NZD/USD struggling to make headway after getting rejected from 0.6200

- Kiwi flat for Thursday after five straight days of gains.

- NZ indicators tilting into the upside.

- NZ Consumer confidence, US manufacturing data due for Friday.

The NZD/USD is trading flat in Thursday's US trading session, battling back into 0.6150 after seeing a technical rejection from the 0.6200 handle on Wednesday.

The Kiwi (NZD) set an early high of 0.6180 against the US Dollar (USD) before getting sent back down into 0.6120, and the NZD/USD is now stuck at the midway point heading into the back quarter of Thursday's trading window.

Kiwi data tilts into the upside, ANZ Business Confidence hits eight-year peak

Early Thursday saw a notable improvement in New Zealand Building Permits, showing an 8.7% increase in residential building projects in October compared to September's -4.6% (revised upwards slightly from -4.7%).

ANZ's November Business Confidence also saw an improvement from October's 23.4, coming in at an eight-year high of 30.8, the indicator's single-highest reading since March of 2015.

NZ Consumer Confidence, US ISM Manufacturing PMI on the docket for Friday

Up next for Kiwi data will be the ANZ Roy Morgan Consumer Confidence figure for November. New Zealand Consumer Confidence has steadily lagged, dropping below 90.0 back in early 2022, and the indicator could be set an upside beat after last printing at 88.1, its highest reading since dropping to a record low of 73.8 a year ago in December 2022.

Friday's upcoming US trading session will see the ISM Manufacturing Purchasing Managers' Index for November. The manufacturing-focused PMI is expected to improve slightly from October's 46.7 to 47.6.

NZD/USD Technical Outlook

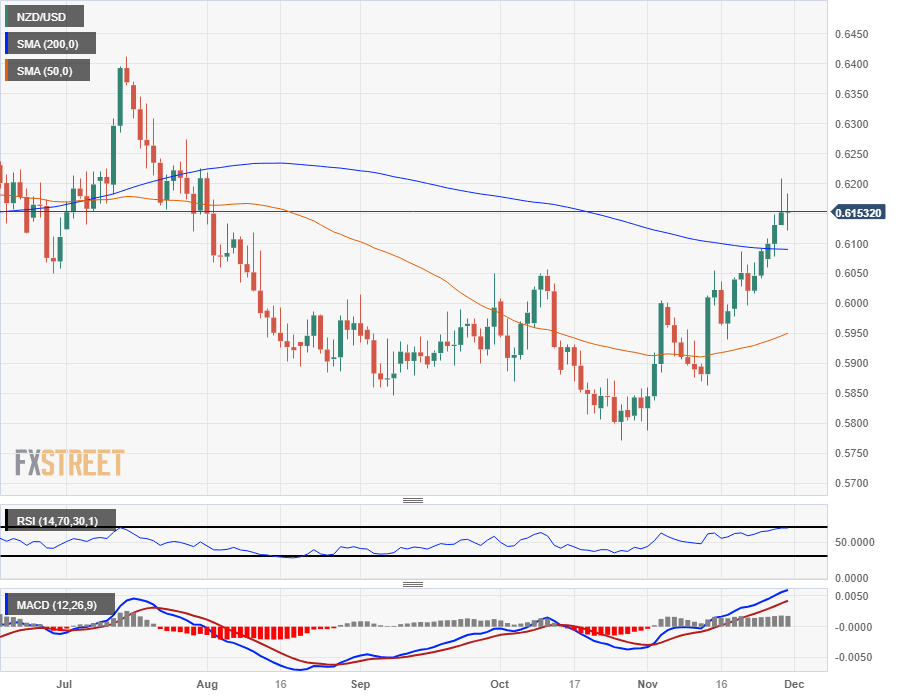

The NZD/USD has closed higher for the past five straight trading days, and gained ground ten of the last twelve days since rallying from 0.5875.

The Kiwi caught a technical rejection from 0.6200 on Wednesday and the pair has thus far succeeded in fighting off a decline back to the 200-day Simple Moving Average (SMA) near 0.6100 as the NZD/USD treads water near 0.6150.

The 50-day SMA, currently rotating bullish from 0.5950, is set to continue rising and will provide technical support into a bullish crossover of the 200-day SMA as long as the NZD/USD continues to bid on the north side of the long-term moving average.

NZD/USD Daily Chart

NZD/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.