Pound Sterling tumbles as upbeat US Manufacturing PMI dampens market sentiment

- The Pound Sterling dips against the US Dollar on robust US Manufacturing PMI data.

- BoE officials see expectations of two or three rate cuts for this year as reasonable.

- Investors await the UK Manufacturing PMI for fresh guidance on the economic outlook.

The Pound Sterling (GBP) faces an intense sell-off against the US Dollar in Monday’s early American session. The US Dollar Index (DXY) rises to 104.90 on stronger than expected United States ISM Manufacturing PMI for March. The Manufacturing PMI rose to 50.3 from expectations and the prior reading of 48.4 and 47.8, respectively. The US factory data climbs above the 50.0 threshold for the first time after contracting for 15 straight months. This indicates a sharp recovery in the manufacturing sector, exhibiting a strong economic outlook.

Meanwhile, investors await fresh guidance on when the Bank of England (BoE) and the Federal Reserve (Fed) will pivot to rate cuts. Earlier this year, the Fed was expected to start reducing interest rates sooner than the BoE, supporting the Pound Sterling’s valuation against the US Dollar. However, the BoE is currently anticipated to follow the Fed’s footprints and start rate cuts from June. Two BoE policymakers, Catherine Mann and Jonathan Haskel, who were described as hawks, see no need for more rate hikes as higher interest rates are impacting labor market conditions and consumer spending.

Catherine Mann said in an interview with Bloomberg last week that she dropped her rate hike call after observing that consumers are reluctant to pay higher prices on services such as travel and hospitality. Mann added that firms are cutting working hours in times when more employment is required. She further added that the number of workers in the labor market will increase due to the government's cuts to social security rates.

The Pound Sterling is expected to depreciate if the BoE reduces key borrowing rates earlier than expected after consistently raising them for more than two years.

Daily digest market movers: Pound Sterling falls sharply while US Dollar rises

- The Pound Sterling refreshes its monthly low near 1.2560 against the US Dollar. Market sentiment has turned downbeat as the upbeat US Manufacturing PMI has improved the safe-haven's appeal. Also, investors remain anxious ahead of the crucial Nonfarm Payrolls (NFP) report for March, which will be published on Friday. The official labor market data is one of the main economic data releases that influences the Fed’s rate cut expectations.

- On the United Kingdom front, investors look for fresh cues about when the Bank of England will start reducing interest rates. The market expectations for the BoE pivoting to rate cuts have come forward to the June meeting as the central bank was seen as slightly dovish in its latest monetary policy statement.

- The BoE sounded dovish as none of the policymakers voted for a rate hike. This indicates that BoE policymakers see current interest rates as restrictive. Policymakers do not see more interest rate hikes appropriate when they are worried that further policy tightening could dampen the economic outlook or they see progress in inflation declining to the 2% target.

- In addition, BoE Governor Andrew Bailey said after the last BoE meeting that market expectations for two or three rate cuts this year are “reasonable,” boosting expectations for the BoE to cut interest rates from June.

- Going forward, investors will focus on the S&P Global/CIPS Manufacturing PMI final data for March, which will be published on Tuesday. The factory data is forecasted to have remained unchanged from its preliminary reading of 49.9, which came in marginally below the 50.0 threshold that separates expansion from contraction. Investors will keenly focus on the agency’s commentary on businesses’ expectations for the domestic and global demand outlook.

Technical Analysis: Pound Sterling falls below 1.2600

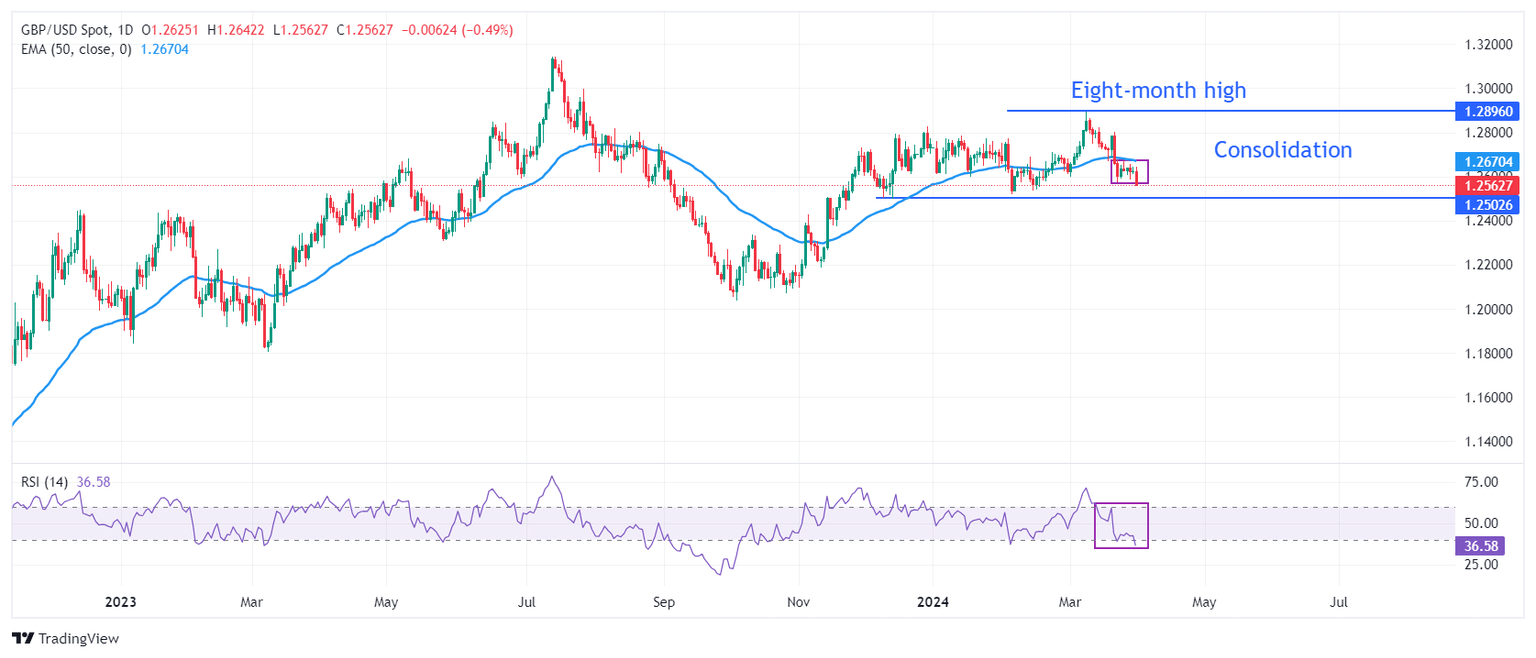

The Pound Sterling is expected to deliver a breakdown of the consolidation formed in a range of 1.2575-1.2675 in the past six trading sessions. The Cable has dropped below the 200-day Exponential Moving Average (EMA), which trades around 1.2665, indicating weak demand in the broader term.

On a broader time frame, the horizontal support from December 8 low at 1.2500 would provide further cushion to the Pound Sterling. Meanwhile, the upside is expected to remain limited near an eight-month high of around 1.2900.

The 14-period Relative Strength Index (RSI) dips below 40.00. If it sustains below this level, bearish momentum will trigger.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.