Pound Sterling outperforms risky peers as US Trump seems unenthusiatic for tariffs on UK

- The Pound Sterling performs strongly among risk-sensitive currencies on expectations that the UK won't face hefty tariffs from the US.

- Market sentiment turns risk-averse after US President Trump imposes tariffs on Canada, Mexico and China.

- The BoE is expected to cut interest rates by 25 bps to 4.5%.

The Pound Sterling (GBP) outperforms its major peers, except safe-haven assets such as the US Dollar (USD) and the Japanese Yen (JPY), on Monday as investors become confident that the United Kingdom (UK) won't face hefty tariffs from the United States (US).

Over the weekend, US President Donald Trump slapped 25% tariffs on Canada and Mexico and 10% on China during the weekend. Trump had already threatened to raise tariffs on his North American partners for allowing illegal immigrants and the deadly opioid fentanyl to enter the country. Alongside North American peers and China, Trump also threatened to impose tariffs on Europe but took a softer approach towards the UK, saying that tariffs might happen but was sure a deal could be made as Prime Minister Keir Starmer has been "very nice". This has improved the Pound Sterling's appeal among risk-sensitive currencies.

On the domestic front, investors will focus on the Bank of England’s (BoE) monetary policy decision, which will be announced on Thursday.

Trades are confident that the BoE will reduce interest rates by 25 basis points (bps) to 4.50%. Of the nine-member-led Monetary Policy Committee (MPC), seven members are expected to vote for a 25 bps interest rate reduction, while two are expected to favor keeping interest rates unchanged. BoE policymaker Catherine Mann, who has been an outspoken hawk, is anticipated to be one of those two members.

Market participants are confident about the BoE reducing interest rates on the back of a slowdown in the United Kingdom (UK) inflationary pressures and growing risks of soft labor demand. The UK core Consumer Price Index (CPI) – which excludes volatile items prices such as energy and food – decelerated to 3.2% in December. The labor market data for the three months ending November showed that the economy added 35K new workers as business owners slowed the hiring process due to dissatisfaction over Chancellor of the Exchequer Raches Reevers’s announcement of raising employers’ contribution to National Insurance (NI).

On the economic front, revised estimates for S&P Global/CIPS Manufacturing PMI came in at 50.1, as shown in the flash reading.

Daily digest market movers: Pound Sterling weakens against US Dollar as investors move to safe-haven fleet

- The Pound Sterling recovers some of its intraday gains and rebounds to near 1.2300 from the low of 1.2250 against the US Dollar (USD) in Monday’s European session. Earlier in the day, the GBP/USD pair had a gap-down opening as the imposition of tariffs on Canada, Mexico, and China by US President Donald Trump spooked global financial markets, forcing investors to shift to safe-haven fleets.

- Dismal market sentiment has led to a sharp increase in the US Dollar (USD), which performs strongly in a turbulent environment. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, rallies above 109.50, the highest level seen in over two weeks.

- On the economic front, investors will pay close attention to labor market-related economic indicators this week, which will influence market speculation for how long the Federal Reserve (Fed) will keep interest rates at their current levels. After the policy meeting on Wednesday, in which the Fed left interest rates unchanged in the range of 4.25%-4.50%, Chair Jerome Powell said that monetary policy adjustments would become appropriate only when they see “real progress in inflation or some weakness in the labor market”.

- In Monday’s session, investors will focus on the US Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers’ Index (PMI) and the revised S&P Global Manufacturing PMI data for January. The ISM Manufacturing PMI is estimated to have improved to 49.5, still below the 50.0 threshold that separates expansion from contraction, from 49.3 in December, suggesting that factory activities contracted but at a slower pace.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.90% | 0.30% | -0.25% | -0.39% | 0.82% | 0.34% | -0.06% | |

| EUR | -0.90% | -0.20% | 0.19% | 0.02% | 0.40% | 0.75% | 0.31% | |

| GBP | -0.30% | 0.20% | -0.73% | 0.22% | 0.60% | 0.95% | 0.48% | |

| JPY | 0.25% | -0.19% | 0.73% | -0.14% | 1.22% | 1.51% | 0.76% | |

| CAD | 0.39% | -0.02% | -0.22% | 0.14% | 0.11% | 0.73% | 0.26% | |

| AUD | -0.82% | -0.40% | -0.60% | -1.22% | -0.11% | 0.35% | -0.08% | |

| NZD | -0.34% | -0.75% | -0.95% | -1.51% | -0.73% | -0.35% | -0.47% | |

| CHF | 0.06% | -0.31% | -0.48% | -0.76% | -0.26% | 0.08% | 0.47% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

