Pound Sterling faces pressure as BoE warns of multiple economic risks

- The Pound Sterling drops to near 1.3575 against the US Dollar as investors await developments regarding US trade negotiations.

- US President Trump has announced new reciprocal tariffs for 21 nations, which will be effective from August 1.

- The BoE warns of economic risks amid geopolitical tensions and increasing national debt.

The Pound Sterling (GBP) ticks down against its major peers on Thursday. The British currency drops as the Bank of England (BoE) warns of multiple risks to the United Kingdom (UK) economy in its mid-year Financial Policy Committee (FPC) report on Wednesday.

"The risk of sharp falls in risky asset prices, abrupt shifts in asset allocation, and a more prolonged breakdown in historical correlations remains high," FPC committee said, Reuters reported. The committee pointed out “geopolitical tensions, global fragmentation of trade and financial markets, and pressures on sovereign debt" as responsible for escalating economic risks.

The report also warned of dismal business sentiment towards fresh investment, which could impact labor market.

Last week, risks to UK Sovereign debt escalated after Chancellor of the Exchequer Rachel Reeves announced a substantial increase in Universal Credit (UC), raising questions over the credibility of the administration that vowed to reduce fiscal expenditure.

Meanwhile, investors await the UK's monthly Gross Domestic Product (GDP) and factory data for May, which are scheduled to release on Friday. The UK GDP is expected to have grown by 0.1% after declining by 0.3% in April.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.06% | 0.08% | 0.01% | -0.05% | -0.35% | -0.26% | 0.17% | |

| EUR | -0.06% | 0.00% | -0.05% | -0.09% | -0.40% | -0.32% | 0.09% | |

| GBP | -0.08% | -0.01% | -0.08% | -0.10% | -0.40% | -0.31% | 0.08% | |

| JPY | -0.01% | 0.05% | 0.08% | -0.05% | -0.35% | -0.20% | 0.06% | |

| CAD | 0.05% | 0.09% | 0.10% | 0.05% | -0.27% | -0.23% | 0.18% | |

| AUD | 0.35% | 0.40% | 0.40% | 0.35% | 0.27% | 0.05% | 0.47% | |

| NZD | 0.26% | 0.32% | 0.31% | 0.20% | 0.23% | -0.05% | 0.41% | |

| CHF | -0.17% | -0.09% | -0.08% | -0.06% | -0.18% | -0.47% | -0.41% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling edges lower against US Dollar

- The Pound Sterling ticks down to near 1.3575 against the US Dollar (USD) during the European trading session on Thursday. The GBP/USD pair edges higher as the US Dollar (USD) struggles to hold over a week-long recovery move amid uncertainty surrounding trade discussions between the United States (US) and its trading partners.

- At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, falls slightly to near 97.40.

- So far, the US has announced trade agreements with the United Kingdom (UK) and Vietnam, and a limited deal with China. US President Donald Trump has expressed confidence in a trade deal with India, but has not confirmed it yet. Meanwhile, the US has announced new reciprocal tariff rates for 21 nations, notably Japan and South Korea, which are two important trading partners.

- Investors await fresh developments about trade negotiations between the US and other leading trading partners, such as the Eurozone, China, Canada and Mexico. The scenario of the US not reaching deals with these nations by the reciprocal tariff deadline of August 1 will accelerate global trade worries, which will be unfavorable for the US Dollar.

- US President Trump has also announced August 1 as the day when proposed 50% tariffs on copper imports will take effect, as stated in a post on Truth Social, while highlighting its scope in various industries.

- In the US, the Federal Open Market Committee (FOMC) minutes of the June 17-18 Federal Reserve (Fed) policy meeting, published on Wednesday, signaled that a majority of members have argued in favor of keeping interest rates steady amid uncertainty surrounding the tariff policy. Policymakers supported reductions in interest rates later this year if tariff-driven inflation proves to be “modest and temporary”.

- The minutes also showed that two policymakers argued in favor of interest rate cuts in the July policy meeting. The two appear to be Fed Governors Christopher Waller and Michelle Bowman who favored the need to unwind monetary policy restrictiveness amid growing labor market risks in their latest commentary.

