Pound Sterling rises against US Dollar ahead of Fed-BoE monetary policy

- The Pound Sterling rises to near 1.2970 against the US Dollar, with investors focusing on the Fed-BoE policy and the UK Employment data.

- US officials, including President Donald Trump, expect economic turbulence from new policies.

- The UK economy contracted by 0.1% and the factory data declined significantly in January.

The Pound Sterling (GBP) jumps to near 1.2970 against the US Dollar (USD) at the start of the week. The GBP/USD pair rises as the US Dollar Index, which tracks the Greenback's value against six major currencies, declined to near 103.50. The USD Index weakens while investors await the monetary policy decision from the Federal Reserve (Fed) and the Bank of England (BoE), which will be announced on Wednesday and Thursday, respectively. Both the Fed and the BoE are expected to keep interest rates steady.

According to the CME FedWatch tool, the Fed is almost certain to keep borrowing rates steady in the range of 4.25%-4.50%. This would be the second straight policy meeting in which the central bank will leave interest rates unchanged. Traders have remained increasingly confident about the Fed maintaining a status quo on Wednesday as officials have been arguing in favor of maintaining a “wait and see” approach amid uncertainty over the economic outlook under the leadership of US President Donald Trump.

Market participants expect President Trump’s economic policies to push inflation higher, and weigh on growth prospects in the near term. Flash University of Michigan’s (UoM) survey of consumers in March showed on Friday that respondents see five-year consumer inflation expectations at 3.9%, up from 3.5% projected in February. The preliminary Michigan Consumer Sentiment index came in significantly lower at 57.9 in March compared to estimates of 63.1 and the former reading of 64.7.

A slew of US officials such as President Trump, Commerce Secretary Howard Lutnick, and Treasury Secretary Scott Bessent have guided that Trump’s policies could lead to economic turbulence, but the transition will make America great again. Bessent said in an interview with NBC News on Sunday, “I can predict that we are putting in robust policies that will be durable, and could there be an adjustment,” adding that the country needed to be weaned off of “massive government spending.” His comments came after the interviewer asked whether Trump’s agenda could lead the economy to a recession.

Daily digest market movers: Pound Sterling trades cautiously as investors shift focus to Fed-BoE monetary policy

- The Pound Sterling trades with caution against its major peers in North American trading hours on Monday. The British currency is expected to remain on tenterhook, with investors focusing on the BoE’s monetary policy announcement on Thursday. Traders are confident about the BoE keeping interest rates steady as a slew of officials have guided a “gradual and cautious” interest rate cut approach.

- Investors will pay close attention to the monetary policy statement and BoE Governor Andrew Bailey’s press conference after the interest rate decision to get cues about the economic and monetary policy outlook.

- An economic contraction in the monthly United Kingdom (UK) Gross Domestic Product (GDP) and a sharp decline in the Industrial and Manufacturing Production data for January have raised concerns over the economic outlook. The BoE also halved its GDP growth forecast to 0.75% in the February policy meeting.

- This week, investors will also focus on the UK labor market data for three months ending January, which will be released on Thursday, too. Investors will keenly focus on the Average Earnings data, a key measure of wage growth that is a major driver of inflation in the services sector.

British Pound PRICE Today

The table below shows the percentage change of the British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.28% | -0.26% | -0.01% | -0.41% | -0.42% | -0.94% | -0.36% | |

| EUR | 0.28% | -0.11% | -0.13% | -0.13% | -0.28% | -0.67% | -0.11% | |

| GBP | 0.26% | 0.11% | 0.31% | -0.24% | -0.19% | -0.58% | -0.08% | |

| JPY | 0.01% | 0.13% | -0.31% | -0.36% | -0.58% | -0.84% | -0.44% | |

| CAD | 0.41% | 0.13% | 0.24% | 0.36% | -0.21% | -0.52% | -0.50% | |

| AUD | 0.42% | 0.28% | 0.19% | 0.58% | 0.21% | -0.36% | 0.21% | |

| NZD | 0.94% | 0.67% | 0.58% | 0.84% | 0.52% | 0.36% | 0.56% | |

| CHF | 0.36% | 0.11% | 0.08% | 0.44% | 0.50% | -0.21% | -0.56% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

