Pound Sterling comes under pressure as UK inflation cools down

- The Pound Sterling comes under pressure against its major peers after the release of a soft UK CPI in March.

- Soft UK inflation and grim employment outlook pave the way for the BoE to cut interest rates in May.

- Investors seek fresh development on deals between the US and its trading partners.

The Pound Sterling (GBP) faces selling pressure against its major peers on Wednesday, except the US Dollar (USD), after the release of the softer-than-expected United Kingdom (UK) Consumer Price Index (CPI) data for March.

The Office for National Statistics (ONS) reported that the headline CPI grew at a moderate pace of 2.6% year-on-year compared to estimates of 2.7% and the February reading of 2.8%. In the same period, the core CPI – which excludes volatile items such as food, energy, alcohol, and tobacco – rose by 3.4%, as expected, slower than the former reading of 3.5%. Month-on-month headline inflation grew by 0.3%, softer than estimates and the prior release of 0.4%.

Inflation in the services sector, which is closely tracked by Bank of England (BoE) officials, decelerated to 4.7% on year from the prior release of 5%. Cooling UK inflationary pressures are expected to boost market expectations that the BoE will cut interest rates in the May monetary policy meeting.

Additionally, the grim UK labor market outlook, with an increase in employers’ contributions to social security schemes becoming effective this month, would also force BoE policymakers to back monetary policy easing. In the Autumn Budget, UK Chancellor of the Exchequer Rache Reeves raised employers’ contribution to National Insurance (NI) from 13.8% to 15%.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.56% | -0.19% | -0.43% | -0.24% | -0.52% | -0.04% | -0.99% | |

| EUR | 0.56% | 0.39% | 0.15% | 0.31% | 0.27% | 0.54% | -0.43% | |

| GBP | 0.19% | -0.39% | -0.26% | -0.07% | -0.11% | 0.15% | -0.77% | |

| JPY | 0.43% | -0.15% | 0.26% | 0.18% | 0.20% | 0.42% | -0.62% | |

| CAD | 0.24% | -0.31% | 0.07% | -0.18% | 0.00% | 0.24% | -0.68% | |

| AUD | 0.52% | -0.27% | 0.11% | -0.20% | -0.01% | 0.23% | -0.65% | |

| NZD | 0.04% | -0.54% | -0.15% | -0.42% | -0.24% | -0.23% | -0.92% | |

| CHF | 0.99% | 0.43% | 0.77% | 0.62% | 0.68% | 0.65% | 0.92% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling demonstrates strength against US Dollar

- The Pound Sterling trades firmly above 1.3250 against the US Dollar during North American trading hours on Wednesday. The GBP/USD pair continues to perform strongly from a past few trading days as the US Dollar (USD) underperforms across the board, with investors becoming increasingly confident that the economic policies of United States (US) President Donald Trump would lead the economy to a recession. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, tumbles to near 99.50 after a short-lived recovery move to 100.00 on Tuesday.

- In spite of the fact that US President Trump has declared a 90-day pause on the execution of reciprocal tariffs for all of its trading partners, except China, which he announced on so-called “Liberation Day”, investors believe that trade war seldom with Asian giant is enough to bring shockwaves to the economy.

- The US economy is unable to offset the demand for Chinese imports immediately, given the insufficient manufacturing facilities and the absence of low-cost competitive advantage. Such a scenario will force US importers to raise prices of substitutes of Chinese goods, which will significantly dent households' purchasing power. Theoretically, lower purchasing power leads to a decline in the overall demand that dampens the economic growth of an economy in a big way, whose two-thirds of the Gross Domestic Product (GDP) growth relies on consumer spending.

- Meanwhile, investors look for announcements from the White House over securing deals with his trading partners. On Tuesday, US Press Secretary Karoline Leavitt said that the Trump administration is discussing trade deals with “more than 15 nations” and that some agreements could be announced "very soon".

- On a trade deal with the United Kingdom (UK), US Vice President JD Vance was confident of having a trade agreement with Britain while speaking with UnHerd on Tuesday. Vance said that there is a "good chance" that both nations will secure a trade deal because of the President’s affinity for Britain.

- Going forward, investors will focus on Federal Reserve (Fed) Chair Jerome Powell’s speech, which is scheduled at 17:30 GMT.

