NZD/USD Price Analysis: Reversal points to weekly losses as bears regain control

the

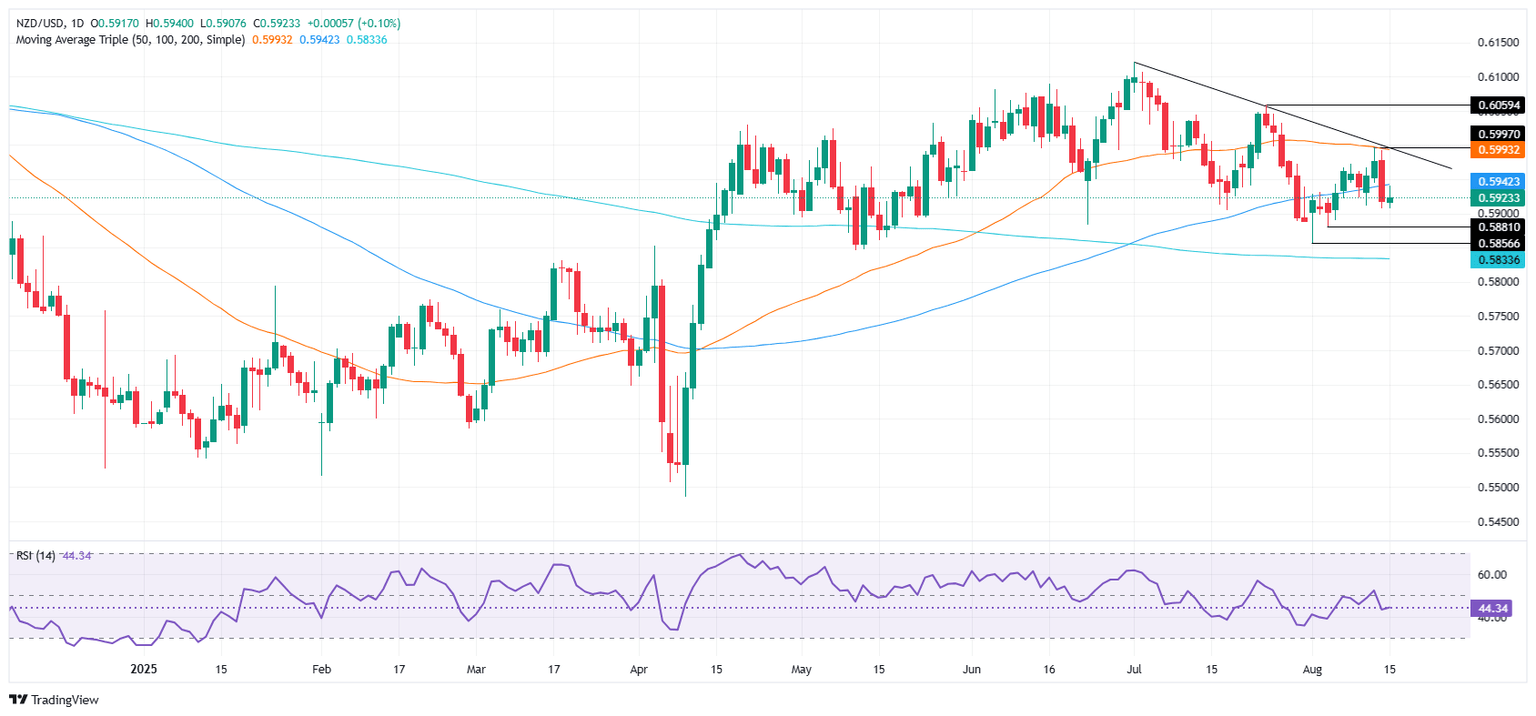

- NZD/USD set for 0.49% weekly loss, trading near 0.5923 after rejection from 0.5994 resistance.

- Pair slips below 50 and 100-day SMAs, turning them into key short-term resistance levels.

- RSI momentum shifts bearish, opening the path toward 0.5900 and August lows near 0.5856.

The New Zealand Dollar (NZD) halted its rally and turned negative, poised to finish 0.49% down in the week, after failing to clear key resistance levels, which paved the way for a drop towards the weekly lows near 0.5900. NZD/USD trades at 0.5923, down 0.09%.

NZD/USD Price Forecast: Technical outlook

From a daily chart perspective, the pair trades sideways to downward biased after NZD/USD faced key resistance at 0.5994, with traders lacking the strength to reclaim the 0.60 handle. On its way south, the pair cleared the 50 and 100-day SMAs, each at 0.5952 and 0.5944, respectively, which turned key resistance levels at the time of writing.

The Relative Strength Index (RSI) turned bearish two days ago. This means that sellers are in charge in the near-term.

For a bearish continuation, the first support would be 0.5900. A breach of the latter will expose the August 5 low of 0.5881, before testing the current month’s low of 0.5856. Conversely, the pair could shift upwards if traders reclaim 0.5952 and the 0.6000 figure.

NZD/USD Price Chart – Daily

New Zealand Dollar PRICE This week

The table below shows the percentage change of New Zealand Dollar (NZD) against listed major currencies this week. New Zealand Dollar was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.46% | -0.75% | -0.22% | 0.45% | 0.26% | 0.60% | -0.27% | |

| EUR | 0.46% | -0.29% | 0.24% | 0.92% | 0.73% | 1.02% | 0.20% | |

| GBP | 0.75% | 0.29% | 0.50% | 1.21% | 1.02% | 1.31% | 0.49% | |

| JPY | 0.22% | -0.24% | -0.50% | 0.71% | 0.53% | 0.89% | 0.10% | |

| CAD | -0.45% | -0.92% | -1.21% | -0.71% | -0.18% | 0.10% | -0.74% | |

| AUD | -0.26% | -0.73% | -1.02% | -0.53% | 0.18% | 0.29% | -0.53% | |

| NZD | -0.60% | -1.02% | -1.31% | -0.89% | -0.10% | -0.29% | -0.81% | |

| CHF | 0.27% | -0.20% | -0.49% | -0.10% | 0.74% | 0.53% | 0.81% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the New Zealand Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent NZD (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.