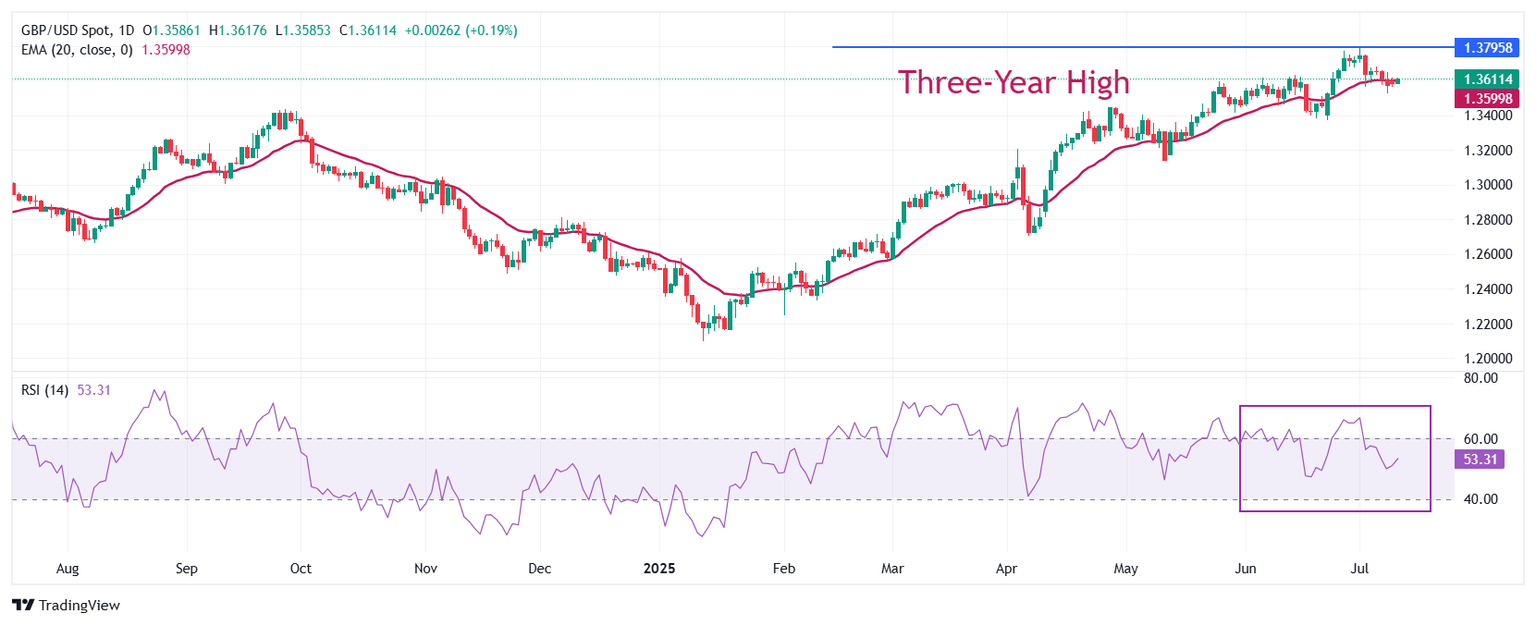

Technical Analysis: Pound Sterling struggles around 20-day EMA

The Pound Sterling trades in a limited range around 1.3600 against the US Dollar on Thursday. The GBP/USD pair wobbles around the 20-day Exponential Moving Average (EMA) near 1.3590, suggesting that the near-term trend is uncertain.

The 14-day Relative Strength Index (RSI) falls to near 50.00, indicating that the bullish momentum has faded.

Looking down, the psychological level of 1.3500 will act as a key support zone. On the upside, the three-and-a-half-year high around 1.3800 will act as a key barrier.

Economic Indicator

FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Last release: Wed Jul 09, 2025 18:00

Frequency: Irregular

Actual: -

Consensus: -

Previous: -

Source: Federal Reserve

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.