NZD/USD Price Analysis: Bulls in control and eye 0.6330/40s

- NZD/USD's market structure is bullish for the day ahead.

- Bulls need to commit above the key the 0.6260 level.

As per the series of prior analyses, NZD/USD Price Analysis: The bird swoops in towards 0.6250s & demand area, and NZD/USD Price Analysis: Bulls lurking near 0.6250, rallies to 0.6340 eyed, the bulls are now back in control again following a critical structure break to the upside.

The following illustrates the market structure across the hourly and lower time frames only. For longer-term analysis, the original article outlines a full multi-timeframe thesis.

NZD/USD hourly chart, prior analysis

As illustrated, the bird has respected the projected flight trajectory until this point.

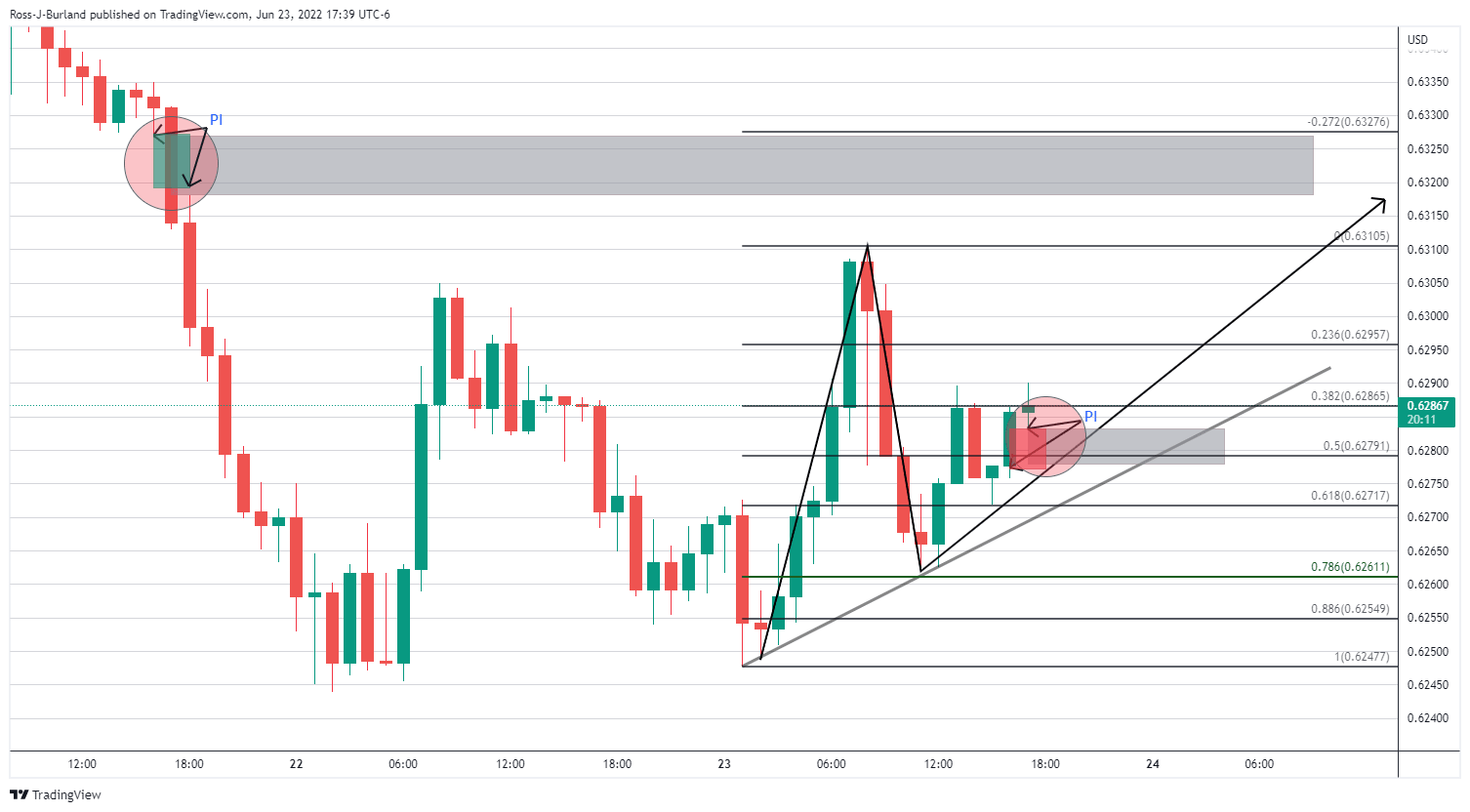

NZD/USD live market analysis

The above chart it is the same hourly chart, albeit stripped down to the current state of play.

The price corrected to a deeper Fibonacci, the 78.6% from where the bulls moved into guard positions established from the demand area below. There is an hourly inefficiency in bids between 0.62778 and 0.62832 which will be mitigated at some stage by offers which could potentially hamstring the bulls for the time being.

Meanwhile, sights are left on the upside price imbalance with offers left unmatched between 0.6318 and 0.6327.

Above 0.6327, which is the 'confirmed' bias given the recent break of hourly structure...

... the bulls can stay focussed on the original target area on the order block:

Switching broker, from chart to chart, the point of control of the prior highs and the order block is located, depending on the broker and price feed, at around 0.6335 while the midpoint of the order block is located at around 0.6330. These can both be used as reference points of interest.

On the downside, the bulls need to stay in control above the market structures and swing lows around 0.6270 and 0.6260.

From a short-term perspective, on the 1-min chart, there are a couple of imbalances that will likely be mitigated in the meantime in the 0.6290s and the 0.6275s:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.