NZD/USD Price Forecast: Trades flat near 0.5950

- NZD/USD surrenders initial gains and turns flat around 0.5950 in the aftermath of the RBNZ interest rate announcement.

- The RBNZ cuts its OCR by 25 bps to 3.25%, as expected.

- The US Dollar gains on hopes of a potential US-EU trade deal.

The NZD/USD pair gives up a majority of its initial gains and flattens around 0.5950 during North American trading hours on Wednesday. Earlier in the day, the Kiwi pair attracted bids after the Reserve Bank of New Zealand (RBNZ) reduced its Official Cash Rate (OCR) by 25 basis points (bps) to 3.25%, as expected.

The RBNZ guided that the monetary expansion cycle will be deeper than what they had anticipated earlier, citing global economic risks and inflation is within the bank’s target.

Meanwhile, an extension in the US Dollar’s (USD) recovery move has also weighed on the Kiwi pair’s early gains. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, rises to near 99.80, following Tuesday’s recovery.

The US Dollar rises on hopes that the European Union (EU) and the United States (US) will reach a trade deal soon. During North American trading hours, EU officials stated that US trade negotiators Howard Lutnick and Jameison Greer have agreed to trade discussions every other day. Additionally, a report from German newspaper Handelsblatt has reported that German carmakers are in talks with the US trade ministry on tariffs and aim to reach an agreement by early July.

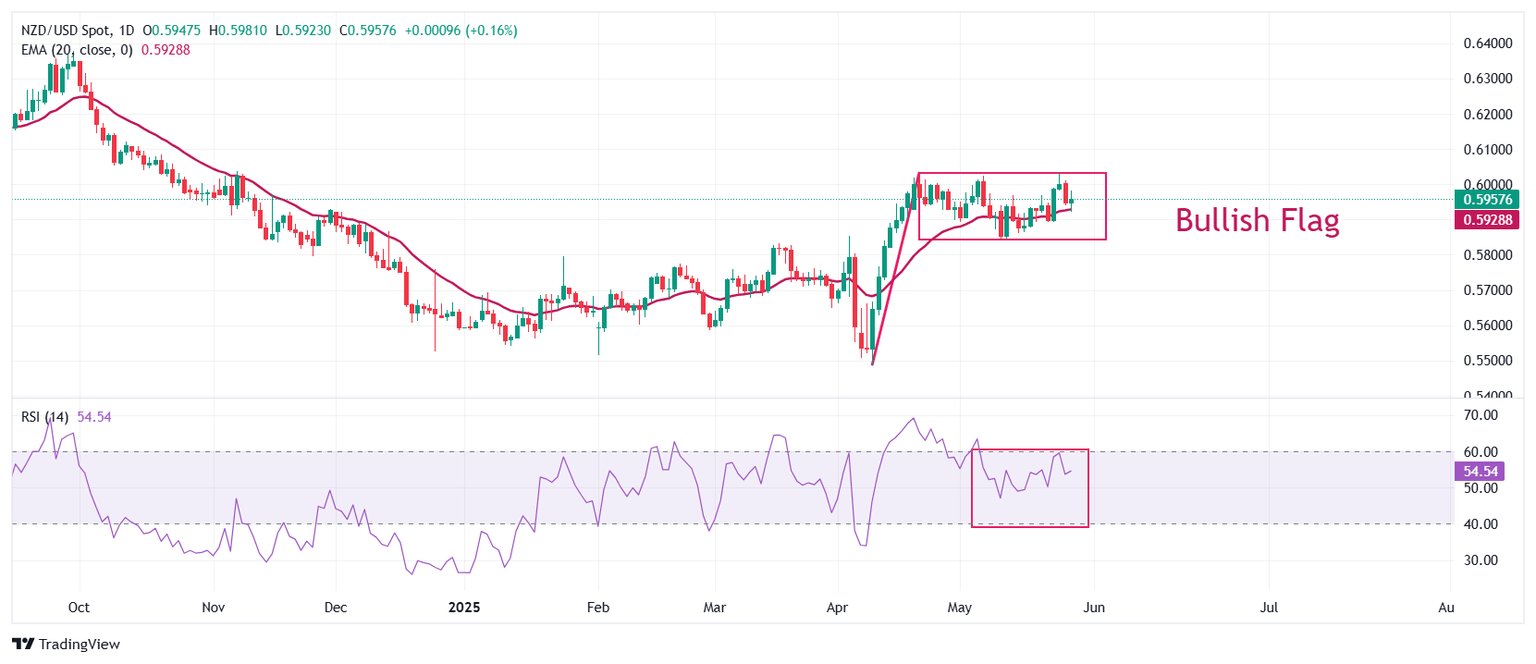

NZD/USD strives to break the Bullish Flag formation on the upside. Historically, the chart pattern resumes its strong rally after a breakout of the consolidation. The near-term trend of the pair is bullish as the 20-day Exponential Moving Average (EMA) slopes higher around 0.5925.

The 14-day Relative Strength Index (RSI) breaks above 60.00. Bulls would come into action if the RSI holds above the 60.00 level.

The Kiwi pair is expected to rise towards the September 11 low of 0.6100 and the October 9 high of 0.6145 after breaking above the intraday high around 0.6030.

In an alternate scenario, a downside move below the May 12 low of 0.5846 will expose it to the round-level support of 0.5800, followed by the April 10 high of 0.5767.

NZD/USD daily chart

Economic Indicator

RBNZ Interest Rate Decision

The Reserve Bank of New Zealand (RBNZ) announces its interest rate decision after each of its seven scheduled annual policy meetings. If the RBNZ is hawkish and sees inflationary pressures rising, it raises the Official Cash Rate (OCR) to bring inflation down. This is positive for the New Zealand Dollar (NZD) since higher interest rates attract more capital inflows. Likewise, if it reaches the view that inflation is too low it lowers the OCR, which tends to weaken NZD.

Read more.Last release: Wed May 28, 2025 02:00

Frequency: Irregular

Actual: 3.25%

Consensus: 3.25%

Previous: 3.5%

Source: Reserve Bank of New Zealand

The Reserve Bank of New Zealand (RBNZ) holds monetary policy meetings seven times a year, announcing their decision on interest rates and the economic assessments that influenced their decision. The central bank offers clues on the economic outlook and future policy path, which are of high relevance for the NZD valuation. Positive economic developments and upbeat outlook could lead the RBNZ to tighten the policy by hiking interest rates, which tends to be NZD bullish. The policy announcements are usually followed by interim Governor Christian Hawkesby's press conference.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.