NZD/USD Price Analysis: Struggles to extend the bounce off 0.6370 support confluence

- NZD/USD seesaws around intraday high, remains indecisive on a day.

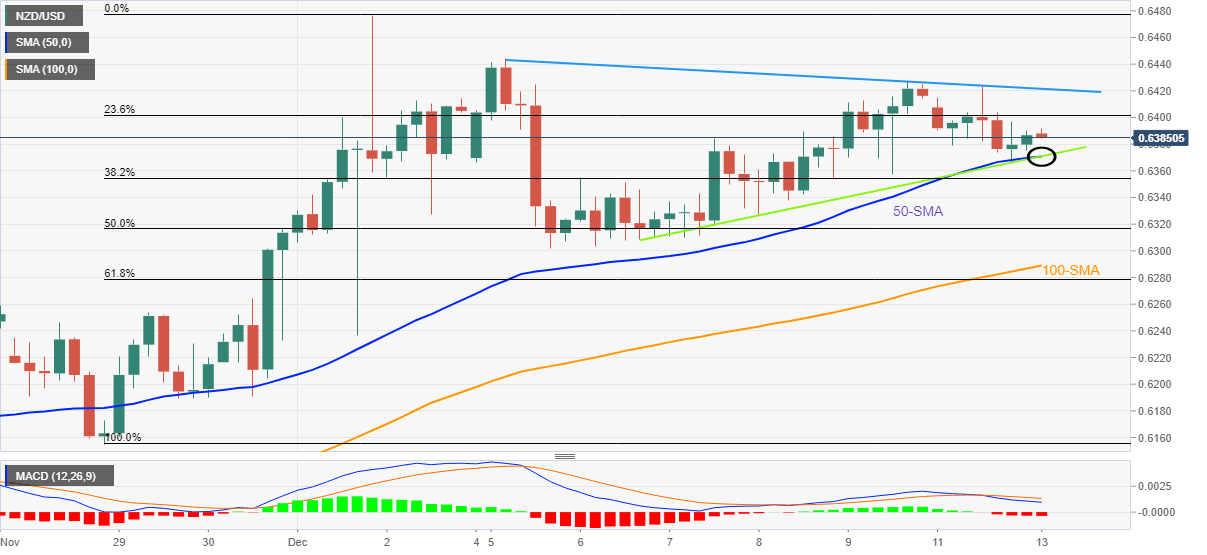

- Convergence of 50-SMA, one-week-old ascending trend appears a tough nut crack for bears.

- Bulls need validation from 0.6420 to retake control.

NZD/USD takes rounds to 0.6390 during early Tuesday as the Kiwi pair traders await more clues to extend the latest recovery from the key support confluence. In doing so, the quote highlights the market’s cautious mood ahead of the United States inflation numbers for November, namely the Consumer Price Index (CPI).

Although NZD/USD snapped a three-day uptrend the previous day, the bears couldn’t conquer a convergence of the 50-bar Simple Moving Average (SMA) and a one-week-old ascending support line, around 0.6370.

The pair’s rebound, however, battles with the bearish MACD signals to challenge the NZD/USD buyers. Also challenging the Kiwi pair’s upside momentum could be the downward-sloping resistance line from December 05, close to 0.6420 by the press time.

In a case where the NZD/USD remains firmer past 0.6420, the odds of witnessing a run-up to refresh the monthly high surrounding 0.6475-80 can’t be ruled out.

On the flip side, a clear break of the 0.6370 support confluence could quickly fetch the quote towards the previous weekly low near the 0.6300 round figure.

However, the 100-SMA and 61.8% Fibonacci retracement level of the NZD/USD pair’s November 28 to December 01 upside, respectively near 0.6290 and 0.6280, could challenge the bears afterward.

NZD/USD: Four-hour chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.