Palantir Technologies (PLTR) Stock Price and Forecast: PLTR sits at key support level

- Palantir shares are stuck in a bearish trend.

- Growth guru Cathie Wood's ARK Invest buys more.

- PLTR sitting on triangle support formation.

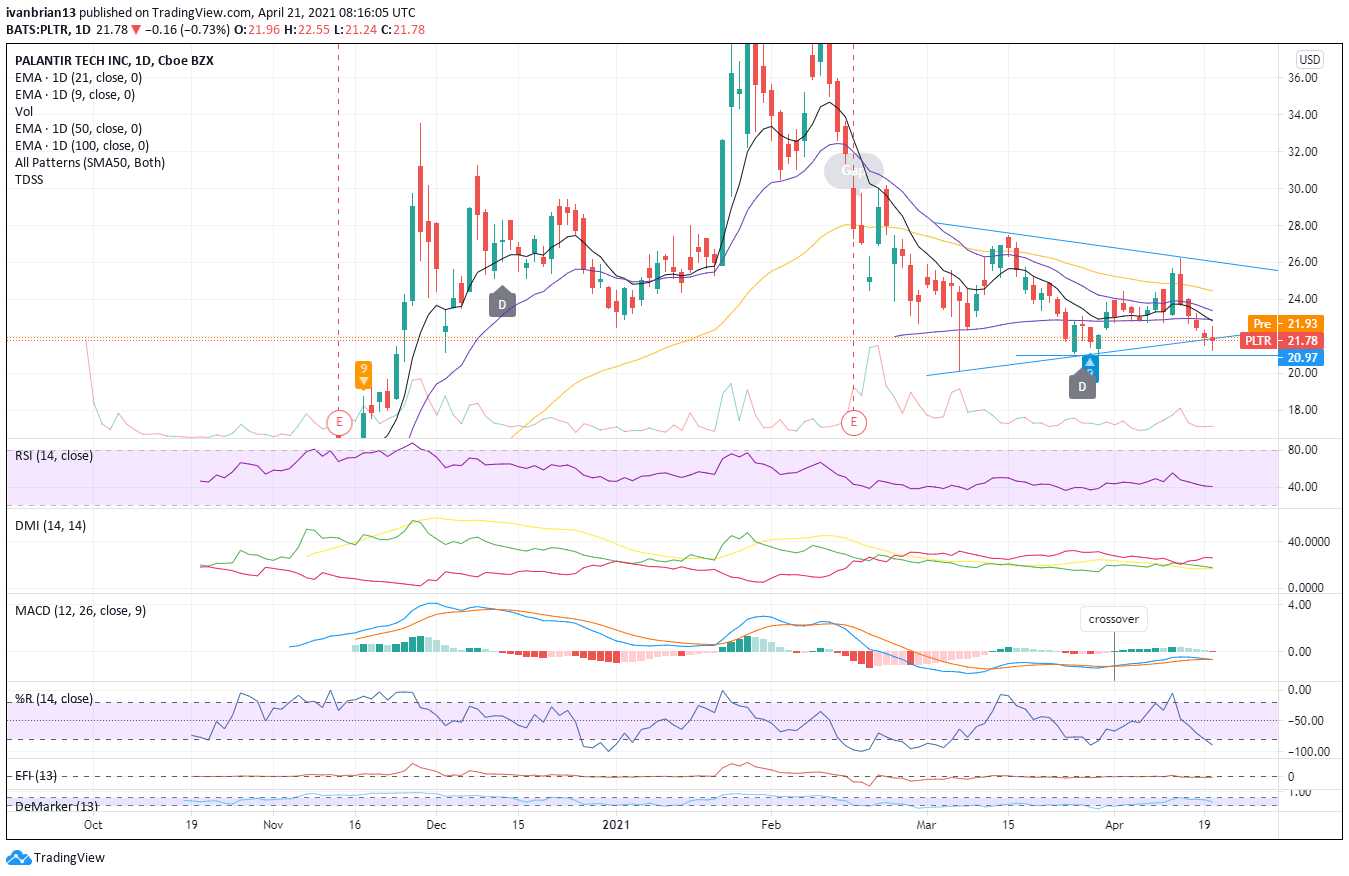

Update April 21: PLTR shares have slid back toward the bottom of our triangle formation and sit at a key level. The Moving Average Convergence Divergence (MACD) indicator and the Directional Movement Index (DMI) have flagged crossover sell signals recently. $20.97 support holds the last chance for bulls.