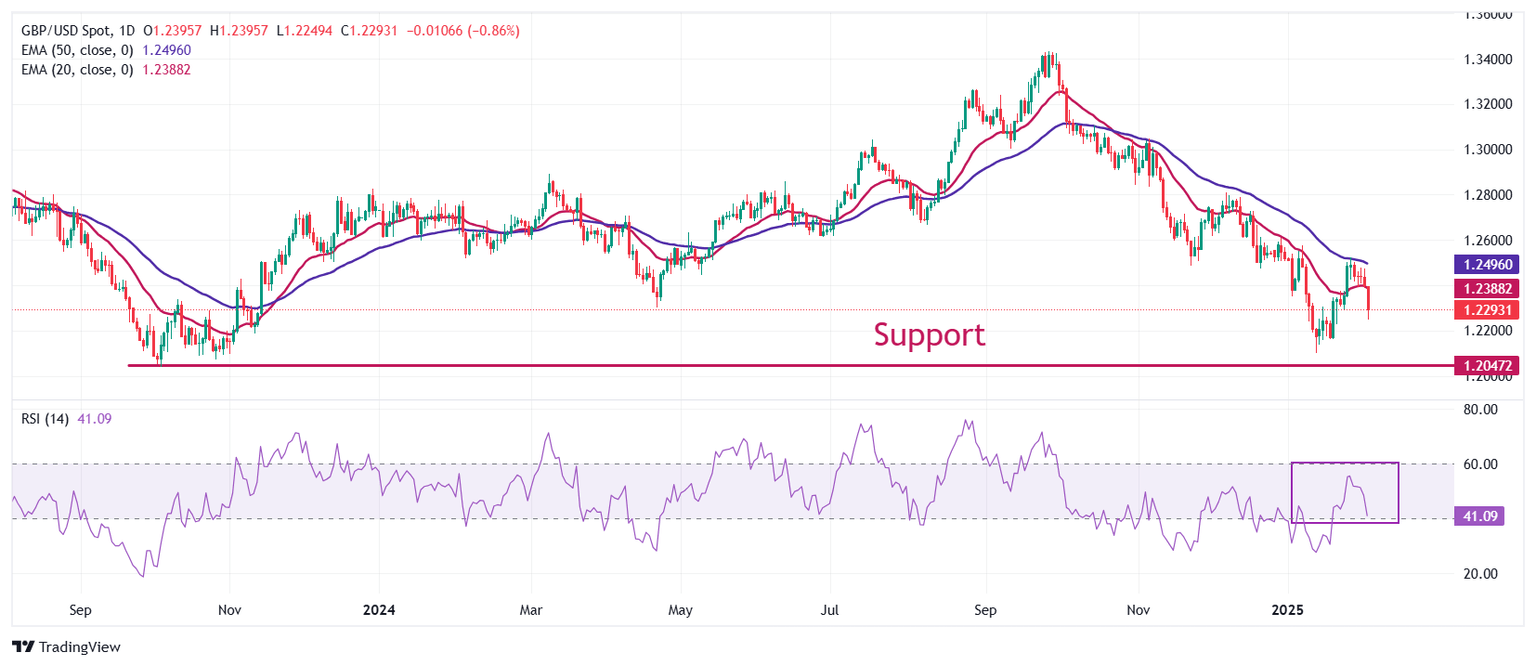

Technical Analysis: Pound Sterling falls back below 20-day EMA

The Pound Sterling falls back to near 1.2250 after failing to extend recovery above the 50-day Exponential Moving Average (EMA), which trades around 1.2500, last week. The near-term outlook of the Cable has turned bearish as it slides below the 20-day EMA, which hovers around 1.2388.

The 14-day Relative Strength Index (RSI) drops to near 40.00. Should the pair face bearish momentum if the RSI dives below that level

Looking down, the January 13 low of 1.2100 and the October 2023 low of 1.2050 will act as key support zones for the pair. On the upside, the December 30 high of 1.2607 will act as key resistance.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.