NZD/USD Price Analysis: Pressured below 0.6700 amid mixed trade numbers from China

- NZD/USD drops to intraday low after China’s July month trade numbers flashed mixed signals.

- The fall in imports supersedes upbeat Trade Balance and Export figures.

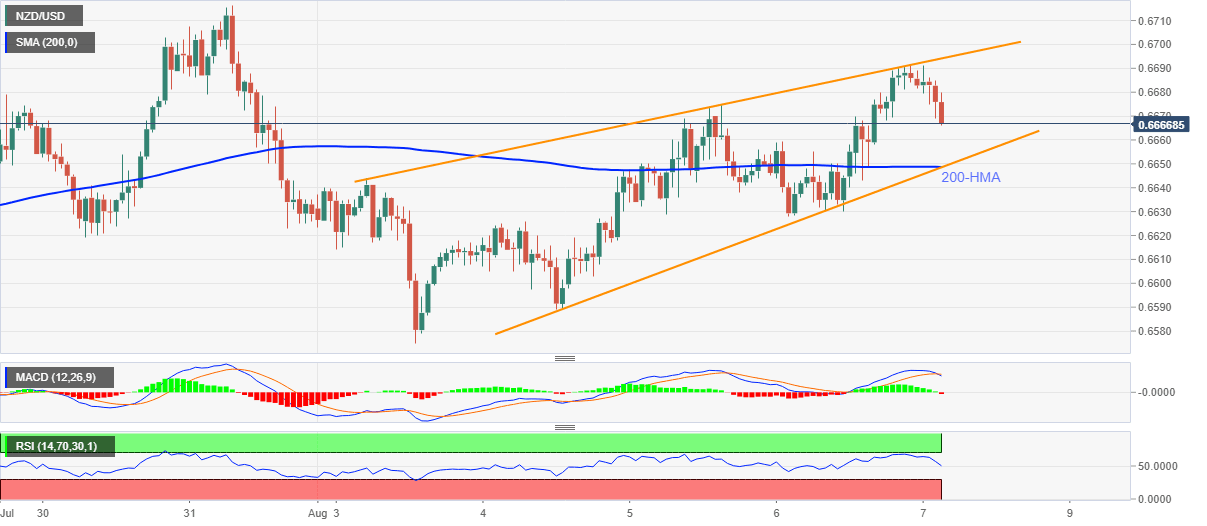

- The rising wedge chart pattern is in focus amid bearish MACD.

- Multiple upside barriers stay strong to challenge the bulls beyond 0.6700.

NZD/USD stands on a slippery ground while declining to 0.6668, down 0.27% on a day, following China’s trade numbers during early Friday. In doing so, the Kiwi pair refreshes the intraday low while also snaps three-day winning streak.

Read: China’s July Trade data (USD): Surplus expands amid a surprise jump in exports

With the MACD turning in favor of the sellers, the pair currently declines towards 0.6660 ahead of highlighting the 0.6650 support confluence, including an ascending trend line from Tuesday and 200-HMA.

However, any more downside past-0.6650 will confirm the bearish chart play and can drag the pair towards the monthly bottom around 0.6575. Though, 0.6600 may offer an intermediate halt during the fall.

On the flip side, 0.6700 continues to become a tough nut to crack for the buyers, a break of which could challenge the July month’s top surrounding 0.6715/20.

If at all the quote rises past-0.6720, the year 2020 peak near 0.6740 and December 31, 2019 high of 0.6756 will in the spotlight.

NZD/USD hourly chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.