Bailey reiterated the need to unwind monetary policy restrictiveness further during his speech before the House of Commons’ Treasury Committee last week, citing labor market risks.

BoE Governor Bailey said that there is “doubt over the pace of interest rate cuts”, although the path “will continue to be downwards”. Bailey warned that he is more concerned about “downside job risks than other Monetary Policy Committee (MPC) members, who voted to keep rates on hold” in the policy meeting in August. On the inflation front, Bailey commented that upside risks to price pressures are coming from the supply side.

Inflation in the UK economy has accelerated significantly, which is allowing a decent number of BoE members to argue in favor of holding interest rates at their current levels. In July, the United Kingdom (UK) headline Consumer Price Index (CPI) rose at an annual pace of 3.8%, the highest level seen since January 2024.

Meanwhile, UK monthly Retail Sales for July came in higher-than-projected on Friday. The Retail Sales data, a key measure of consumer spending, rose by 0.6%, faster than expectations of 0.2% and the prior reading of 0.3%.

Going forward, investors will focus on the speech from BoE Deputy Governor Sarah Breeden, which is scheduled for Tuesday. Breeden was one of five MPC members who voted to reduce interest rates by 25 bps to 4% in the August policy meeting.

Pound Sterling edges higher against US Dollar on Fed rate cut optimism

- The Pound Sterling trades firmly near 1.3500 against the US Dollar (USD) during the European trading session on Monday. The GBP/USD pair demonstrates strength as the US Dollar faces selling pressure, following the emergence of chances that the Federal Reserve (Fed) could deliver a bigger-than-usual interest rate reduction of 50 basis points (bps) in the policy meeting next week.

- At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades with caution below 98.00.

- According to the CME FedWatch tool, traders see a 10% chance that the Fed will cut interest rates by 50 bps to the 3.75%-4.00% range, while the rest point a 25 bps interest rate reduction, a sharp shift from the nearly 15% chance that the central bank would keep rates unchanged a week ago.

- Fed dovish expectations swelled after the United States (US) Nonfarm Payrolls (NFP) data for August signaled cracks in the labor market on Friday. According to the report, the US economy added 22K fresh workers, the lowest reading since January 2021. The Unemployment Rate accelerated to 4.3%, as expected, from the prior reading of 4.2%.

- Market expectations for the Fed’s interest rate cuts for the September meeting also intensified in early August after the release of July's NFP report, which showed a sharp downward revision in employment figures of May and June.

- In the US, investors will focus on the CPI data for August, which will be released on Thursday. Investors will closely monitor the US inflation data to get cues about whether US President Donald Trump’s tariffs are promoting price pressures.

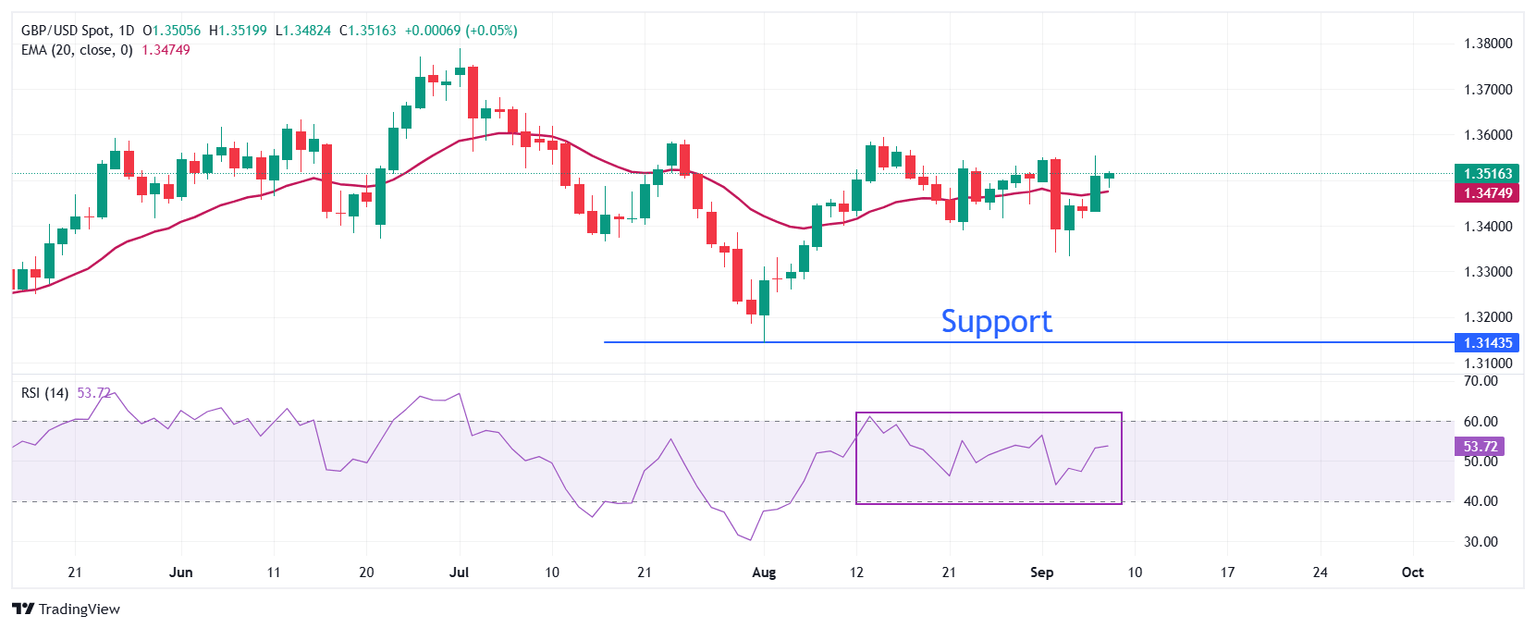

Technical Analysis: Pound Sterling trades close to 20-day EMA

The Pound Sterling edges higher to near 1.3515 against the US Dollar on Monday, but is still inside Friday’s trading range. The near-term trend of the GBP/USD pair is sideways as it trades around the 20-day Exponential Moving Average (EMA), which is around 1.3475.

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, indicating a sideways trend.

Looking down, the August 1 low of 1.3140 will act as a key support zone. On the upside, the August 14 high near 1.3600 will act as a key barrier.

Economic Indicator

Consumer Price Index (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as The Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier.The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Thu Sep 11, 2025 12:30

Frequency: Monthly

Consensus: 2.9%

Previous: 2.7%

Source: US Bureau of Labor Statistics

The US Federal Reserve (Fed) has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.