NZD/JPY Price Analysis: Pair saw gains but remains stuck in trading channel

- NZD/JPY rose by 0.58% to 91.65 during Monday's session.

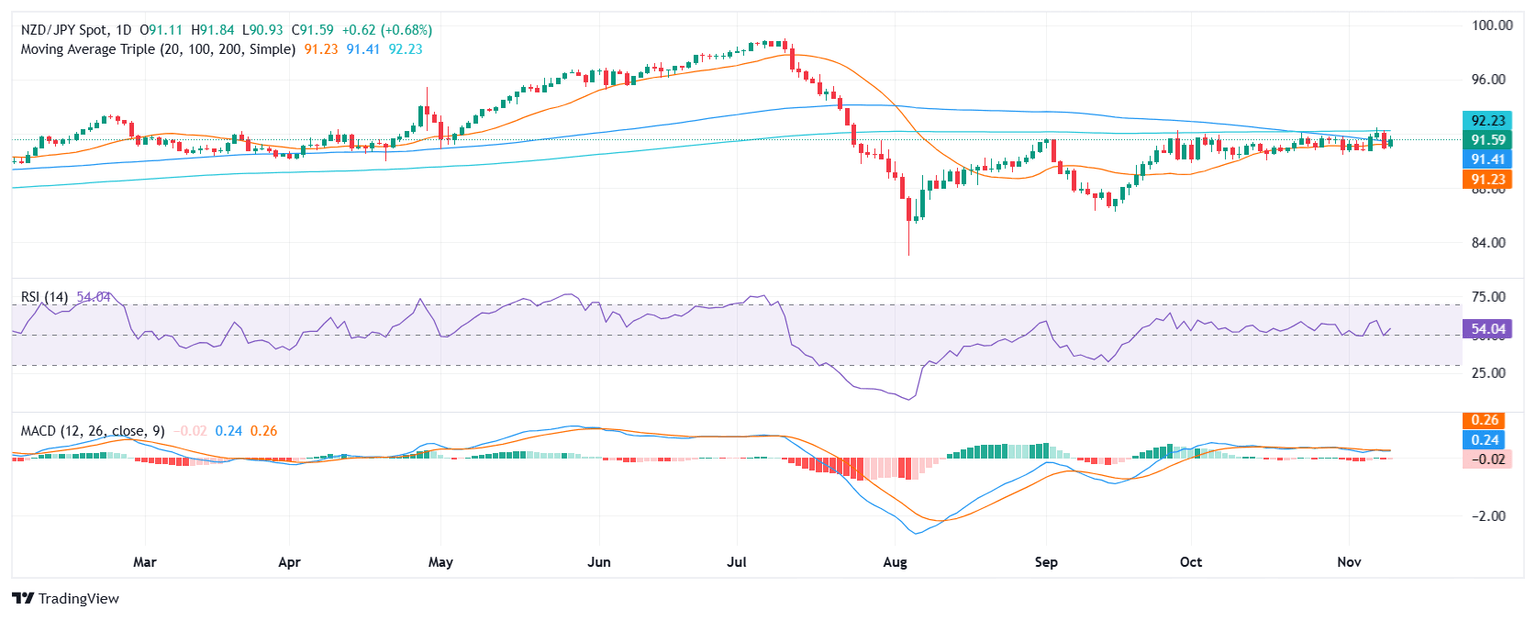

- NZD/JPY gained ground, but the cross remains stuck within a clear trading range between 92.00 and 91.00.

- The RSI indicates that buying pressure has been building, while the MACD suggests that selling pressure has been flat.

The NZD/JPY pair rose by 0.58% to 91.65, continuing the positive momentum seen during Monday's session. However, the pair remains stuck within a clear trading channel between 92.00 and 91.00. The overall momentum seems to be mixed, as the pair has been unable to break out of its trading range. A bearish crossover completed between the 20 and 100-day Simple Moving Averages (SMA) might push the pair lower, according to recent technical analysis.

The technical indicators provide mixed signals for NZD/JPY. The Relative Strength Index (RSI) is currently at 55, which suggests that buying pressure is rising. However, the Moving Average Convergence Divergence (MACD) is currently flat, which suggests that selling pressure is flat. The overall outlook is mixed, as the trend is unable to break out of its trading range.

Despite positive momentum, the pair has not broken out of its trading range. Traders should monitor the pair's reaction at its current trading channel to gauge potential breakout or reversal signals.

NZD/JPY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.