Pound Sterling slumps after UK budget update

- The Pound Sterling falls against its major peers on Wednesday after the release of a cooler-than-expected UK CPI report for February.

- UK Chancellor Reeves confirms lower GDP growth forecasts for the year to 1%.

- Market participants will pay close attention to the US PCE inflation data on Friday.

The Pound Sterling (GBP) faces selling pressure against its major peers in North American trading hours on Wednesday after United Kingdom (UK) Chancellor of the Exchequer Rachel Reeves unveils the Spring Statement. Reeves was expected to cut fiscal spending as she promised not to raise taxes again after increasing employers' contribution to social security schemes in the Autumn Statement. She announced that amendments in welfare spending will save £4.8 billion.

Reeves unveiled a £2.2bn increase in defence spending amid uncertainty surrounding the Ukraine war, as expected. She indicated that the "world is changing" and the administration is responding with higher defence spending.

In the budget update, Reeves confirmed that the Office for Business Responsibility (OBR) has revised the Gross Domestic Product (GDP) growth for the current year lower to 1% from 2% forecasted in the Autumn Statement due to global economic uncertainty. "The increased global uncertainty has had two consequences,. First, on our public finances. And second, on the economy," Reeves said. However, the agency has raised growth forecasts for the next four years.

The scenario of lower fiscal spending measures would be unfavorable for the Pound Sterling as lesser government spending results in moderate economic growth, which keeps inflationary pressures capped.

Daily digest market movers: Pound Sterling weakens against US Dollar after soft UK CPI data

- The Pound Sterling dips below 1.2900 against the US Dollar (USD) on Wednesday after the release of the soft UK Consumer Price Index (CPI) report for February. The UK CPI report showed that inflation cooled down at a faster-than-expected pace due to a significant slowdown in the prices of clothing and footwear.

- Headline CPI increased 2.8% year-over-year (YoY) compared to estimates of 2.9% and the 3.0% increase seen in January. In the same period, the core CPI – which excludes volatile items – rose by 3.5%, against expectations of 3.6% and the former release of 3.7%. Month-on-month headline CPI grew 0.4% after deflating by 0.1% in January, missing estimates of 0.5%.

- Inflation in the services sector, which is closely tracked by Bank of England (BoE) officials, rose at a steady pace of 5%. Technically, soft inflation data prompts traders to raise bets supporting the BoE to ease the monetary policy. However, sticky UK service inflation data could limit traders from going all-in for an interest rate cut by the BoE in the May policy meeting.

- Meanwhile, the US Dollar stabilized despite uncertainty over how potential tariffs by President Donald Trump on April 2 will shape the United States (US) economic outlook. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, ticks higher to near 104.40.

- Market participants expect that President Trump’s tariff agenda can expose the US economy to a recession, along with a resurgence in inflationary pressures in the near term. On Monday, Trump reiterated threats to unveil tariffs on April 2 but teased that not all impending tariffs will be imposed as he may give a "lot of countries" breaks on tariffs.

- Additionally, investors seek fresh cues about the Federal Reserve’s (Fed) monetary policy outlook for the remaining year. Regarding this, investors will focus on the US Personal Consumption Expenditures Price Index (PCE) data for February, which will be released on Friday. The US core PCE inflation, the Fed’s preferred inflation gauge, is estimated to have grown 2.7% year-on-year, compared to the 2.6% increase seen in January.

- According to the CME FedWatch tool, the Fed is certain to keep interest rates in the current range of 4.25%-4.50% in the May policy meeting, but there is a 65% chance that interest rates will be lower in June.

