Pound Sterling weakens against USD even as Michigan Sentiment data slides again

- The Pound Sterling falls back below 1.3300 against the US Dollar as the Greenback rebounds.

- The Fed is expected to keep interest rates steady in the next two policy meetings.

- Investors await the UK CPI data next week for fresh cues about the BoE’s monetary policy outlook.

The Pound Sterling (GBP) turns upside down below 1.3330 against the US Dollar (USD) in Friday’s North American session. The GBP/USD pair gives up intraday gains and turns negative as the US Dollar (USD) claws back losses after the release of the preliminary US Michigan Consumer Sentiment Index (CSI) and the Consumer Inflation Expectations data for May.

The US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, rebounds to near 100.90.

Flash CSI unexpectedly declined to 50.8 from 52.2 in April, the lowest level seen since June 2022. Economists expected the sentiment data to have increased to 53.4. The sentiment data has come in lower for the fifth time in a row. Meanwhile, one-year forward Consumer Inflation Expectations have increased to 7.3% from the prior release of 6.5% - a move that would encourage the Federal Reserve (Fed) to keep interest rates at their current levels.

Fed officials have been arguing in favor of keeping borrowing rates in the current range of 4.25%-4.50% until they get clarity over how much new economic policies by US President Donald Trump will impact the economic outlook. While the US and China have agreed to a 90-day pause in the tariff war and have reduced tariffs by 115%, Fed officials still believe that the current level of tariffs is enough to prompt inflation.

According to the CME FedWatch tool, the probability for the Fed to leave rates steady in the range of 4.25%-4.50% in the June and July meetings is at 91.8% and 61.4%, respectively.

Earlier in the day, the Greenback underperformed due to softer-than-expected Producer Price Index (PPI) data for April. The US PPI data showed that producer prices unexpectedly fell compared with the previous month due to a sharp slowdown in the hospitality sector.

Soft Retail Sales data has also weighed on the US Dollar. Retail Sales, a key measure of consumer spending, rose by just 0.1%, substantially slower than the March reading of 1.5%. It appears that households rushed to shops in March in anticipation of reciprocal tariffs to be introduced by US President Trump. Auto sales contracted by 0.1%, against a 5.5% surge seen in March. Also, durable items saw a moderate growth of 0.3% in April compared to a robust increase of 1.5% in the prior month.

Daily digest market movers: Pound Sterling corrects against its peers, UK CPI in focus

- The Pound Sterling retraces against its major peers, except for the US Dollar, on Friday after a strong upside move the previous day. The British currency attracted significant bids on Thursday after the release of United Kingdom (UK) monthly and quarterly Gross Domestic Product (GDP) data, which showed that the economy expanded at a faster-than-expected pace.

- Strong GDP growth rate has provided room for Bank of England (BoE) officials to maintain interest rates at their current levels if inflation persists or even accelerates.

- This week, BoE Chief Economist Huw Pill warned that inflation could continue to prove stronger-than-expected: “I remain concerned that we have seen a sort of structural change in price and wage-setting behaviour, maybe driven by the type of things that were involved in models of the inflation process from the ’70s and ’80s.". He stressed that high inflation would strengthen the need to maintain interest rates higher. Pill was one of the two Monetary Policy Committee (MPC) members, along with Catherine Mann, who voted to leave interest rates unchanged in the policy meeting last week. The BoE reduced its key borrowing rates by 25 basis points (bps) to 4.25%.

- To get fresh cues on the UK inflation, investors await the Consumer Price Index (CPI) data for April, which will be released on Wednesday. Signs of cooling inflationary pressures would add to market expectations that the BoE will cut interest rates again in the policy meeting in June.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.07% | 0.21% | 0.10% | 0.10% | 0.01% | -0.19% | 0.28% | |

| EUR | -0.07% | 0.15% | 0.05% | 0.02% | -0.04% | -0.26% | 0.21% | |

| GBP | -0.21% | -0.15% | -0.08% | -0.12% | -0.21% | -0.39% | 0.08% | |

| JPY | -0.10% | -0.05% | 0.08% | -0.03% | -0.13% | -0.34% | 0.15% | |

| CAD | -0.10% | -0.02% | 0.12% | 0.03% | -0.11% | -0.28% | 0.20% | |

| AUD | -0.01% | 0.04% | 0.21% | 0.13% | 0.11% | -0.18% | 0.28% | |

| NZD | 0.19% | 0.26% | 0.39% | 0.34% | 0.28% | 0.18% | 0.47% | |

| CHF | -0.28% | -0.21% | -0.08% | -0.15% | -0.20% | -0.28% | -0.47% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

