PLTR Stock News: Palantir Technologies Inc drops 1% from weekly highs, what’s next?

- Palantir rallies 3% on Monday to close above $24.

- PLTR shares participate in a broad retail-led rally.

- PLTR breaks 9 and 21-day moving average resistance.

Update April 28: Shares of Palantir Technologies Inc. (NYSE: PLTR) snapped their two-day uptrend and fell from weekly highs on Tuesday, finishing the day about 1% lower at $23.88. The stock price fell further by 0.38% in the after-hours, although held above $23.50. After reaching an all-time high at $45 in January, the price of PLTR has tumbled 40%, as the company remains unprofitable after operating for nearly two decades while the near-term outlook appears bleak. Further, the company’s management has been aggressively offloading its shares in recent months, weighing negatively on the PLTR shares.

Palantir Technologies shares have been one of the 2021 meme stock top performers. Thankfully, PLTR stock has lately calmed down with volatility appearing more normal and volumes declining from elevated levels earlier in 2021.

Palantir has a number of fundamental catalysts going for it. A strong government client list, ARK Invest making regular block purchases so far in 2021, and Goldman Sachs turning bullish after the latest set of PLTR results are some of the major pieces of good news.

PLTR shares have struggled to recapture the earlier rise seen in 2021, but perhaps this is not a bad thing for the long-term investor. PLTR shares had moved too high and stretched the valuation metrics too much. Now, back toward the mid to low $20s, it is a much more interesting proposition.

Palantir launched on the stock market at the end of September 2020 at a price of $7.25 a share. PLTR was co-founded by legendary Silicon Valley investor Peter Thiel. The firm is a data mining and analytics technology company. It helps companies integrate and analyse their various diverse data sets to help make sense of complicated data. Palantir streamlines decision-making based on data analysis. The company helps with search functions and is heavily involved in the security industry, with links to law enforcement agencies such as the FBI, CIA and Department of Defense.

PLTR stock price

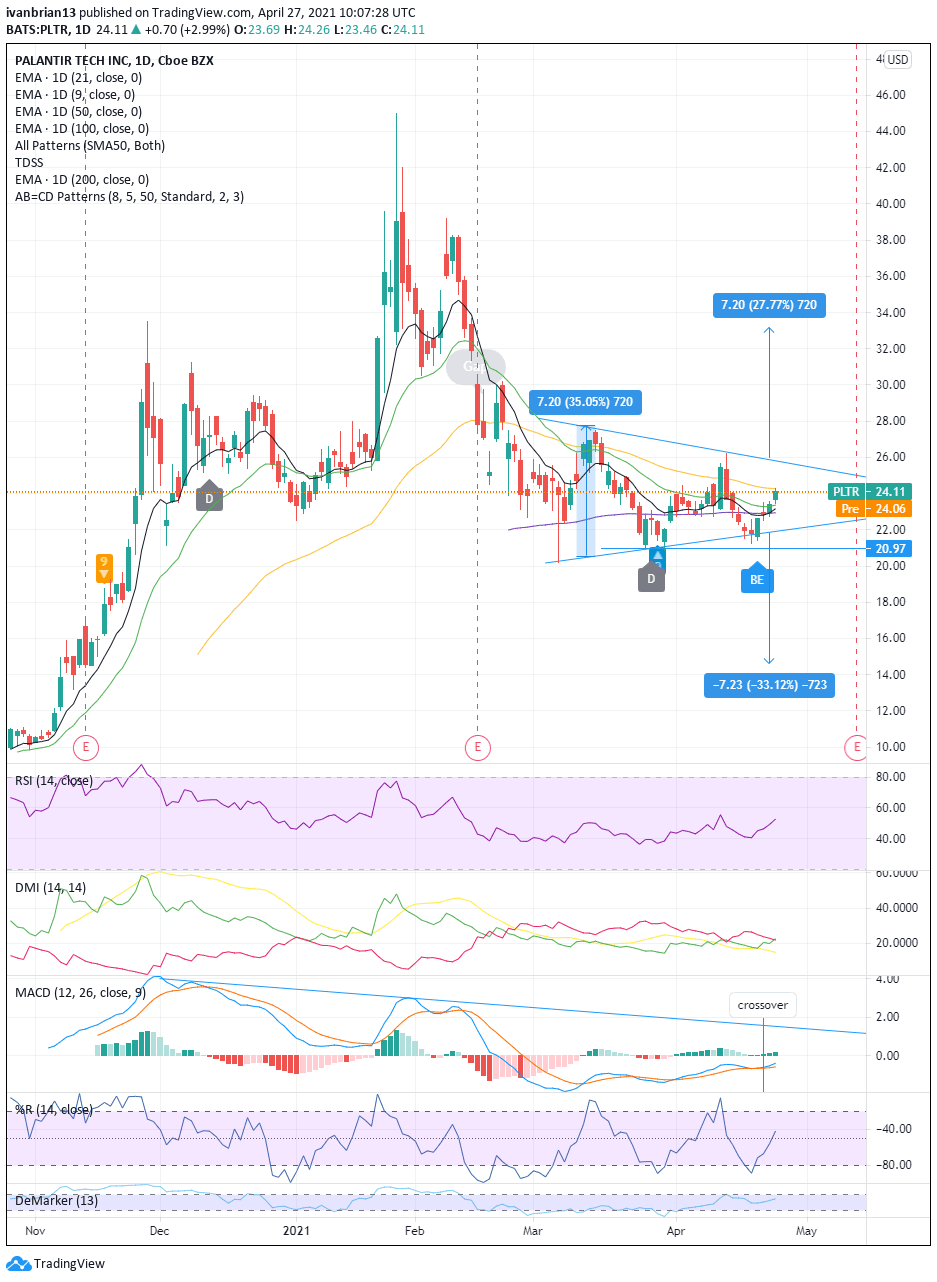

Palantir shares have been trading in a triangle formation since early March, with declining volume and volatility. Eventually, a catalyst will result in a breakout of this range. Usually, the breakout can be sharp.

Yesterday, Monday was an important one as PLTR broke the 9 and 21-day moving average resistance levels. So, the short-term trend is now contolled by bulls. The Moving Average Convergence Divergence indicator also gave a crossover buy signal yesterday. This signal came after a near-miss with a bearish crossover on April 20.

The Directional Movement Index is also about to give a bullish crossover, but this signal is showing a weak underlying trend with the ADX line below 25.

PLTR shares have stalled at the 50-day moving average and this is the first target/resistance. A break here, $24.28, would bring the top of the triangle as the next target, at $25.77. A triangle breakout gives an ultimate target of the size of the entry formation of the triangle. This is means a $7.20 range, so the breakout target is at $32.97.

Along the way, old highs at $26.20 and $27.47 will provide interim resistance. Above $30, there is a vacum which should see PLTR quckly accelerate to $32. A vacum is akin to a gap, there has been no price or volume at this level so when prices get toward this level, there are no legacy sell orders to stall price progression.

Remaining above the 9-day moving average is key to the bullishness currently in control in PLTR. A break below this barrier would bring a test of the lower end of the triangle and a similar $7.20 range to the downside. $20.97 is the last chance for bulls, as breaking this would end the bullish series of higher lows.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.