Pound Sterling ticks up against US Dollar as Trump terminates Fed's Cook

- The Pound Sterling ticks up to near 1.3470 against the US Dollar as US President Trump signs letter to terminate Fed Governor Cook.

- The removal of Fed’s Cook has dampened the central bank’s independence.

- Investors await BoE Mann’s speech for fresh cues on the monetary policy outlook.

The Pound Sterling (GBP) ticks up to near 1.3470 against the US Dollar (USD) during the European trading session on Tuesday. The GBP/USD pair edges higher as the US Dollar falls slightly after the ousting of Federal Reserve (Fed) Governor Lisa Cook by United States (US) President Donald Trump, which has increased concerns over the central bank’s independence.

On early Tuesday, US President Trump shared a letter on Truth.Social in which he announced the removal of Fed Governor Cook, citing that she made false statements on one or more mortgage agreements.

Market experts have seen Fed Cook’s removal by US President Trump as a serious dent in the central bank’s independence. They have also argued that the intention behind Cook’s removal is to fit people in the Federal Open Market Committee (FOMC) to support Trump's economic agenda.

"The concern is the intent of the Trump administration: it’s not to preserve Fed integrity, it’s to install Trump’s own people at the Fed,” analysts at Capital.com said, Reuters reported.

However, Cook said that she will continue to carry out her duties as Fed Governor. In a statement shared by her attorneys, “President Trump purported to fire me ‘for cause’ when no cause exists under the law, and he has no authority to do so.”

In the past, President Trump has also attacked the Fed’s independence several times by threatening Chair Jerome Powell for not lowering interest rates. However, Trump praised Powell after his speech at the Jackson Hole Symposium on Friday, in which he surprisingly delivered a dovish interest rate guidance, citing labor market concerns.

Pound Sterling trades stably ahead of BoE Mann’s speech

- The Pound Sterling trades calmly ahead of Bank of England (BoE) Monetary Policy Committee (MPC) member Catherine Mann’s speech at 16:00 GMT. Investors will pay close attention to BoE Mann’s speech to get cues about whether the United Kingdom (UK) central bank will cut interest rates again in the remainder of the year.

- Financial market participants doubt whether the BoE to ease monetary policy further as inflationary pressures are turning out to be persistent. Inflation in the UK economy has been accelerating at a faster pace in recent months.

- Investors should note that BoE’s Mann was one of the MPC members who voted for holding interest rates in the monetary policy meeting earlier this month. In the meeting, the BoE reduced its key borrowing rates by 25 basis points (bps) to 4%, with a slim majority.

- In the US, investors await the Personal Consumption Expenditures Price Index (PCE) data for July, which is scheduled to be released on Friday. The inflation data will influence market expectations for the Fed’s monetary policy outlook.

- According to the CME FedWatch tool, there is an 84% chance that the Fed will cut interest rates in the September monetary policy meeting.

- Fed dovish expectations intensified earlier this month after the Nonfarm Payrolls (NFP) report for July showed downward revisions in May and June.

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.29% | -0.27% | -0.35% | -0.11% | -0.15% | -0.15% | -0.02% | |

| EUR | 0.29% | 0.08% | 0.07% | 0.18% | 0.19% | 0.38% | 0.29% | |

| GBP | 0.27% | -0.08% | -0.02% | 0.12% | 0.16% | 0.31% | 0.21% | |

| JPY | 0.35% | -0.07% | 0.02% | 0.16% | 0.07% | 0.36% | 0.11% | |

| CAD | 0.11% | -0.18% | -0.12% | -0.16% | -0.03% | 0.18% | -0.05% | |

| AUD | 0.15% | -0.19% | -0.16% | -0.07% | 0.03% | 0.00% | -0.04% | |

| NZD | 0.15% | -0.38% | -0.31% | -0.36% | -0.18% | -0.01% | -0.09% | |

| CHF | 0.02% | -0.29% | -0.21% | -0.11% | 0.05% | 0.04% | 0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

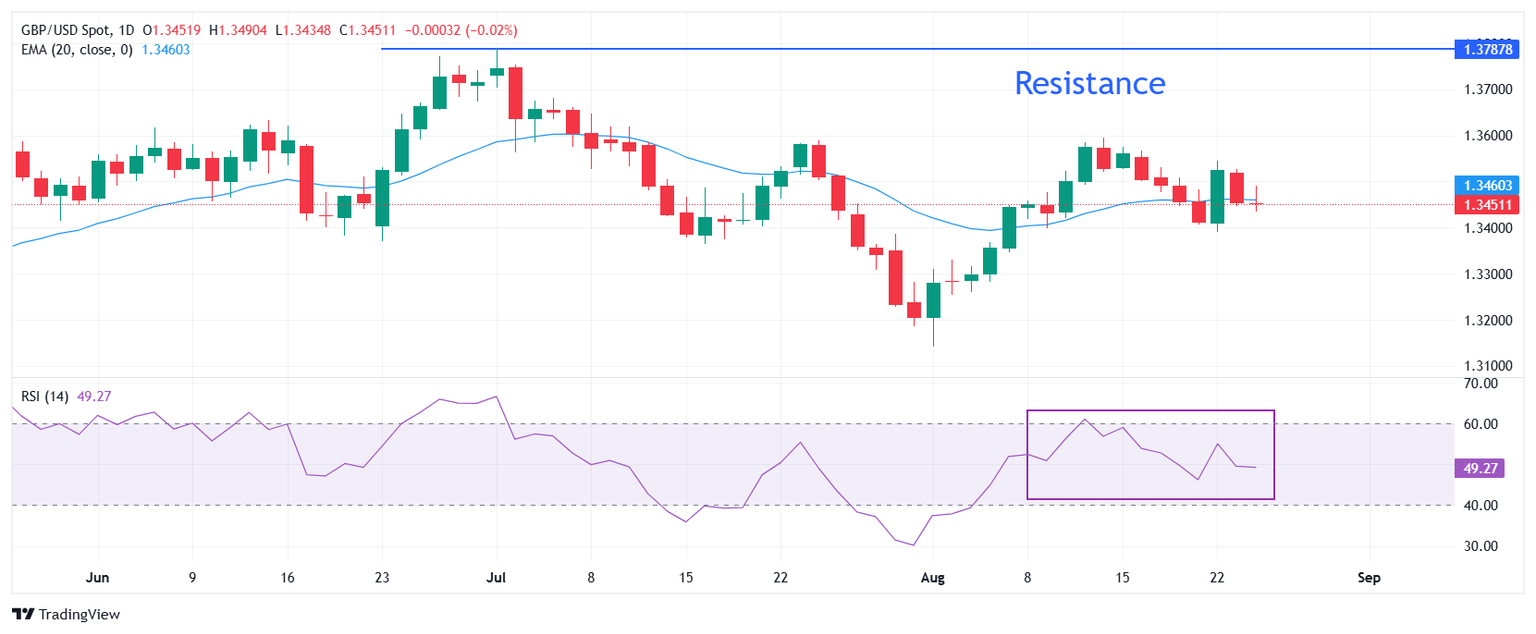

Technical Analysis: Pound Sterling ticks up to near 1.3460

The Pound Sterling moves slightly higher to near 1.3460 against the US Dollar on Tuesday. The near-term outlook of the GBP/USD pair is uncertain as it wobbles near the 20-day Exponential Moving Average (EMA), which trades around 1.3460.

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, suggesting a sharp volatility contraction.

Looking down, the August 11 low of 1.3400 will act as a key support zone. On the upside, the July 1 high near 1.3790 will act as a key barrier.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.