- Meanwhile, US Retail Sales data for March has come in better-than-expected. The Retail Sales data, a key measure of consumer spending, rose by 1.4% on month against estimates of 1.3%. In February, the consumer spending measure grew by 0.2%

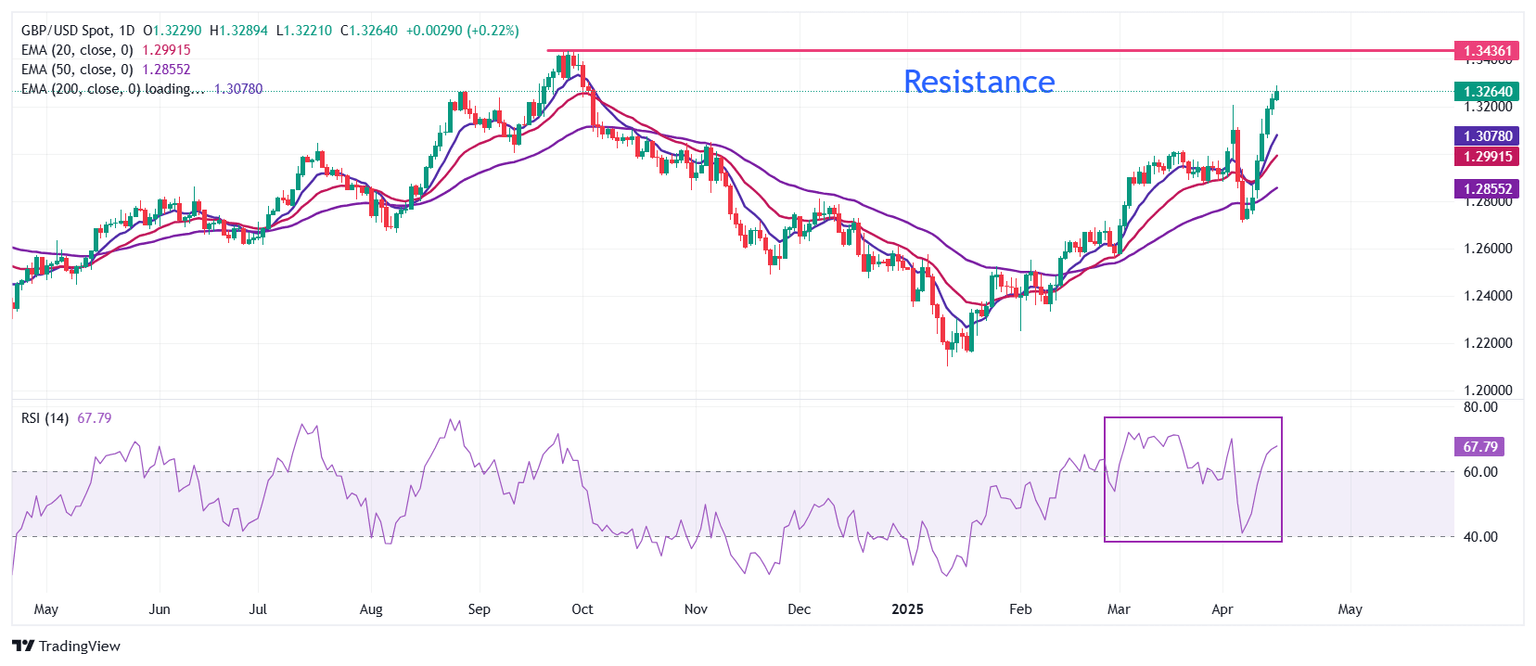

Technical Analysis: Pound Sterling approaches 1.3400

The Pound Sterling extends its winning streak for the seventh trading day and jumps to near 1.3300 against the US Dollar on Wednesday. The near-term outlook of the pair is upbeat as all short-to-long Exponential Moving Averages (EMAs) are sloping higher.

The 14-day Relative Strength Index (RSI) has shown a V-shape recovery from 40.00 to 68.00, suggesting a strong bullish momentum.

Looking down, the psychological support of 1.3000 will act as a key support zone for the pair. On the upside, the three-year high of 1.3430 will act as a key resistance zone.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.