Update April 14: Palantir Technologies Inc (NYSE: PLTR) is on a roll, hitting the highest levels since March 17. The 8.9% rally on Tuesday may be followed by another swing higher, at least according to pre-market data. There are three significant factors pushing the Denver-based firm higher – the broad market rally pushed by tame US inflation figures, an investment by Cathie Wood's ARK Invest, and Goldman Sachs' support.

Palantir Technologies shares have been one of the 2021 meme stock performers. Lately, the shares have been more stable. This has allowed some more technical analysis to identify key levels.

Palantir has a number of fundamental catalysts going for it. A strong government client list, ARK Invest making regular block purchases so far in 2021, and Goldman Sachs turning bullish after the latest set of PLTR results are some of the major pieces of good news.

PLTR shares have struggled to recapture the earlier rise seen in 2021, but perhaps this is not a bad thing for the long-term investor. PLTR shares had moved too high and stretched the valuation metrics too much. Now back toward the mid to low $20s, it is a much more interesting proposition.

Stay up to speed with hot stocks' news!

Palantir launched on the stock market at the end of September 2020 at a price of $7.25 a share. PLTR was co-founded by legendary Silicon Valley investor Peter Thiel. The firm is a data mining and analytics technology company. It helps companies integrate and analyse their various diverse data sets to help make sense of complicated data. Palantir streamlines decision-making based on data analysis. The company helps with search functions and is heavily involved in the security industry, with links to law enforcement agencies such as the FBI, CIA and Department of Defense.

PLTR stock price forecast

Ignoring the price spike from Jan 27 (peak GameStop day!) Palantir has a number of bullish technical features one can identify from the chart. The low from March 5 at $20.18 was sharply rejected with a close significantly higher. This is similar but not exactly like an inverted shooting star candlestick formation or a hammer. Either way, the bullish logic can be evidenced by the close being much higher than the intraday low. PLTR shares retraced to test these lows in late March and failed. Again, a bullish case.

Adding to this is the MACD crossover signal on April 1 – hopefully not a joke for bulls.

Now, all we need is for PLTR shares to break and remain above the 21-day moving average at $23.82 as PLTR is already above the shorter-term 9-day moving average.

The intermediate target is $27.48, the high from March 15. A break of this level gives further continuation to the bullish trend's ultimate goal, which is to fill the gap from February 12 to 16. A break of the lower end of the gap at $30.44 should see PLTR shares rapidly move toward $32.

$20.86 is the key to remaining bullish. While this is not the ultimate low from March 5 mentioned earlier, it would end the series of higher lows.

Previous updates

Update: PLTR shares are lower but still holding their moving average supports. Just! 9-day support comes at $23.21 currently. A break of that will probably see a move down to trendline support which we would like to see hold. Resistance levels remain unchanged and bullish MACD remains in place. Any weakness without an MACD crossover gives a buying opportunity. A purchase at teh 9 day moving average with a stop just below or a wait for lower nearer the trendline support at $21.41 with a stop on a break of the March 30 low as breaking this means the bullishness is also broken.

Update April 13: Palantir Technologies Inc (NYSE: PLTR) has ended Monday's trading session with a slide of 2.87% to close at $23.34 and in after hours, it is only two cents higher, a minuscule increase. However, the one-month charts is showing that shares of the somewhat secretive data analytics firm have set a higher low – a bullish sign. Investors are awaiting all-important US inflation figures for March for the next moves, with rising bond yields weighing on equities.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.