NZD/USD Price Forecast: Struggles to break above 20-EMA

- NZD/USD clings to gains around 0.5885 ahead of the US PCE inflation data for July.

- The US core PCE inflation is expected to have grown at an annualized basis of 2.9%, faster than 2.8% in June.

- Investors expect the Fed to cut interest rates in the September policy meeting.

The NZD/USD pair holds onto gains near 0.5885 during the European trading session on Friday. The Kiwi pair demonstrates strength ahead of the United States (US) Personal Consumption Expenditure Price Index (PCE) data for July, which will be published at 12:30 GMT.

The Bureau of Economic Analysis (BEA) is expected to show that the core PCE inflation, which is the Federal Reserve’s (Fed) preferred inflation gauge, rose at an annualized pace of 2.9%, faster than 2.8% in June. On a monthly basis, the underlying inflation rose steadily by 0.3%.

Investors will pay close attention to the US inflation data as it will influence market expectations for the Federal Reserve’s (Fed) monetary policy outlook. Meanwhile, traders are confident that the Fed will cut interest rates in the September policy meeting, according to the CME FedWatch tool.

Meanwhile, investors brace for a sideways trend in the New Zealand Dollar (NZD) as the Caixin Manufacturing PMI data is scheduled to be published on Monday. China’s private sector PMI data will impact the Kiwi dollar, given the strong reliance of the New Zealand (NZ) economy on its exports to China.

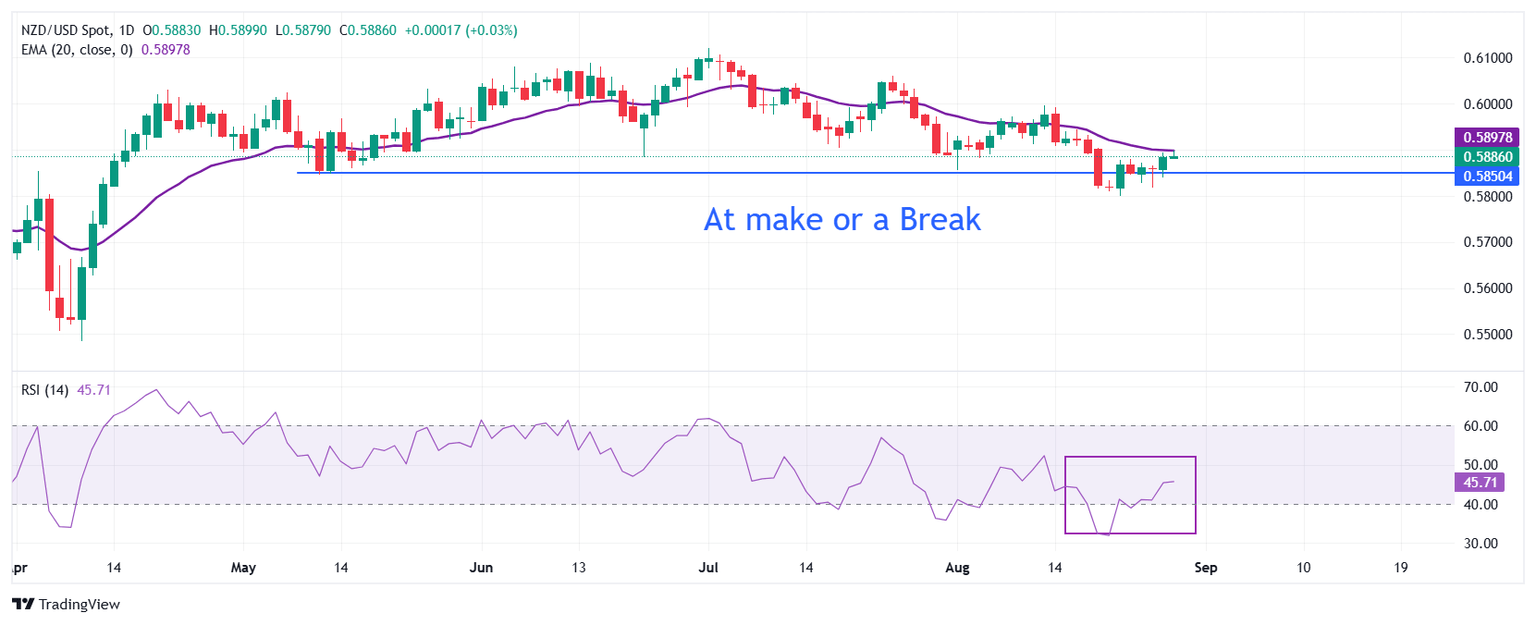

NZD/USD struggles to extend its recovery move above the 20-day Exponential Moving Average (EMA), which trades around 0.5900.

The 14-day Relative Strength Index (RSI) oscillates around 50.00, indicating a sideways trend.

Going forward, a downside move by the pair below the August 2 low of 0.5800 will expose it to the April 11 low of 0.5730, followed by the round-level support of 0.5700.

In an alternate scenario, the Kiwi pair would rise towards the June 19 high of 0.6040 and the September 11 low of 0.6100 if it manages to return above the psychological level of 0.6000.

NZD/USD daily chart

Economic Indicator

Core Personal Consumption Expenditures - Price Index (YoY)

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures." Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri Aug 29, 2025 12:30

Frequency: Monthly

Consensus: 2.9%

Previous: 2.8%

Source: US Bureau of Economic Analysis

After publishing the GDP report, the US Bureau of Economic Analysis releases the Personal Consumption Expenditures (PCE) Price Index data alongside the monthly changes in Personal Spending and Personal Income. FOMC policymakers use the annual Core PCE Price Index, which excludes volatile food and energy prices, as their primary gauge of inflation. A stronger-than-expected reading could help the USD outperform its rivals as it would hint at a possible hawkish shift in the Fed’s forward guidance and vice versa.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.