Pound Sterling declines on mounting UK fiscal risks

- The Pound Sterling ticks lower against the US Dollar even as Trump threatens new tariffs reates on nations that failed to ink a trade pact with Washington.

- US President Trump imposes 25% tariffs on Japan and South Korea,but delays their implementation until August 1.

- Investors await the FOMC minutes and the UK monthly GDP data for May.

The Pound Sterling (GBP) trades lower against its major peers on Tuesday. The British currency remains on the back foot due to the overhang of mounting fiscal risks in the United Kingdom (UK) following the presentation of a higher welfare spending bill by the Labour government before the House of Commons last week.

The welfare bill announced showed an increase in the standard allowance for Universal Credit (UC), which is expected to raise the debt financial burden by £4.8 billion by fiscal year 2029-2030.. This led to investors dumping UK gilts as the bill raised financial risks.

Meanwhile, Chancellor of the Exchequer Rachel Reeves has confirmed that the government would fund the additional financial burden, but didn’t clarify whether it will be through tax increases or spending cuts. "Of course, there is a cost to the welfare changes that Parliament voted through this week and that will be reflected in the Budget," Reeves said.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the weakest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.26% | 0.06% | 0.13% | -0.22% | -0.73% | -0.29% | -0.23% | |

| EUR | 0.26% | 0.33% | 0.43% | 0.04% | -0.49% | -0.02% | 0.04% | |

| GBP | -0.06% | -0.33% | 0.10% | -0.29% | -0.82% | -0.36% | -0.30% | |

| JPY | -0.13% | -0.43% | -0.10% | -0.36% | -0.87% | -0.37% | -0.26% | |

| CAD | 0.22% | -0.04% | 0.29% | 0.36% | -0.53% | -0.06% | -0.01% | |

| AUD | 0.73% | 0.49% | 0.82% | 0.87% | 0.53% | 0.47% | 0.52% | |

| NZD | 0.29% | 0.02% | 0.36% | 0.37% | 0.06% | -0.47% | 0.06% | |

| CHF | 0.23% | -0.04% | 0.30% | 0.26% | 0.00% | -0.52% | -0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling drops against US Dollar, FOMC minutes eyed

- The Pound Sterling ticks down to near 1.3600 against the US Dollar (USD) during the European trading session on Tuesday. The GBP/USD pair edges lower even as the US Dollar retraces after posting a fresh weekly high, following the announcement of fresh tariff rates by United States (US) President Donald Trump on key 14 trading partners.

- At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades cautiously around 97.35.

- On Monday, US President Trump sent letters to 14 countries dictating tariff rates for nations that have failed to strike a trade deal with Washington during the 90-day tariff extension. Notably, the White House slapped 25% tariffs on imports from Japan, with whom Washington has been negotiating actively in the past few weeks.

- Meanwhile, Japanese Prime Minister Shigeru Ishiba said that Tokyo would continue to negotiate with the US to seek a mutually beneficial trade deal, Reuters reported.

- After sending letters to his trading partners, US President Trump warned through a post on Truth.Social that any sort of retaliation would be followed by a similar increase in import duties. Despite the threats of tariffs, Asian markets trade higher on Tuesday as Trump left the door open for additional trade negotiations until August 1, when the new tariffs would come into force.

- Persistent uncertainty surrounding Trump’s tariff policy is expected to keep the US Dollar on the back foot. Market experts struggle to gauge the impact of the US tariff policy on American and global growth outlook. During European trading hours, Director of United Nations (UN) Trade Agency stated that, "Tariffs will have an impact on US economy in the long run".

- On the domestic front, investors await the Federal Open Market Committee (FOMC) minutes of the June 17-18 policy meeting, which will be published on Wednesday. In the policy announcement, the Federal Reserve (Fed) kept interest rates steady for the fourth straight time in the range of 4.25%-4.50%.

- During the policy announcement, Fed Chair Jerome Powell stated that monetary policy adjustments aren't on the cards until officials get clarity on how much the tariff policy will impact inflation and economic growth.

- On the UK monetary policy front, traders are becoming increasingly confident that the Bank of England (BoE) will reduce interest rates in the August policy meeting. In the June meeting, the BoE held key borrowing rates steady at 4.25%, but suggesting that interest rates are likely to decline.

- This week, investors will focus on the UK monthly Gross Domestic Product (GDP) and factory data for May, which are scheduled to be released on Friday. The UK GDP is expected to have grown by 0.1% after declining by 0.3% in April.

