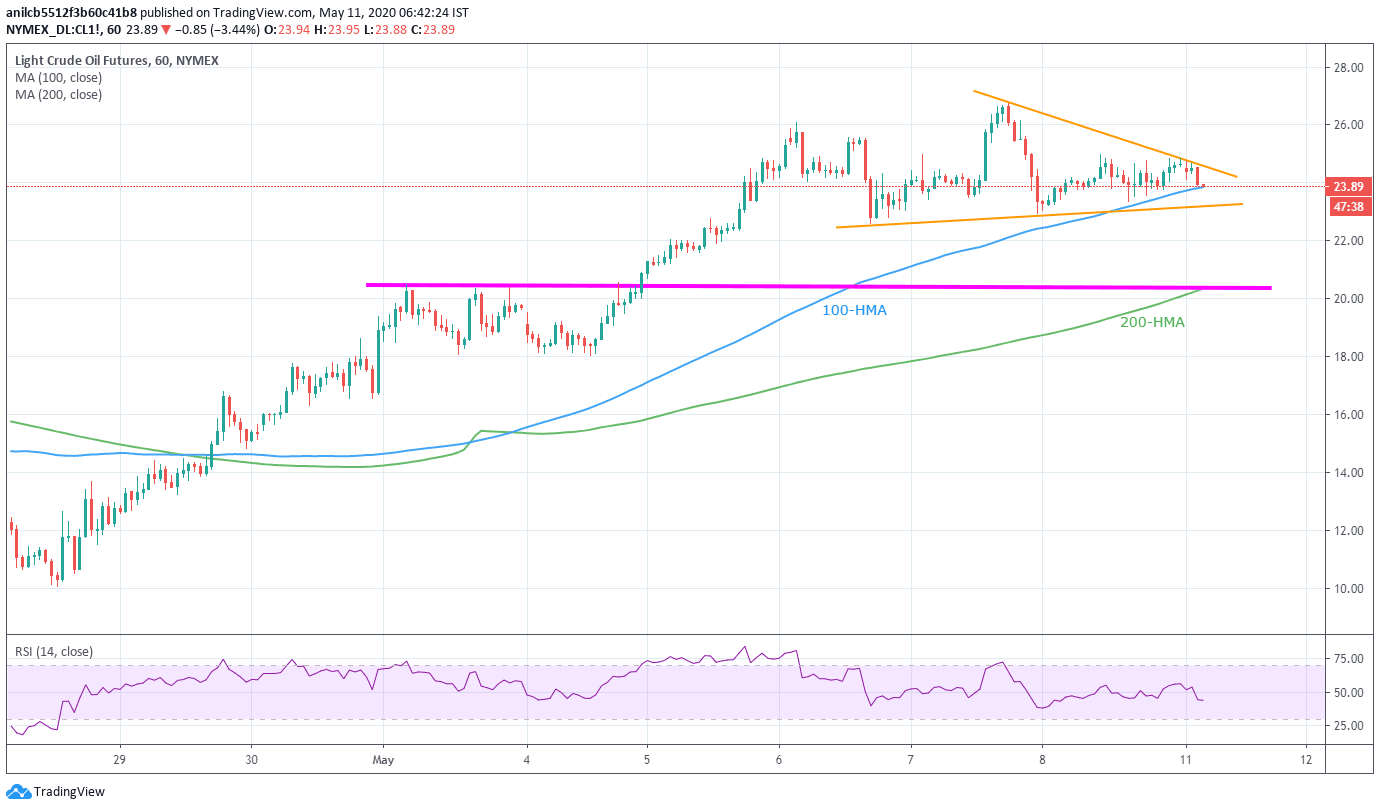

Oil Price Forecast: WTI slips below $24.00, stays inside short-term triangle

- WTI June Futures refreshes intraday low to near 100-HMA.

- A short-term symmetrical triangle limits immediate moves.

- 200-HMA, early-month tops offer strong downside support.

While stepping back from the two-day-old falling trend line, WTI June Futures on NYMEX drop to $23.92, down near 3.30% on a day, during Monday’s Asian session.

The black gold currently declines towards a 100-HMA level of $23.82 ahead of visiting the triangle’s support line around $23.20.

It should, however, be noted that the oil benchmark’s drop beneath $23.20 will make it vulnerable to slide towards $2050/30 support confluence including the early-May tops and 200-HMA.

During the quote’s fresh move up, the triangle’s resistance line near $24.65/70 can challenge buyers before pushing them towards Wednesday’s top near $26.00.

If at all the bulls manage to successfully cross $26.00, expectations of refreshing monthly high surrounding $26.70 can’t be ruled out.

WTI hourly chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.