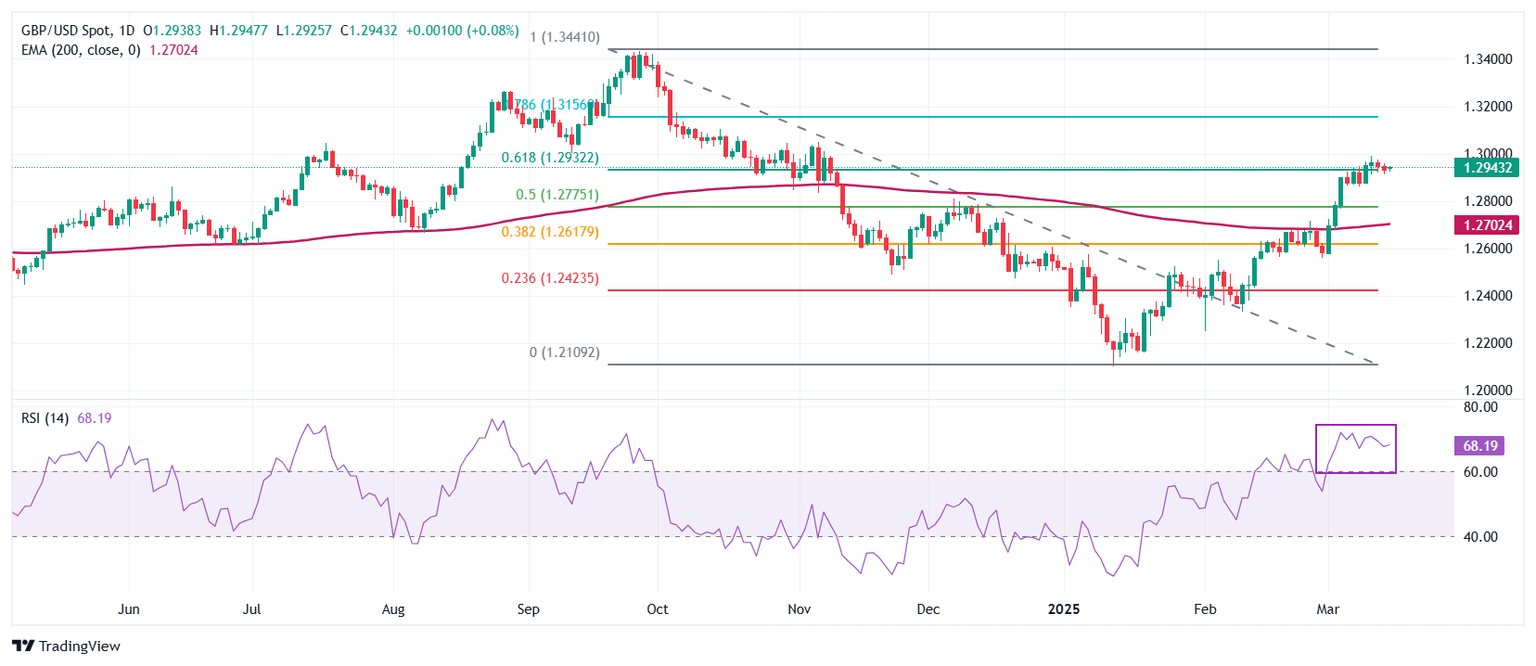

Technical Analysis: Pound Sterling stays above 1.2950

The Pound Sterling moves higher and aims to reclaim the psychological level of 1.3000 against the US Dollar in Monday's European session. The long-term outlook of the GBP/USD pair remains bullish as it holds above the 200-day Exponential Moving Average (EMA), which is around 1.2700.

The 14-day Relative Strength Index (RSI) holds above 60.00, indicating that the strong bullish momentum is intact.

Looking down, the 50% Fibo retracement at 1.2775 and the 38.2% Fibo retracement at 1.2618 will act as key support zones for the pair. On the upside, the October 15 high of 1.3100 will act as a key resistance zone.

Economic Indicator

BoE Interest Rate Decision

The Bank of England (BoE) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoE is hawkish about the inflationary outlook of the economy and raises interest rates it is usually bullish for the Pound Sterling (GBP). Likewise, if the BoE adopts a dovish view on the UK economy and keeps interest rates unchanged, or cuts them, it is seen as bearish for GBP.

Read more.Next release: Thu Mar 20, 2025 11:00

Frequency: Irregular

Consensus: 4.5%

Previous: 4.5%

Source: Bank of England

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.