Technical Analysis: Pound Sterling declines toward 20-day EMA

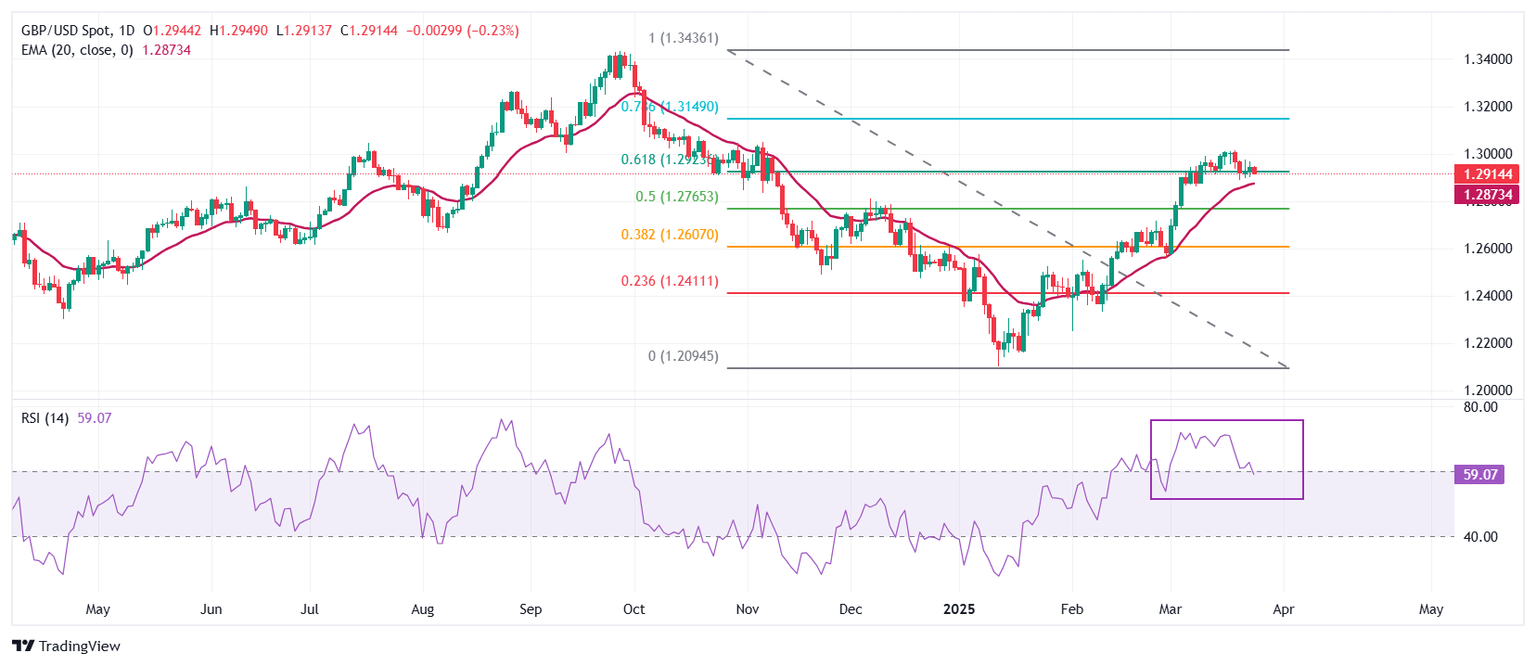

The Pound Sterling trades slightly lower to near 1.2900 against the US Dollar on Wednesday. The GBP/USD pair struggles to hold the 61.8% Fibonacci retracement, plotted from the late-September high to mid-January low, at 1.2930.

The 20-day Exponential Moving Average (EMA) near 1.2875 is expected to act as a major support zone for the Pound Sterling bulls.

The 14-day Relative Strength Index (RSI) cools down to near 60.00 after turning overbought above 70.00. Should a fresh bullish momentum come into action if the RSI resumes the upside journey after holding above 60.00.

Looking down, the 50% Fibonacci retracement at 1.2765 and the 38.2% Fibonacci retracement at 1.2610 will act as key support zones for the pair. On the upside, the October 15 high of 1.3100 will act as a key resistance zone.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.