GBP/USD drops after strong US ISM Manufacturing PMI data

The Pound Sterling slumps in the mid-North American session, as robust US economic data could dent the Federal Reserve’s intentions to cut

rates. That underpinned the Greenback while US Treasury yields skyrocketed, a headwind for

Cable. The GBP/USD trades at 1.2587, down 0.57%.

Read More...

Pound Sterling tumbles as upbeat US Manufacturing PMI dampens market sentiment

The Pound Sterling (GBP) faces an intense sell-off against the US Dollar in Monday’s early American session. The

US Dollar Index (DXY) rises to 104.90 on stronger than expected

United States ISM Manufacturing PMI for March. The Manufacturing PMI rose to 50.3 from expectations and the prior reading of 48.4 and 47.8, respectively. The US factory data climbs above the 50.0 threshold for the first time after contracting for 15 straight months. This indicates a sharp recovery in the manufacturing sector, exhibiting a strong

economic outlook.

Read More...

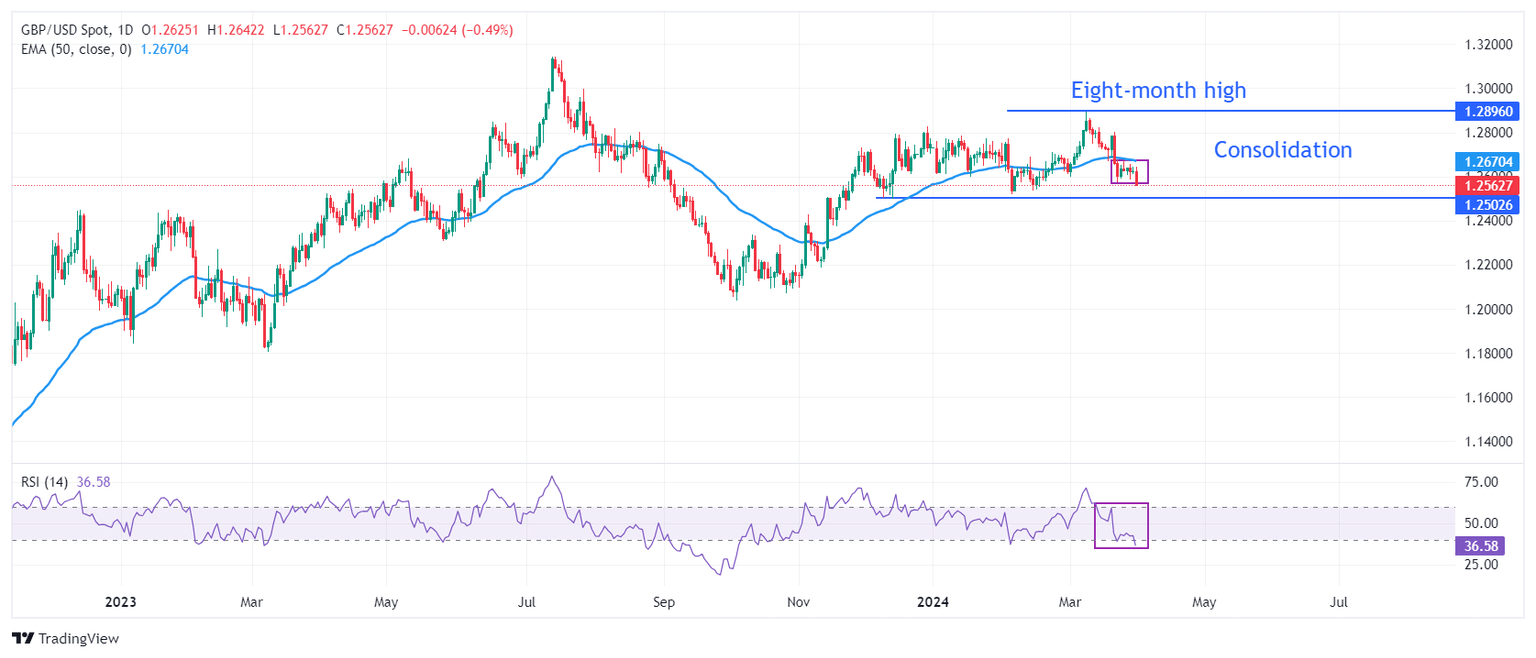

GBP/USD Price Analysis: The initial support level is located at 1.2610

The GBP/USD pair holds positive ground near 1.2628, snapping the two-day losing streak on Monday. The modest recovery of the major pair is backed by the dovish comments from Federal Reserve (Fed) Chairman Jerome Powell. The Fed’s Powell stated on Friday that recent US inflation data was in line with expectations and that the Fed's goal for the interest rate this year remained unchanged. The US central bank maintains projections of three rate cuts this year, and traders anticipate the first rate cuts will begin in the June meeting.

Read More...

-638475480653976143.png&w=1536&q=95)