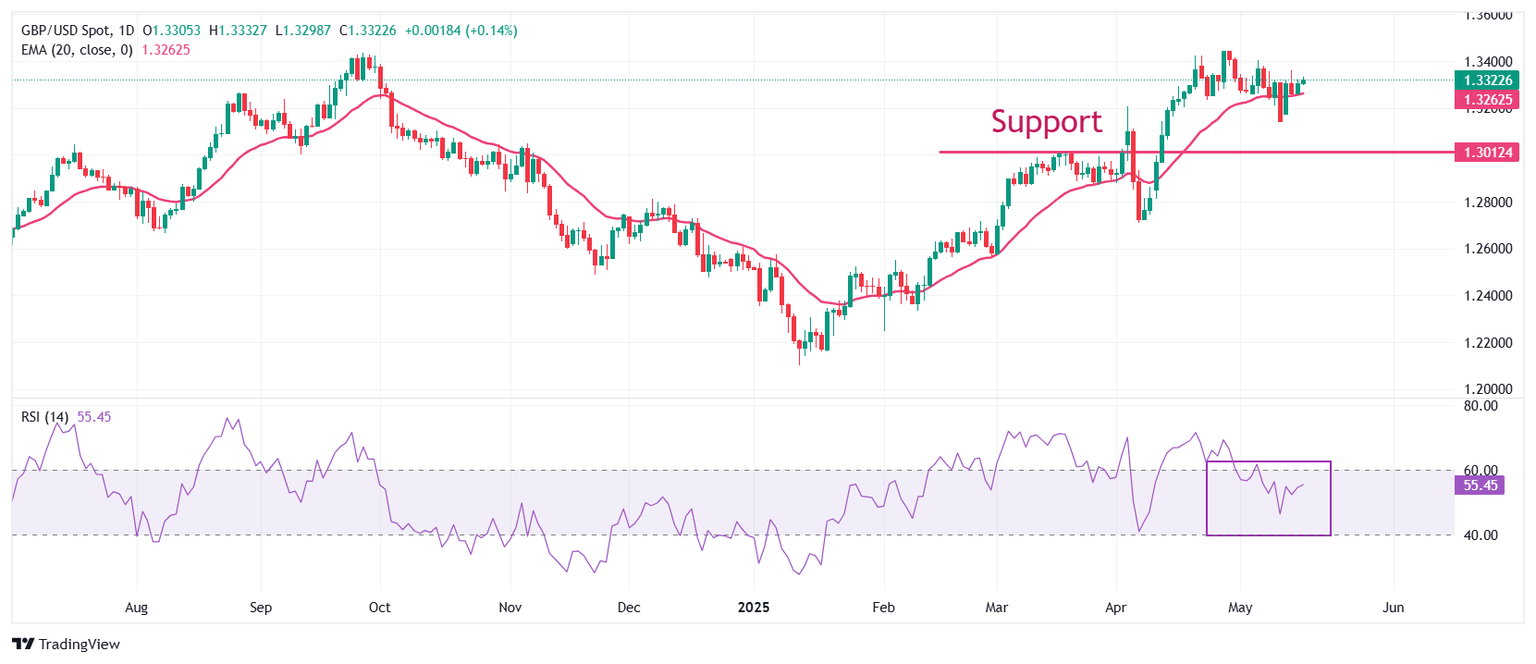

Technical Analysis: Pound Sterling struggles around 1.3300

The Pound Sterling faces pressure above 1.3300 against the US Dollar on Friday. Still, the GBP/USD pair holds above the 20-day Exponential Moving Average (EMA), which trades around 1.3256, suggesting that the near-term trend is bullish.

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range. A fresh bullish momentum would appear if the RSI breaks above 60.00.

On the upside, the three-year high of 1.3445 will be a key hurdle for the pair. Looking down, the psychological level of 1.3000 will act as a major support area.

Economic Indicator

Michigan Consumer Sentiment Index

The Michigan Consumer Sentiment Index, released on a monthly basis by the University of Michigan, is a survey gauging sentiment among consumers in the United States. The questions cover three broad areas: personal finances, business conditions and buying conditions. The data shows a picture of whether or not consumers are willing to spend money, a key factor as consumer spending is a major driver of the US economy. The University of Michigan survey has proven to be an accurate indicator of the future course of the US economy. The survey publishes a preliminary, mid-month reading and a final print at the end of the month. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Last release: Fri May 16, 2025 14:00 (Prel)

Frequency: Monthly

Actual: 50.8

Consensus: 53.4

Previous: 52.2

Source: University of Michigan

Consumer exuberance can translate into greater spending and faster economic growth, implying a stronger labor market and a potential pick-up in inflation, helping turn the Fed hawkish. This survey’s popularity among analysts (mentioned more frequently than CB Consumer Confidence) is justified because the data here includes interviews conducted up to a day or two before the official release, making it a timely measure of consumer mood, but foremost because it gauges consumer attitudes on financial and income situations. Actual figures beating consensus tend to be USD bullish.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.