Pound Sterling drops to 1.2600 against the US Dollar

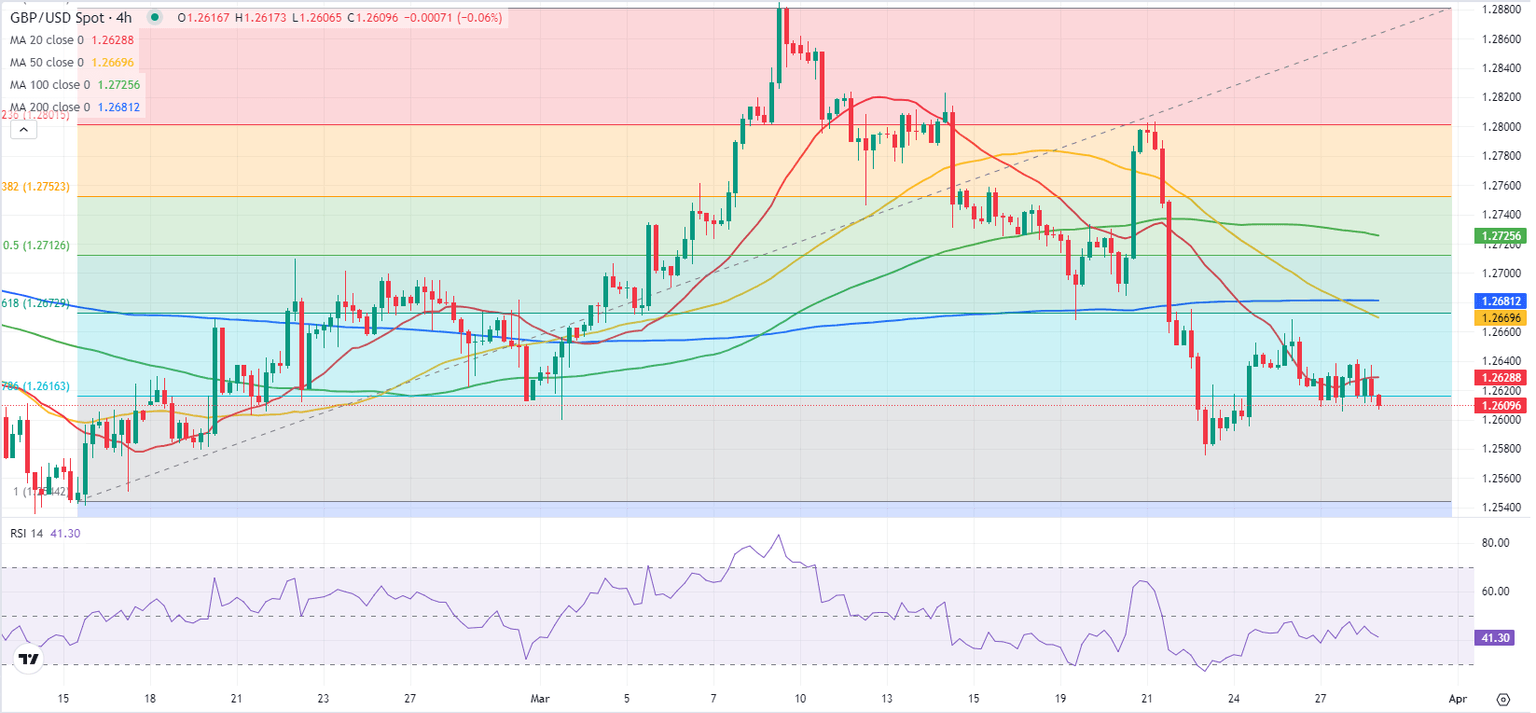

GBP/USD Forecast: Pound Sterling trades dangerously close to 1.2590

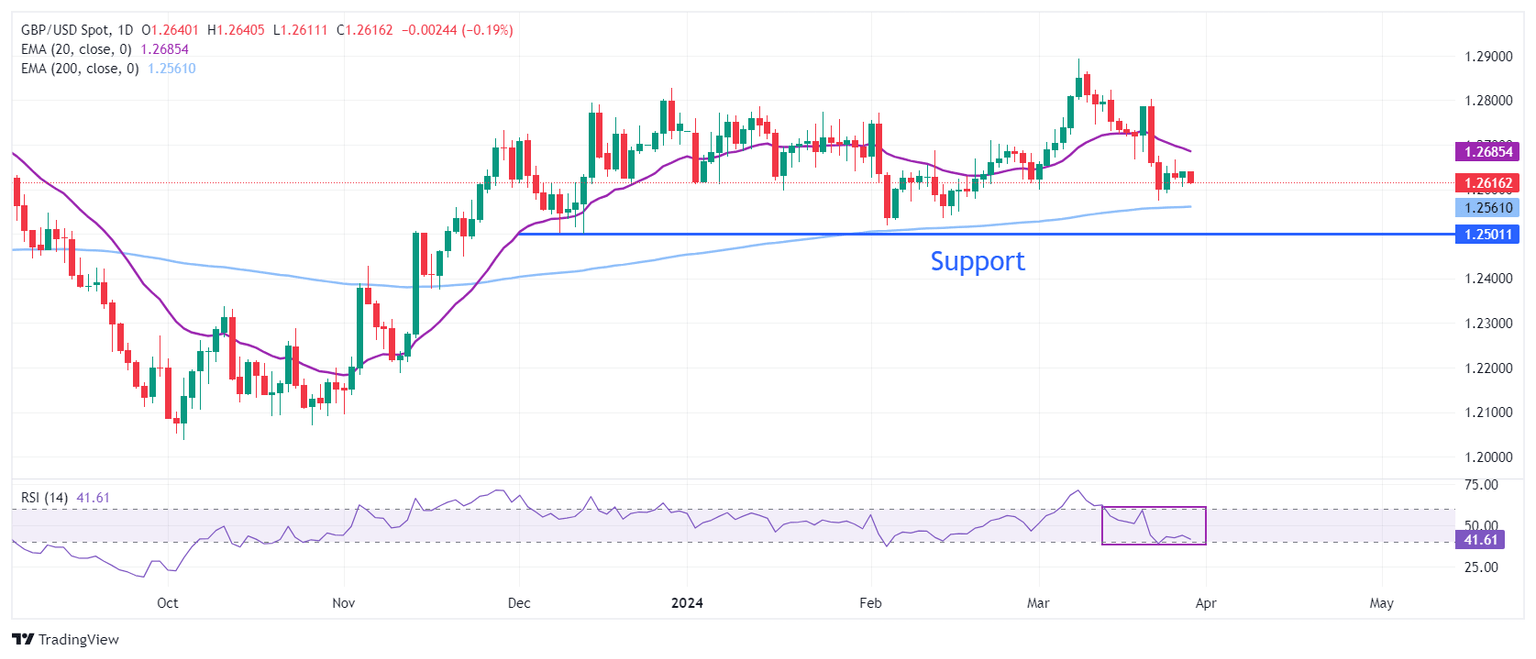

GBP/USD came under bearish pressure and fell slightly below 1.2600 in the European session on Thursday. The 200-day Simple Moving Average (SMA) aligns as key technical support at 1.2590.

The renewed US Dollar (USD) strength weighs on GBP/USD in the second half of the week. Federal Reserve (Fed) Governor Christopher Waller said on Wednesday that the US central bank was in no rush to cut rates amid sticky inflation data and argued that it might be appropriate to hold the restrictive stance for longer than previously thought to help inflation return to the 2% target on a sustainable trajectory. Read more...

Pound Sterling faces sell off on firm BoE rate cut bets

The Pound Sterling (GBP) drops to 1.2600 against the US Dollar in Thursday’s London session. More broadly, the GBP/USD pair struggles for direction as investors wait for fresh cues about when the Bank of England (BoE) will begin reducing interest rates. The United Kingdom’s inflation has come down significantly, but BoE policymakers are expected to adopt a cautious approach as early rate cuts could revamp price pressures again.

Investors expect that the BoE will start cutting rates from the June meeting. The expectations have been prompted by sharply easing inflation in February. Also, no BoE policymakers see the need for more rate hikes, indicating that the current level of interest rates is sufficiently restrictive. Generally, the Pound Sterling weakens when investors expect the BoE will start reducing borrowing rates early. Read more...

Author

FXStreet Team

FXStreet