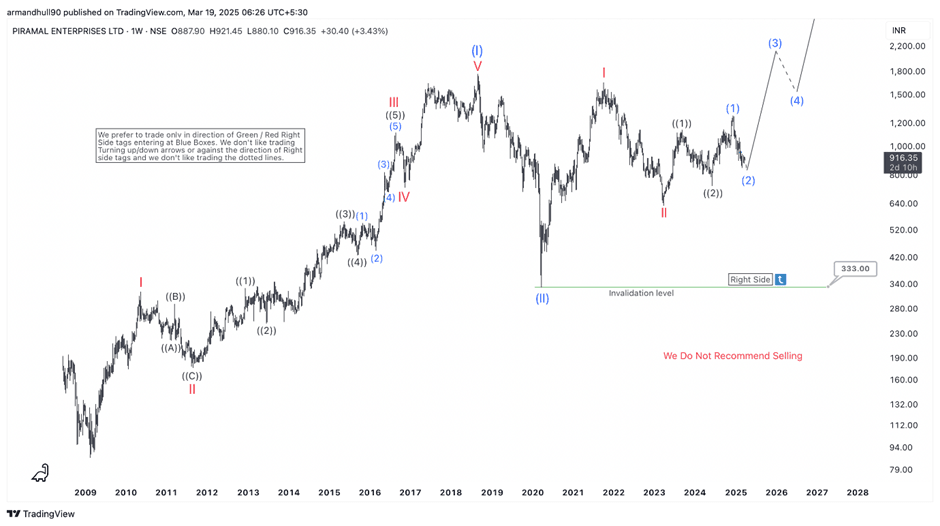

Piramal Enterprises Ltd (PEL) Elliott Wave analysis: Bullish cycle underway

Elliott Wave Analysis Suggests a Strong Bullish Cycle as PEL Completes Wave II Correction.

Piramal Enterprises Ltd (PEL) has completed its Wave II correction. Now, the stock is in the early stages of a strong bullish cycle. The Elliott Wave count suggests that the stock has formed a significant bottom and is set to advance in an impulsive Wave III. The invalidation level remains at 333 INR. As long as the price stays above this mark, the bullish outlook remains intact. The right-side tag further confirms that the stock favors higher prices in the long term.

Wave structure and market outlook

Previously, PEL completed a five-wave advance, marking the end of a higher-degree Wave I. A corrective Wave II followed, pushing prices lower. Now, the market has started a fresh impulse, with Wave (1) of III already in place. A short-term pullback in Wave (2) is underway. When this correction ends, Wave (3) should trigger a powerful rally. If the price follows the expected Elliott Wave path, PEL could reach 2,000 INR and beyond.

Key levels and trading strategy

The 333 INR level acts as the invalidation point for the bullish setup. As long as prices hold above this level, the uptrend should continue. In the near term, resistance could emerge around 1,500 INR. However, as Wave III unfolds, the stock could break above this level.

Traders should watch the current dip in Wave (2) as a potential buying opportunity. The market structure supports bullish positions. Long-term investors may consider accumulating during pullbacks. With a well-defined Elliott Wave setup, PEL presents a compelling long-term bullish case.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com