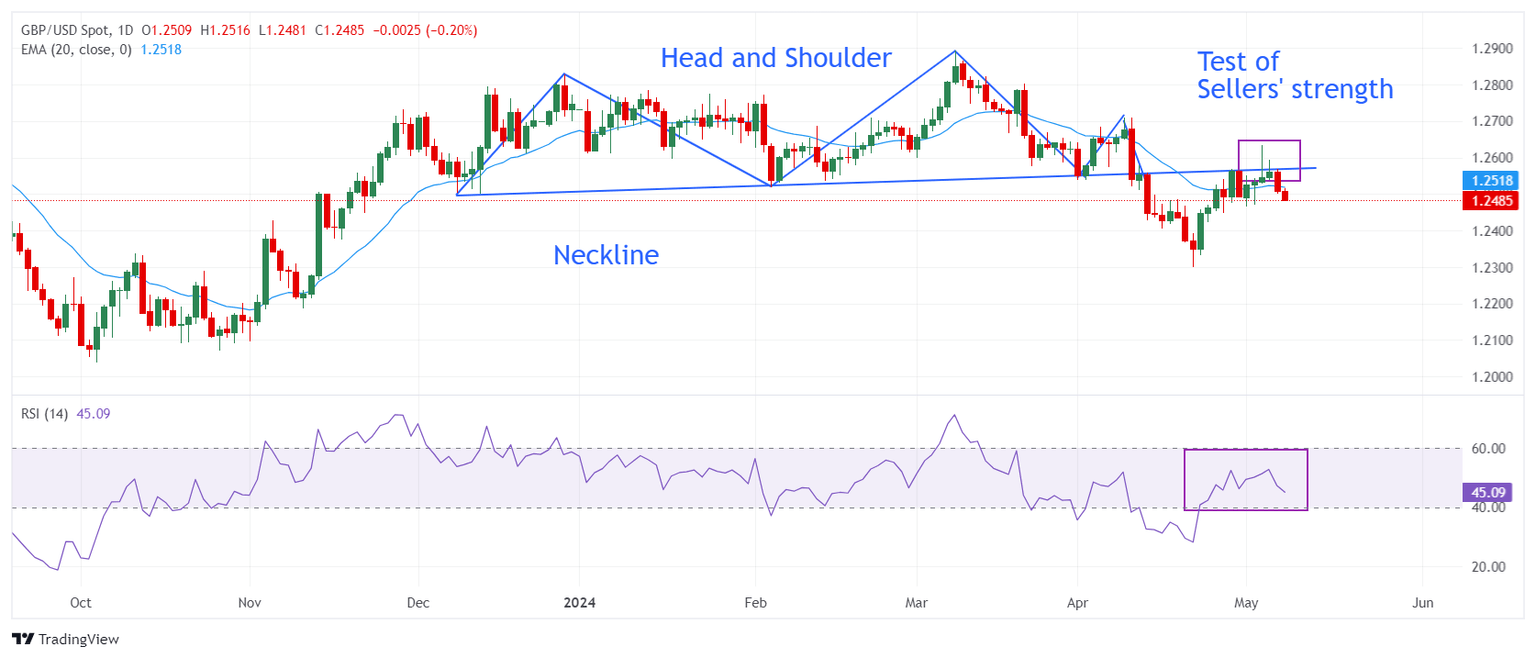

GBP/USD Price Analysis: Downtrend remains, despite bouncing off the daily low

In early trading on Wednesday, the

Pound Sterling resumed its downtrend against the US Dollar, as the Greenback remained the strongest currency against other peers. Despite printing losses, Cable remains at familiar levels, ahead of the

Bank of England (BoE) monetary policy decision. The GBP/USD trades at 1.2483, down 0.20%.

Read More...

Pound Sterling slumps amid uncertainty ahead of BoE’s policy decision

The

Pound Sterling (GBP) slips below the psychological support of 1.2500 against the US Dollar (USD) in Wednesday’s early New York session. The GBP/USD pair faces a sell-off due to multiple headwinds, such a sharp recovery in the US Dollar and uncertainty ahead of the Bank of England’s (BoE) interest rate decision, which will be announced on Thursday.

Read More...

GBP/USD hovers around 1.2500 on the stronger US Dollar, focus on BoE rate decision

The GBP/USD pair trades on a softer note around 1.2500 on Wednesday during the early Asian session. The USD Index (DXY) recovers modestly to 105.40, which drags the major pair lower. The Federal Reserve’s (Fed) Philip Jefferson, Susan Collins, and Lisa Cook are scheduled to speak later on Wednesday. The Bank of England's (BoE) interest rate decision will take centre stage on Thursday.

Read More...