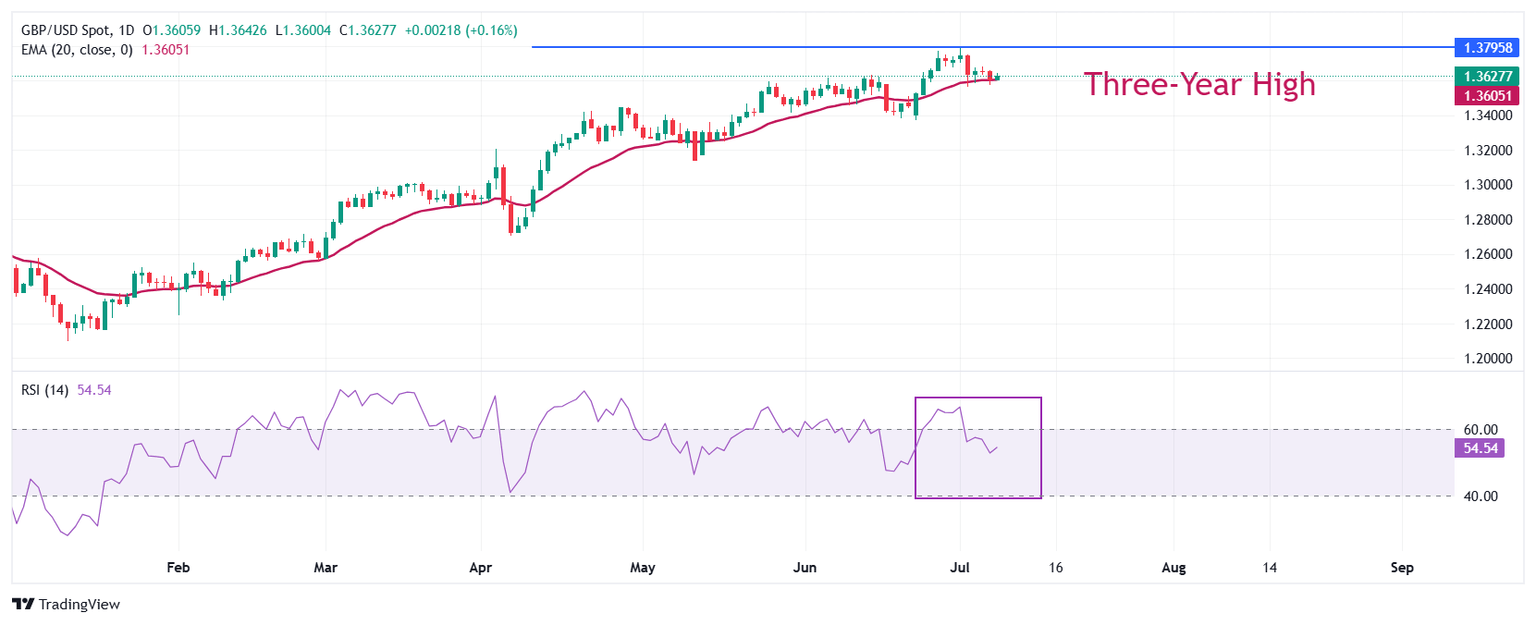

Technical Analysis: Pound Sterling struggles around 20-day EMA

The Pound Sterling moves slightly higher to near 1.3630 against the US Dollar on Tuesday. The GBP/USD pair strives to hold the 20-day Exponential Moving Average (EMA), which trades around 1.3600. A downside move by the pair below the same would turn the near-term trend to bearish.

The 14-day Relative Strength Index (RSI) hovers slightly above 50.00, suggesting that the bullish momentum has faded.

Looking down, the psychological level of 1.3500 will act as a key support zone. On the upside, the three-and-a-half-year high around 1.3800 will act as a key barrier.

Economic Indicator

Gross Domestic Product (MoM)

The Gross Domestic Product (GDP), released by the Office for National Statistics on a monthly and quarterly basis, is a measure of the total value of all goods and services produced in the UK during a given period. The GDP is considered as the main measure of UK economic activity. The MoM reading compares economic activity in the reference month to the previous month. Generally, a rise in this indicator is bullish for the Pound Sterling (GBP), while a low reading is seen as bearish.

Read more.Next release: Fri Jul 11, 2025 06:00

Frequency: Monthly

Consensus: 0.1%

Previous: -0.3%

Source: Office for National Statistics

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.